Why You Should Steer Clear of Steel

Cyclical industries always have their ups and downs. But the steel industry is experiencing something much more serious than just a short-term downturn. A glut of worldwide steel mills and lower steel prices are crippling the industry. If things don't change, investors should be wary of riding the steel train for much longer.

Steel's kryptonite

The steel industry has one major problem - too much production. The top five worldwide steel producers account for only 18% of the world steel market. ArcelorMittal is the world's largest steelmaker, but only holds 6% of the market. When big players don't have large market share, their profits plummet. Last quarter, ArcelorMittal booked a $709 million loss year over year.

Part of the problem comes from a country that produces 45% of the world's steel - China. Chinese steel mills are incentivized to produce large amounts of steel and increase revenues. If the Chinese mills hit revenue goals, they get more government subsidies. Profits are much less important.

But there's another gap in steel's rusty armor as well. Prices for iron ore, a main ingredient in steel, dropped more than 40% in the past year. They've come back up slightly over the past few months, but the price still hovers around a two-year low. This may seem like a good thing for steel producers, but it's hurting the overall industry. Cheap ore prices, coupled with low demand for steel, have lowered profits for mining companies like Rio Tinto and BHP Billiton . Miners have seen their profits fall and their stock prices drop, and they've cut iron ore jobs in response.

A heavy load for steel stocks

AK Steel Holding , United States Steel , and Steel Dynamics are all down more than 59% since July 2008. Even for a cyclical industry, that's a hard number to swallow.

AK Steel's recent Q3 earnings report showed revenue was down 8% year over year. The company has been free cash flow negative for the past few years, and net income has been negative since 2009. But AK's not the only one suffering.

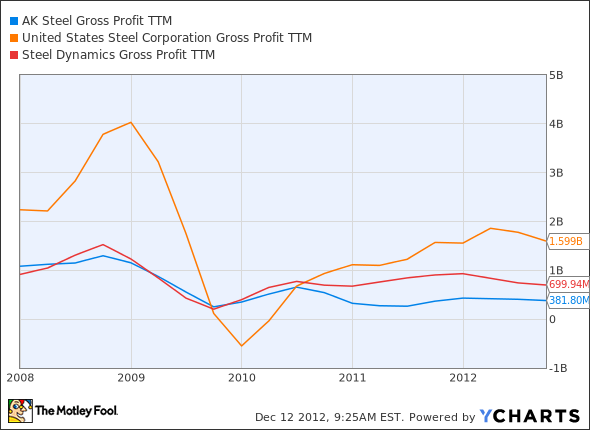

To get a broad view of how some steelmakers are doing, let's take a look at how net income has dropped since 2008 for these three companies:

AKS Gross Profit TTM data by YCharts

United States Steel's gross profit has plummeted the most, but gross profit for each company is below 2008 levels, despite a minor bounce back in 2010. AK Steel and Steel Dynamics have yet to break the $1 billion net income threshold since 2009. In any cyclical industry, this could be just a blip on the screen - but in this case, it's not.

A steely future

As an investment, steel stocks don't look too promising at the moment. The wrong incentives and overproduction in China have overstuffed the industry with steel - and China is still building more mills. This is more than the bottom of a boom and bust cycle. It's going to take significant downgrades to production and factories, an increase in mergers and acquisitions, and the right help from governments to put the steel industry back on a firm foundation.

It's hard to find a steel company to get excited about, especially when top steel producer ArcelorMittal just cut its dividend by 75%. I'd wait to see if the European and global economies improve, and if some of the major steel players can consolidate operations, before I'd put money in the industry.

But one company that may show some promise is Cliffs Natural Resources. The company has grown from a domestic iron ore producer into an international player in both the iron ore and metallurgical coal markets. It has performed well, relative to many competitors, in a very cyclical industry because of several factors that are likely to remain advantageous for Cliffs' management. For details on these advantages and more, click here now to check out The Motley Fool's brand new premium report on the company.

The article Why You Should Steer Clear of Steel originally appeared on Fool.com.

Fool contributor Chris Neiger has no positions in the stocks mentioned above. The Motley Fool owns shares of ArcelorMittal. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.