How Dividends Change the Game for This Dow Stock

The wealth-building power of compound interest will never cease to amaze me. It's a story of patience and attention to detail, where small differences in the short term add up to massive divergence over decades. In the end, the biggest winners don't always deliver the fattest share-price returns.

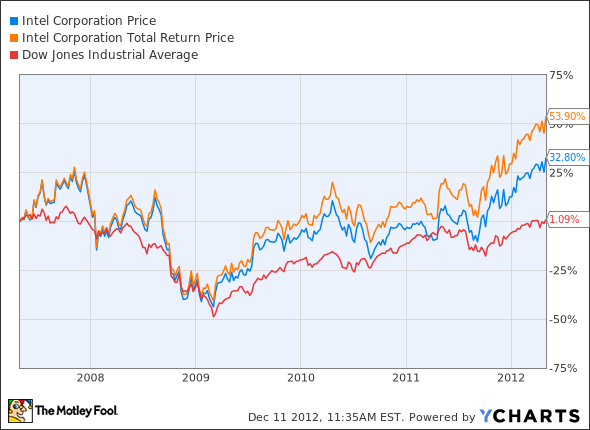

Here's one example that's very near and dear to my heart right now. Earlier this year, chip-making titan Intel was on a roll, totally crushing the Dow Jones Industrial Average on a five-year basis. Generous dividends played a large part in this outperformance:

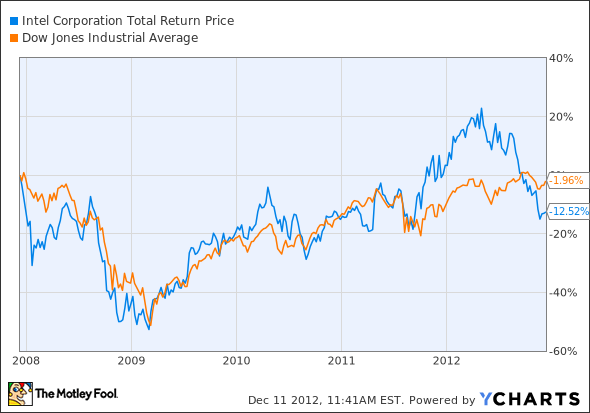

But something funny happened this summer: Investors suddenly assumed that tablets and smartphones were killing the traditional PC market, making Intel shares worth less than the paper they're printed on. Now, the stock has underperformed its Dow peers in a five-year window, even with dividends reinvested:

INTC Total Return Price data by YCharts.

Is that fair? Only if you buy the "death of the PC" idea without question.

I invite you to check out our premium report on Intel, which weighs the market challenges against the busload of opportunities that remain for Intel. Let me just point out that archrival Advanced Micro Devices looks weaker than ever, and potential server rival ARM Holdings has yet to stake a real claim on the data center market.

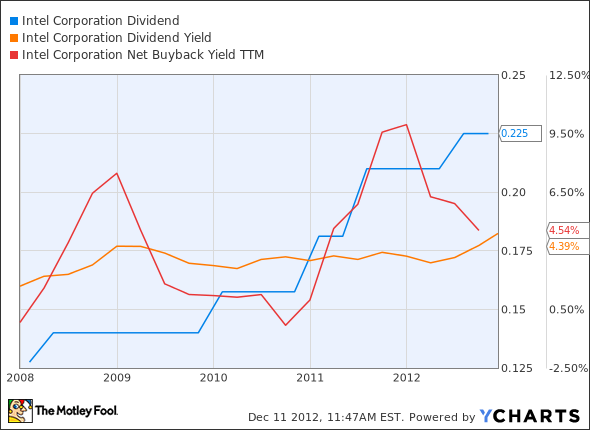

Meanwhile, the recent price drop has created a rare buy-in window if you're not convinced of Intel's imminent death. You see, Intel tends to turn stock market weakness into shareholder opportunity by buying back shares when they're cheap and raising dividends without pause.

INTC Dividend data by YCharts.

Add up Intel's record-high dividend yields with the trailing buyback rate, and you get an effective return-booster of nearly 9%. And that's before considering that Intel just borrowed $6 billion to buy back more stock in the near future. These shareholder-friendly policies moved me to open a position last week. This dividend fire hose will pour cash right into my portfolio for years to come.

Should you do the same?

Get an investing edge

When it comes to dominating markets, it doesn't get much better than Intel's position in the PC microprocessor arena. However, that market is maturing, and Intel is in a precarious long-term situation if it doesn't find new avenues for growth. In this premium research report on Intel, our analyst runs through all of the key topics investors should understand about the chip giant. Better yet, you'll continue to receive updates for an entire year. Click here now to learn more.

The article How Dividends Change the Game for This Dow Stock originally appeared on Fool.com.

Fool contributor Anders Bylundowns shares of Intel but holds no other position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+. The Motley Fool owns shares of Intel. Motley Fool newsletter services have recommended buying shares of Intel. Motley Fool newsletter services have recommended writing puts on Intel. The Motley Fool has a disclosure policy.We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.