Stocks for the Long Run: Mercury General vs. the S&P 500

Investing isn't easy. Even Warren Buffett counsels that most investors should invest in a low-cost index like the S&P 500. That way, "you'll be buying into a wonderful industry, which in effect is all of American industry," he says.

But there are, of course, companies whose long-term fortunes differ substantially from the index. In this series, we look at how individual stocks have performed against the broad S&P 500.

Step on up, Mercury General .

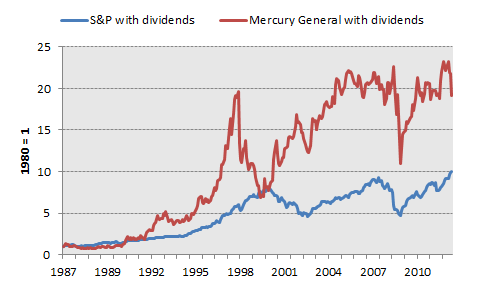

Mercury General shares have crushed the S&P 500 over the past quarter-century, albeit with more volatility:

Source: S&P Capital IQ.

Since 1987, shares have returned an average of 13.1% a year, compared with 9.7% a year for the S&P (both include dividends). One thousand dollars invested in the S&P in 1987 would be worth $19,200 today. In Mercury General, it'd be worth $52,100.

Dividends accounted for a lot of those gains. Compounded since 1987, dividends have made up 58% all of Mercury General's returns. For the S&P, dividends account for 39% of total returns.

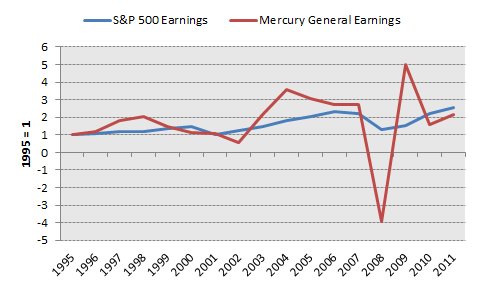

Now have a look at how Mercury General earnings compare with S&P 500 earnings:

Source: S&P Capital IQ.

Some underperformance here. Since 1995, Mercury General's earnings per share have increased by an average of 4.9% per year, compared with 6% a year for the broader index.

What's that meant for valuations? Mercury General has traded for an average of 19 times earnings since 1987 -- below the 24 times earnings for the broader S&P 500.

Through it all, shares have been strong performers over the past quarter-century.

Of course, the important question is whether that will continue. That's where you come in. Our CAPS community currently ranks Mercury General with a four-star rating (out of five). Care to disagree? Leave your thoughts in the comment section below, or add Mercury General to My Watchlist.

The article Stocks for the Long Run: Mercury General vs. the S&P 500 originally appeared on Fool.com.

Fool contributor Morgan Housel and The Motley Fool have no positions in the stocks mentioned above. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.