Nobody Cares About Activision Blizzard's Sales Records

Yesterday, Activision Blizzard passed the $1 billion sales mark for Call of Duty: Black Ops II, the latest iteration of its annual shoot-em-up blockbuster. It took just 15 days. By comparison, Microsoft's Xbox-exclusive Halo 4 sold less than half as much on its first day as Call of Duty, which passed $500 million in the first 24 hours.

CEO Bobby Kotick said, "Since Call of Duty was launched, cumulative franchise revenues from players around the world are greater than current worldwide box office receipts to date for the top-10 grossing films of 2012 combined." Since the worldwide box office total is about $8.4 billion, that's pretty dang impressive.

Big deal?

The market has thus far reacted with a yawn. Since Black Ops II's release on Nov. 13, Activision's stock is up by about 5%, a gain of about $600 million in market cap. That's not enough to restore the stock to its 2011 year-end level. So far, Activision's still down 6% in 2012, despite not only releasing the year's best-selling game, but also setting preorder records with the multimillion-selling Diablo III and pushing its World of Warcraft subscriber numbers back over the 10 million mark with the release of expansion pack Mists of Pandaria.

As often as I've taken my shots at Activision over the past year, I still admit that I'm a little confused by the complete non-response. Based on the figures available from presale tracking site VGChartz, I anticipated a decline in Call of Duty sales. I was wrong on that count, but the market didn't react with any excitement at all. I think I may know why, though.

Deceptively stagnant

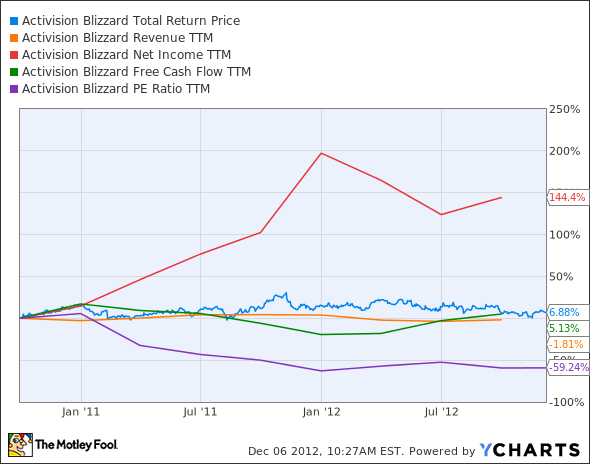

Activision's latest quarter was good enough to push its falling net income level back upward, but the long-term trend has not been particularly appealing. When I examined Activision this September, I noted that free cash flow levels have been stagnant for years. Over eight quarters, which have included not only the release of two monstrously successful Call of Duty sequels (the latest won't be included in financial totals until fourth-quarter results come out) but also the updates to two long-awaited Blizzard franchises, StarCraft II and Diablo III, free cash flow is... still stagnant.

ATVI Total Return Price data by YCharts.

Net income has risen, but investors appear to be paying closer attention to free cash flow, which has been a far more accurate indicator of the stock's movement in the past two years. Until this number nudges higher, we're unlikely to see any major stock-price shift. I also believe that investors are still expecting a long-term decline in World of Warcraft's subscriber base to offset any efficiency gains made from shifting to digital distribution, and also the sales gains from new franchises.

Warcrack addiction

Despite branching out lately, Activision remains hugely dependent on the monthly fees generated by World of Warcraft, which has an estimated lifetime take of over $10 billion. That's a larger amount than even Call of Duty, depending on how one reads Kotick's statement. Most game studios wind up heavily dependent on one huge franchise, and its absence is acutely felt by shareholders. Take-Two Interactive hasn't released a new Grand Theft Auto since 2008. That game was one of the best-selling titles of all time, and the anticipation surrounding its release pushed the company's stock to all-time highs, which didn't last long. The mere rumor of a new GTA in 2011 was enough to generate fresh market excitement in the slaughtered stock.

You have to hand it to Activision. They've kept to a grueling annual release schedule for Call of Duty, and gamers keep buying the titles in ever-greater numbers. I have my doubts that this is sustainable, but a more pressing concern is World of Warcraft. When (not if) the game's subscribers reach new lows next year, Activision's stock will likely reflect that exodus. It's really just a matter of time.

Some of the best investments in gaming aren't in gaming companies, but in the hardware manufacturers making those great graphics possible. One such company sits at the heart of "The Next Trillion-Dollar Revolution," which includes all major gaming platforms, from PC to mobile. Want to learn more about this opportunity? Click here to get the information you need, at no cost.

The article Nobody Cares About Activision Blizzard's Sales Records originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more news and insights.The Motley Fool owns shares of Microsoft. The Fool owns shares of and has written calls on Activision Blizzard. Motley Fool newsletter services have recommended buying shares of Activision Blizzard and Take-Two Interactive Software. Motley Fool newsletter services have recommended creating a synthetic long position in Activision Blizzard. Motley Fool newsletter services have recommended creating a synthetic covered call position in Microsoft. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.