Another Sign of Nokia's Downfall

Another day, another desperate leaseback deal.

Former cell phone giant Nokia is selling Nokia House, its enormous headquarter building in Espoo, Finland. Local investment firm Exilion will pay about $222 million up front for the 517,000 square feet of starkly Nordic glass and steel before the end of 2012. Nokia isn't leaving Nokia House, though -- the company will lease back the structure and plans on "continuing to operate in our head office building on a long-term basis."

Nokia House, or as Nokia likes to call it, a quick $220 million. Source: WikiMedia user -Majestic-.

These leaseback deals are getting popular among downtrodden tech companies. Semiconductor company Advanced Micro Devices announced a similar leaseback just last week, hoping to squeeze about $200 million of quick cash out of an attractive slice of Texas real estate. That leaseback doesn't have a buyer yet, and AMD plans to sell an auxiliary research facility rather than its Silicon Valley headquarters, but both of these fallen stars could use some spare cash right about now.

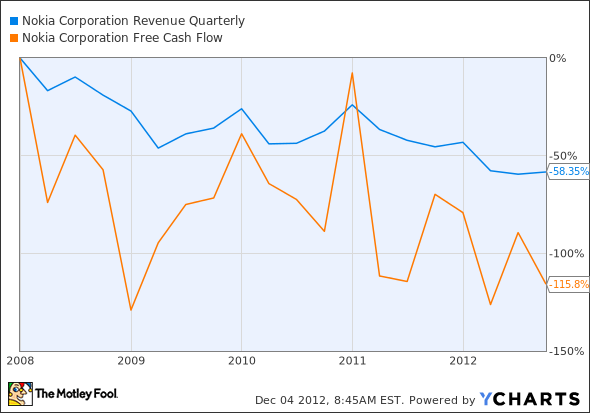

The painful decline of Nokia's fortunes. Note that 0% growth is at the top of this chart.NOK Revenue Quarterly data by YCharts.

A leaseback is kinda-sorta the corporate version of a reverse mortgage. Once you own a valuable building or piece of land outright, these are popular methods to monetize all that juicy equity again. But these deals aren't designed to provide a gentle stream of monthly income, like the popular retirement-padding strategy. Instead, Nokia and AMD are reaching for an immediate paycheck and buckling down for higher operating costs in the long run.

It's a desperate move for desperate times. Nokia is losing the smartphone race to Apple and Android, and the widely touted partnership with Microsoft isn't paying off so far. The Finns are cutting costs like there's no tomorrow, as well as trying to sell fringe assets like technology patents and real estate.

CFO Timo Ihamuotila wants to put a positive spin on the transaction, of course: "Owning real estate is not part of Nokia's core business," so why not monetize this valuable asset? But if Nokia's turnaround efforts were working at all, the company wouldn't be digging through the couch pillows for spare change like this.

Given the way heads are rolling at Nokia House, I'd imagine that the company could have chosen to lease out some recently barren office space to other companies for a more sustainable cash-raising strategy. Leave that option to Exilion, because Nokia really might not have a tomorrow.

Apple is at the center of technology's largest revolution ever, and longtime shareholders have been handsomely rewarded with over 1,000% gains. However, there is a debate raging as to whether Apple remains a buy. The Motley Fool's senior technology analyst and managing bureau chief, Eric Bleeker, is prepared to fill you in on both reasons to buy and reasons to sell Apple, and what opportunities are left for the company (and your portfolio) going forward. To get instant access to his latest thinking on Apple, simply click here now.

The article Another Sign of Nokia's Downfall originally appeared on Fool.com.

Fool contributor Anders Bylund holds no position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+.The Motley Fool owns shares of Microsoft and Apple. Motley Fool newsletter services have recommended buying shares of Apple. Motley Fool newsletter services have recommended creating a synthetic covered call position in Microsoft. Motley Fool newsletter services have recommended creating a bull call spread position in Apple. The Motley Fool has a disclosure policy.We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.