Investors Snub SolarCity IPO

It's not a kind time to bring a renewable energy IPO to the market. Over the past two years investors have been burned by high hopes and disappointing stock performance. To garner interest the investment thesis better be air tight. So, when SolarCity gave more detail about its investment tax credit squabble with the Treasury Department (which I'll get into below) investors didn't just lower the price they would pay, they bailed altogether.

Last week's report of a $13-$15 IPO raising $151 million was revised down to a $10 IPO earlier this week, and postponed late yesterday. Today, the latest news is that the company will offer 11.5 million shares at $8 per share, a huge discount from the original plan (see the latest S-1 here).

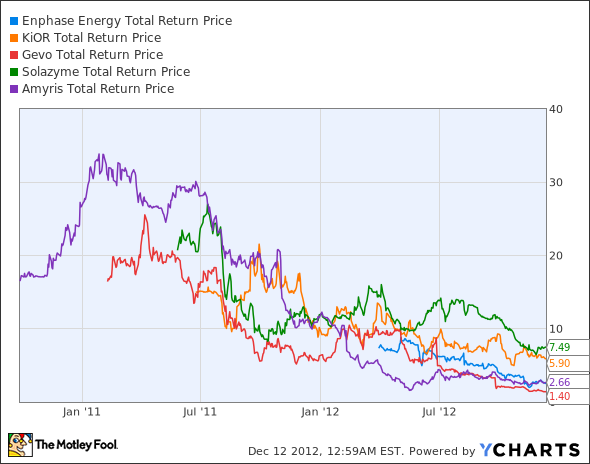

The trepidation is understandable. Below I've charted the performance of Enphase Energy , KiOR , Gevo , Solazyme , and Amyris , all renewable energy companies who had high hopes when they came to the public market.

ENPH Total Return Price data by YCharts

But as you can see, each has been an abysmal failure for investors since the launch of an IPO. So the bar is raised for SolarCity, which is trying to be the first true solar company in years to launch an IPO.

Problems with the Feds

SolarCity has a strong business model -- that's not the problem. Residential and commercial installations are growing and SolarCity is a dominant player in the industry.

But there are questions around how the company handled the Federal Investment Tax Credit, or ITC, and the Treasury grant program. These programs gave either cash grants or tax credits to solar installers based on the market value of a solar installation. SolarCity got into trouble because it is the installer and manager of funds that buy the installations. So, for example, an installation may cost $5 per watt to install, but it would be valued at $6 per watt in the case of the ITC or grant program, inflating the amount paid to SolarCity or investors.

Earlier this month the U.S. Treasury Department said that it had new guidelines for projects in California and Arizona. The company previously had been reimbursed at $6.87 per watt in California and $6.20 per watt in Arizona, but the Treasury Dept. said that fair value was $6 per watt and $5 per watt, respectively. The company would have to pay back the difference, which it estimates could be $17 million.

Up in the air

Right now it's still anybody's guess if SolarCity will actually have a successful IPO or not. It looks like Chairman Elon Musk, also CEO of Tesla Motors, may save the day by filling the order book for investment bankers. That may mean we will see shares trade tomorrow... or it may be cancelled again.

If you're looking for our recommendation on how to play a solar stock that's actually made it to market and is turning a profit, check out our report on First Solar. You get continuing updates and guidance on the company whenever news breaks in this brand new report that details every must know side of this stock. To get started, just click here now.

The article Investors Snub SolarCity IPO originally appeared on Fool.com.

Fool contributor Travis Hoium has no positions in the stocks mentioned above. The Motley Fool owns shares of Enphase and Solazyme. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.