The Opportunity for MGM Resorts

MGM Resorts barely survived the financial crisis and is just now clawing its way back to sustainability. Unlike some of its rivals, MGM must rely on Las Vegas for most of its revenue and needs a healthy Strip to survive. But just how big is the opportunity in Las Vegas, and will it recover?

I cover this and just how a new resort in Macau could save MGM in our new premium report on the stock. Below you'll find an excerpt of the report but there's much more, and you can only find it by clicking here.

The opportunity

If you've ever been to Las Vegas, you've seen a number of MGM Resorts' most iconic properties. The MGM Grand, New York-New York, Luxor, CityCenter, and Bellagio are just a few of the company's properties on the Las Vegas Strip, and they form the heart of MGM Resorts' business.

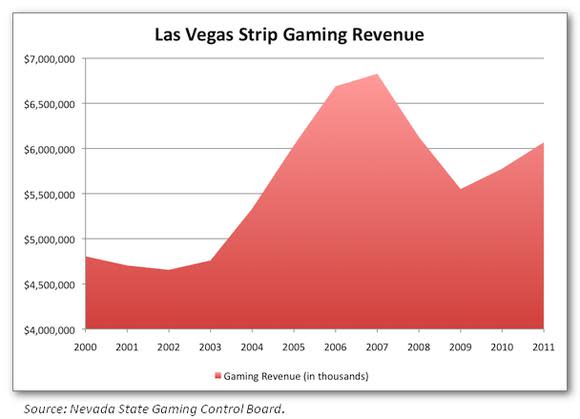

Gaming has always been at the heart of MGM Resorts, and it provides the single largest opportunity for growth in the future. This reliance on gaming has been a benefit and a challenge for MGM over just the past decade. When gaming grew double digits annually from 2003 to 2006, the company was flying high and profits were rolling in. But when the financial crisis hit, the company began to struggle.

This trough in gaming came at the exact same time that supply was added with CityCenter and Cosmopolitan in the center of the Strip, and profits have yet to return as a result.

That's the near-term challenge for results, but it also lays the groundwork for the company's opportunity going forward. The biggest opportunity for MGM is tied directly to economic growth in the U.S. The chart below shows that expenditures on gambling are leveraged to economic growth. This makes sense because when the economy grows, people have more money to spend on gaming. All MGM needs to see is good economic growth -- it's that simple.

The downside to this chart can be seen from 2008 to 2010. If you're leveraged on the upside, you're also leveraged on the downside. So when the economy went into the tank, so did spending on gambling.

Gambling is the biggest part of the business and it will come and go with the economy, but that's still only half of MGM. Nearly 50% of the company's revenue now comes from non-gaming activities. Hotel rooms are the second-biggest revenue generator, followed by food and beverage, and entertainment. If you think about the average person's expenses in Las Vegas, it's easy to see gambling as a shrinking piece of the pie. Visitors are spending money on expensive shows, expensive food, pool parties, and outrageously priced nightclubs.

This diversity of revenue helps MGM expand its business beyond gaming, but it is also tied to the economy, so it doesn't diversify the business's drivers. In the U.S., MGM will do well if the economy does well and will continue to flounder if the economy continues to be stuck in a rut.

Las Vegas still generates a majority of MGM's revenue, but just one casino in Macau generates more earnings before interest, taxes, depreciation, and amortization (EBITDA) than Bellagio, MGM Grand, and Mandalay Bay combined. MGM China is now MGM's best hope to recover from the rut it is currently in, and a bet on Cotai in Macau could make the stock a winner again.

MGM is a relatively new entrant in Macau, partnering with the daughter of Hong Kong business magnate Stanley Ho to gain a gaming concession in the world's largest gaming market. Currently, MGM owns 51% of its Macau operations, and this is the one casino that consistently spits off operating cash the company can use to pay down debt. But soon MGM will transition into an expansion phase in Macau, a phase that promises to be extremely profitable for the company.

To understand exactly how much of an opportunity MGM's expansion onto Cotai is, we have to look at the old Macau and the new Macau. The northern part of the map below is the Macau Peninsula, and for decades this is where most gaming took place. SJM Holdings, a rival casino operator, has a large stable of casinos there, and when gaming first opened up in Macau, this is where Las Vegas Sands, Wynn Resorts, and MGM built resorts.

But Cotai is the new center of gaming and entertainment in Macau, and we're just starting to see this area reach a critical mass. Cotai is an area of reclaimed land between two islands, and this created a blank canvas for gaming companies. So far, there are five resorts built in the area (Galaxy's resort is not shown below) and there will likely be four more under construction for the next three to five years.

To put it simply, Cotai is like the Las Vegas Strip, and the Macau Peninsula is slowly becoming Downtown Las Vegas.

MGM is planning to spend $2.5 billion to build a resort with 1,600 hotel rooms, 500 gaming tables, and 2,500 slot machines. When completed, this single resort could double or even triple the company's revenue and EBITDA in Macau. This could make MGM China the largest contributor to EBITDA and is the best hope the company has to grow revenue in a meaningful way.

The wild-card opportunity for MGM going forward is online gaming. If online gaming is legalized, it's easy to see it adding over $1 billion of EBITDA for gaming companies, and MGM would be one of the largest beneficiaries. MGM and Caesars would likely vie for the top spot in online gaming because of each company's reach and strong stable of gaming brands.

I hope you enjoyed this preview of MGM's future prospects. To keep reading the full report -- along with a year of key updates and guidance as news develops -- simply click here now.

The article The Opportunity for MGM Resorts originally appeared on Fool.com.

Fool contributor Travis Hoium has no positions in the stocks mentioned above. The Motley Fool has no positions in the stocks mentioned above. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.