1 Sign Netflix Is Ready to Soar

Netflix and Walt Disney announced Tuesday that they have entered into multiyear licensing/catalog agreements that grant Netflix users access to Disney's new films, as well as many of the film company's most coveted classics. This newest move puts Netflix back on the media map, but does it have what it takes to compete with the big boys?

Disneyflix

Effective immediately, Disney favorites such as Dumbo, Pocahontas, and Alice In Wonderland are now available to Netflix users. Starting in 2013, Disney's direct-to-video releases will be made available, and in 2016 Netflix users will receive first-run rights to Disney, Pixar, Marvel, and Disneynature films.

"Disney and Netflix have shared a long and mutually beneficial relationship and this deal will bring to our subscribers, in the first pay TV window, some of the highest-quality, most imaginative family films being made today," said Ted Sarandos, chief content officer at Netflix. "It's a bold leap forward for Internet television and we are incredibly pleased and proud this iconic family brand is teaming with Netflix to make it happen."

Disney-ABC Domestic Television President Janice Marinelli added that "Netflix continues to meet the demands of its subscribers in today's rapidly evolving digital landscape, and we are delighted that they will have much earlier access to our top-quality and entertaining slate."

Disney's dealings

The announcement comes on the same day that federal regulators approved Disney's $4 billion Lucasfilm acquisition. According to Lucasfilm.com, the deal includes promises of at least three Star Wars sequels starting in 2015. That means Netflix just nabbed Star Wars, too, as a healthy bonus to an already lucrative agreement.

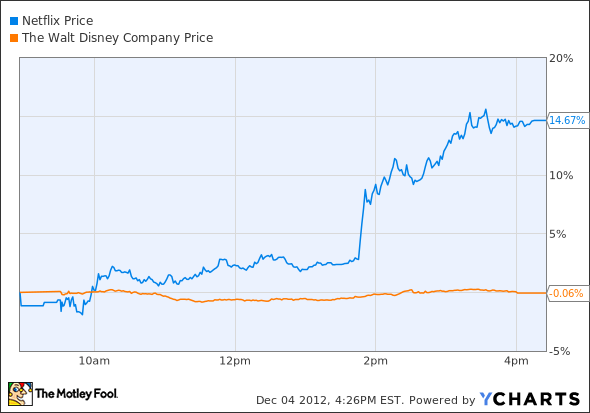

Although the joint press release didn't disclose any financial details of either agreement between Disney and Netflix, signs of the agreement's success are already playing out in the markets.

Disney shareholders seemed satisfied with their company's decision, while Netflix's stock soared 14.7%.

The licensing moat

Netflix shares have dropped 60% in the past two years, but things may just be looking up for this online streaming company. Billionaire investor Carl Icahn recently bought a 10% stake in Netflix, and the company's third-quarter results met revenue expectations and nearly tripled EPS expectations. In addition, the company upped its quarter-to-quarter domestic streaming margin by 0.8% to 16.4% and voluntary churn continues to drop.

The road ahead is unclear, especially as competitors like Amazon and Apple ramp up their own offerings. Amazon expanded its content by 10% to 22,000 titles with its recent Epix partnership, adding box office blockbusters like The Avengers and The Hunger Games to its lineup. Apple continues to boost its iTunes video usage (up 16% in September), and has a mountain of cash to buy up licensing agreements when it's good and ready to go after online streaming with a vengeance.

Exclusive excellence

But Netflix's Disney deals are exactly the type of strategic maneuvers that this company needs to compete with new entrants. Competitive moats for online companies are notoriously shallow, and exclusive licensing agreements are one of the few ways that media corporations can separate themselves from the crazed pack of commoditizing corporations.

The financial details are still under wraps, and there's no doubt that Netflix paid a pretty penny to be Disney's darling, but I do think the company made a smart decision. By coupling classic films with priority viewing for the newest Disney and Pixar features, Netflix's value proposition just got a whole lot stronger.

Along with its exclusive offerings for six of its top 10 TV shows, the company is going where Amazon and Apple cannot (at least for the next few years). If the company's voluntary churn keeps dropping and it can make up in online sales what it's losing in DVD subscriptions, Netflix might just be the best turnaround story of 2013.

The precipitous drop in Netflix shares since the summer of 2011 has caused many shareholders to lose hope. While the company's first-mover status is often viewed as a competitive advantage, the opportunities in streaming media have brought some new, deep-pocketed rivals looking for their piece of a growing pie. Can Netflix fend off this burgeoning competition, and will its international growth aspirations really pay off? These are must-know issues for investors, which is why we've released a brand-new premium report on Netflix. Inside, you'll learn about the key opportunities and risks facing the company, as well as reasons to buy or sell the stock. We're also offering a full year of updates as key news hits, so make sure to click here and claim a copy today.

The article 1 Sign Netflix Is Ready to Soar originally appeared on Fool.com.

Fool contributor Justin Loiseau has no positions in the stocks mentioned above, but he does think Sword in the Stone is Disney's most undervalued film of all time. You can follow him on Twitter, @TMFJLo, and on Motley Fool CAPS, TMFJLo.The Motley Fool owns shares of Walt Disney and Netflix. Motley Fool newsletter services recommend Walt Disney and Netflix. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.