Is Teva Pharmaceutical Destined for Greatness?

Every investor can appreciate a stock that consistently beats the Street without getting ahead of its fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with improving financial metrics that support strong price growth. Let's take a look at what Teva Pharmaceutical's recent results tell us about its potential for future gains.

What the numbers tell you

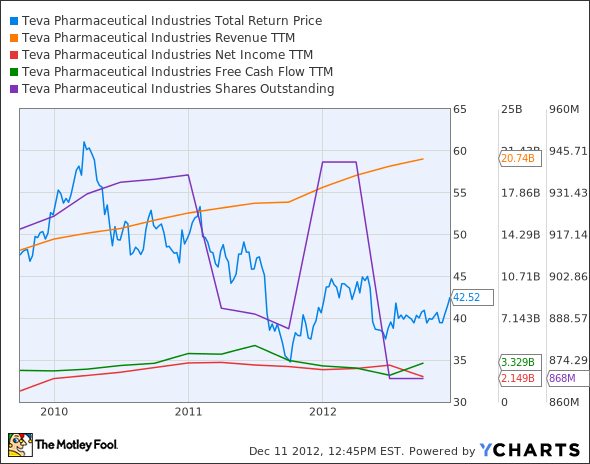

The graphs you're about to see tell Teva's story, and we'll be grading the quality of that story in several ways.

Growth is important on both top and bottom lines, and an improving profit margin is a great sign that a company's become more efficient over time. Since profits may not always reported at a steady rate, we'll also look at how much Teva's free cash flow has grown in comparison to its net income.

A company that generates more earnings per share over time, regardless of the number of shares outstanding, is heading in the right direction. If Teva's share price has kept pace with its earnings growth, that's another good sign that its stock can move higher.

Is Teva managing its resources well? A company's return on equity should be improving, and its debt to equity ratio declining, if it's to earn our approval.

Healthy dividends are always welcome, so we'll also make sure that Teva's dividend payouts are increasing, but at a level that can be sustained by its free cash flow.

By the numbers

Now, let's take a look at Teva's key statistics:

TEVA Total Return Price data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 60.3% | Pass |

Improving profit margin | (108.7%) | Fail |

Free cash flow growth > Net income growth | 23.4% vs. 130.3% | Fail |

Improving EPS | 162.4% | Pass |

Stock growth (+ 15%) < EPS growth | (10.6%) vs. 162.4% | Pass |

Source: YCharts. *Period begins at end of Q3 2009.

TEVA Return on Equity data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | 69.9% | Pass |

Declining debt to equity | 99.6% | Fail |

Dividend growth > 25% | 62.8% | Pass |

Free cash flow payout ratio < 50% | 25% | Pass |

Sources: YCharts and Morningstar. *Period begins at end of Q3 2009.

How we got here and where we're going

Six of nine passing grades isn't bad, but Teva's allowed its free cash flow to fall behind its profit, which gives the appearance of more growth than may really be occurring. Teva's profit margin is also lower today than it once was, and there's a lot of new debt on the books. What will it take to turn those flagging metrics around?

That turnaround might take a little bit longer than expected if Teva's own guidance is to be believed. Underwhelming the Street is never a good sign, particularly since the consensus for next year already projects a decline from 2012's bottom line. Teva's growth seems to hinge largely on the right acquisitions now. Last year, it acquired Cephalon. The latest rumors point to a possible tie-up with Amarin . My fellow Fool Dan Carroll offers reasons why this isn't a good idea for Teva, but what are the next-best buyout candidates -- and if there aren't any, can Teva push forward on its own?

Teva isn't just a generic-drug maker, and acquisitions are likely to only accentuate its transition toward greater patent strength. Multiple sclerosis drug Copaxone is currently the crown jewel in Teva's portfolio, at least until 2015. Both Mylan and Momenta Pharmaceuticals have been trying to introduce generic forms of the drug, and will be counting down the days until Copaxone's patent expires. No other of Teva's branded drugs come close to equaling Copaxone's sales, and the generic space is becoming more crowded as Pfizer realizes that multibillion-dollar blockbusters don't happen every year.

However, generic drugs aren't going to fade any time soon. UnitedHealth's management sees a bright future for generics, a logical consequence of tighter cost controls implemented by Obamacare's various provisions. Nor is Teva sitting idly by while Copaxone's patent ticks down. The drug is currently in a new trial as a combination treatment with Biogen Idec , which could give it a slightly longer lease on life should the treatment excel. Teva is also collaborating with fellow Israeli drugmaker Protalix BioTheraputics on therapeutic proteins.

Teva's branded future isn't certain, but today it is one of the more stable stocks you can buy. In these turbulent times, that might be enough to justify a closer look.

Putting the pieces together

Today, Teva has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Teva may yet decide to swallow Amarin. If that happens, Teva shareholders should be aware of the key issues on Amarin's plate. The Motley Fool's premium research report on Amarin answers your questions, whether you're looking for information on Amarin's viability as an independent drugmaker, or are investigating why it might be an ideal acquisition for Teva. Click here now to keep reading.

The article Is Teva Pharmaceutical Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more news and insights.Motley Fool newsletter services have recommended buying shares of Momenta Pharmaceuticals and UnitedHealth Group. Motley Fool newsletter services have recommended creating a diagonal call position in UnitedHealth Group. The Motley Fool has a disclosure policy.We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.