Google Wants to Cast Off Some Dead Weight

Just last month, Apple decided to jettison some dead weight. And by "dead weight," I mean the unwanted business operations of a recent acquisition.

In Apple's case, the undesired part was AuthenTec's embedded security solutions business, which was sold to Inside Secure for $48 million. This came several months after Apple acquired AuthenTec for approximately $356 million. Before the deal closed, AuthenTec was sitting on about $25.3 million in cash and investments and no debt. That means Apple was able to recoup approximately 15% of its net acquisition price.

Do I hear $2.5 billion?

Google is reportedly looking to do the same with Motorola's set-top box division, previously known as its home segment. Last week, The Wall Street Journalreported that the search giant was nearing the end of its auction for the business. The deadline for bids had reportedly closed last Friday, but it was possible for Google to extend that time frame.

Big G may be able to fetch bids anywhere from $1.5 billion to $2.5 billion, and Google may even help finance the deal. The search giant is allegedly hoping to bring in about $2 billion. Bloomberg says that Google might still want to retain a chunk of equity and the division's patents, further complicating the deal.

Arris Group , Pace, and Technicolor have been named as the top suitors. Arris already provides telecommunications gear, so a set-top box business would be complementary to its business. The company would need to finance the deal, though, since it only had about $548 million in cash and investments at the end of last quarter and its market cap is $1.6 billion.

Not interested

When Google first announced the acquisition, the set-top box was thought to be a cherry on top. Google was primarily after Motorola's patents, but the smartphone business could be used to make Android devices with a newfound level of integration. Meanwhile, as tech giants like Apple and Microsoft continue to push further into the living room, the home division would have been a natural fit to spearhead a renewed Google TV foray.

Of the three, Microsoft already has the largest installed base in the living room thanks to its Xbox 360, which has now sold a lifetime total of 70 million units. The software titan is even reportedly working on an Xbox TV device that would be positioned closer to the $99 Apple TV. Targeting lower price points could expand Microsoft's Xbox consumer base.

Google's interest in selling the home business shows that it's not interested playing a hardware role in the expansion of Google TV. Instead, the company is relying on hardware partners like LG, Sony , and Vizio to sell integrated TVs and "buddy boxes" with Google TV. There hasn't been any talk of Google selling off Motorola's handset business, which implies that it could one day have Motorola build a Nexus device of some type.

Who needs operating income?

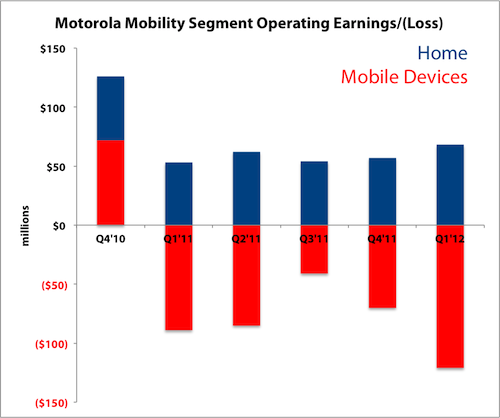

Oddly enough, the home business was actually the profitable segment of Motorola's two operating divisions. The top line was dominated by the mobile device business responsible for making smartphones and tablets.

Source: SEC filings.

Even though the home segment was smaller in terms of revenue, at least it was consistently profitable.

Source: SEC filings.

On the other hand, it's not like the home division's operating profit would be meaningful to Google, which generated $2.7 billion in operating income last quarter.

The price is right

The final price tag of Google's big splurge was $12.4 billion, but that also included the $2.9 billion in cash that Motorola had on its books. That brings its net cost down closer to $9.5 billion. If Big G can get as much as $2.5 billion for the home business, it will recoup a solid 26% of its net purchase price.

The search giant's final net purchase price might end up closer to $7 billion if it can fetch the high end of its asking price, substantially less than the initial $12.5 billion headline figure. The company has valued Motorola's patents and developed technology at $5.5 billion, which would end up being the bulk of what it paid for.

Time for Google to lose some weight.

Get smart

As one of the most dominant Internet companies ever, Google has made a habit of driving strong returns for its shareholders. However, like many other web companies, it's also struggling to adapt to an increasingly mobile world. Despite gaining an enviable lead with its Android operating system, the market isn't sold. That's why it's more important than ever to understand each piece of Google's sprawling empire. In The Motley Fool's new premium research report on Google, we break down the risks and potential rewards for Google investors. Simply click here now to unlock your copy of this invaluable resource, and you'll receive a bonus year's worth of key updates and expert guidance as news continues to develop.

The article Google Wants to Cast Off Some Dead Weight originally appeared on Fool.com.

Fool contributor Evan Niu, CFA, owns shares of Apple. The Motley Fool owns shares of Apple, Google, and Microsoft and is short Sony and has the following options: long JAN 2013 $22.00 calls on Sony. Motley Fool newsletter services recommend Apple, Google, and Microsoft. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.