These 3 Stocks Are Leading Today's Dow Rally

At the halfway point of the trading day, the Dow Jones Industrial Average is up 59 points, or 0.45%, to 13,133. The S&P 500 is up 1.7 points, or 0.12%. Despite some mixed economic reports, some stocks are leading the Dow higher.

Here are this morning's three U.S. economic releases:

Report | Period | Result | Previous |

|---|---|---|---|

Nonfarm payrolls | November | 146,000 | 138,000 |

Unemployment rate | November | 7.7% | 7.9% |

University of Michigan Consumer Sentiment Index | December | 74.5 | 82.7 |

Source: MarketWatch U.S. Economic Calendar.

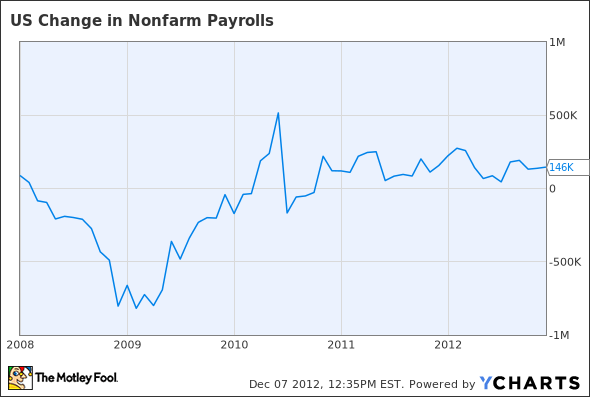

This morning the Department of Labor announced the U.S. added 146,000 nonfarm jobs. That's far beyond the 80,000 forecast by analysts, who had expected Not-Quite-a-Hurricane Sandy to slow jobs growth. While better than expected, 146,000 is still a tepid rate of jobs growth.

US Change in Nonfarm Payrolls data by YCharts.

While jobs growth wasn't great, the unemployment rate actually dropped 0.2 percentage points to 7.7%. This was the result of a drop in the number of people active in the labor market, i.e., those employed or seeking employment. The labor market dropped from 155.7 million to 155.3 million.

This week has seen a string of positive jobs-related reports. Yesterday the Department of Labor announced that new unemployment claims fell 25,000 to a seasonally adjusted 370,000. On Wednesday, ADP reported that the U.S. added 118,000 jobs in November, fewer than October's 157,000 jobs but in line with analyst estimates. The market is waiting for tomorrow's official monthly jobs report from the Department of Labor.

The market is down today, as the University of Michigan Consumer Sentiment index came in at 74.5, falling short of last month's 82.7 and analyst expectations of 82. Consumers said current conditions are positive, but they are very worried about the fiscal cliff. Investors fear this will translate into poor holiday sales.

Investors continue to be fixated on the fiscal cliff, and with no news about the fiscal-cliff negotiations, it's no surprise that the market is relatively unchanged. Some stocks are trying to get the Dow to finish the week higher. Here are today's leaders.

Today's Dow leaders

Today's Dow leader is JPMorgan Chase , up 2% to $42.30. Following close behind is Bank of America up 1.4% to $10.60. The big banks' financial results are highly dependent on the health of the economy, so these stocks are up thanks to today's unexpectedly positive jobs numbers.

Banks have been doing well this year. Fool analyst John Maxfield recently compiled five charts from the FDIC's Quarterly Banking Profile, which shows how the industry is recovering. There's a lot to like about JPMorgan. Fool analyst Amanda Alix recently pointed out three reasons to buy JPMorgan, including the bank's expansion into fast-growing niches, great leadership team, and top spot in the syndicated-loan business.

Second for the day is Caterpillar , up 1.5% to $87.23. Yesterday, speaking on CNBC about the fiscal cliff, CEO Doug Oberhelman said, "I talk every day to our customers around this country, and they're all scared to death [of] what happens in January," adding that "we're already looking at [capital expenditures] for next year -- what could we, and should we, do if things really start to slow down."

Fool analysts believe the risk that the country will go over the fiscal cliff is priced into Caterpillar's shares and that many investors are forgetting that Caterpillar gets over 66% of its business from outside North America. Furthermore, Caterpillar's quality products, extensive service network, and unparalleled brand strength combine to give it solid competitive advantages. Read all about Caterpillar's strengths and weaknesses in our brand-new report. Just click here to access it now.

The article These 3 Stocks Are Leading Today's Dow Rally originally appeared on Fool.com.

Dan Dzombak can be found on his Facebook page. He holds no position in any company mentioned. Click here and like his Facebook page to follow his investing articles. The Motley Fool owns shares of JP Morgan Chase and Bank of America Corporation Com. The Motley Fool has a disclosure policy.

We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.