Heelys to Be Acquired by Sequential Brands

Wheel-heeled shoe manufacturer Heelys announced today that it has agreed to be acquired by Sequential Brands Group for approximately $63 million.

Sequential will purchase Heelys' shares for $2.25 each in cash, a 1.8% increase over Friday's $2.21 closing price .

"The Sequential transaction represents an attractive outcome and is in the best interest of Heelys stockholders," said Heelys President and CEO Tom Hansen in a statement. "Their all-cash offer provides our stockholders with a fixed cash value and eliminates the need to proceed with the previously announced Plan of Dissolution."

Heelys said it has terminated an asset purchase agreement with The Evergreen Group Ventures from October and has agreed to pay a termination fee, which Sequential will reimburse.

Yehuda Shmidan, CEO of Sequential, said his company is excited to add Heelys to the corporation's brand portfolio. A spokesperson for Tengram Capital Partners, Sequential's advising firm on the acquisition, said, "The Sequential model is simple: find great brands and marry them with equally great operating licensees to build on their core DNA."

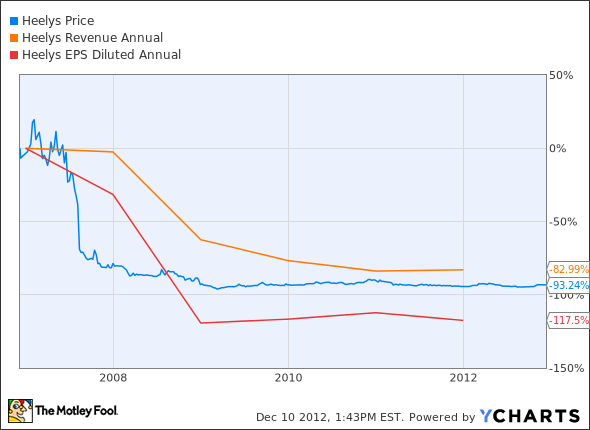

Since its IPO in 2006, Heelys shares have fallen 93% to their current value ($2.21 at yesterday's close). The company's stock price, sales, and net profit suffered heavily during the Great Recession, and have yet to recover.

The article Heelys to Be Acquired by Sequential Brands originally appeared on Fool.com.

Justin Loiseau has no positions in the stocks mentioned above. You can follow him on Twitter, @TMFJLo, and on Motley Fool CAPS, @TMFJLo.The Motley Fool has no positions in the stocks mentioned above. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.