Is Energy Transfer Partners Destined for Greatness?

Every investor can appreciate a stock that consistently beats the Street without getting ahead of its fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with improving financial metrics that support strong price growth. Let's look at what Energy Transfer Partners' (NYS: ETP) recent results tell us about its potential for future gains.

What the numbers tell you

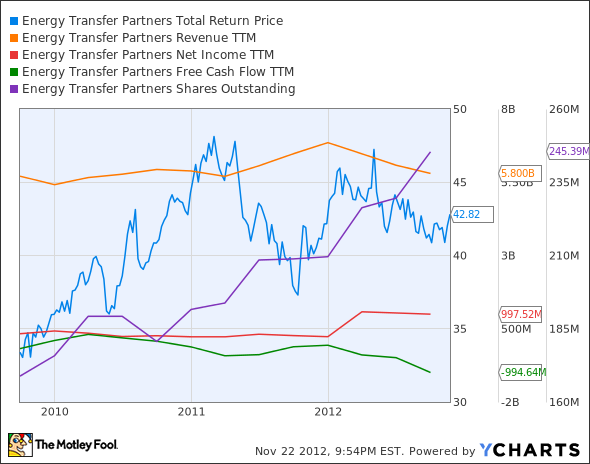

The graphs you're about to see tell ETP's story, and we'll be grading the quality of that story in several ways.

Growth is important on both top and bottom lines, and an improving profit margin is a great sign that a company's become more efficient over time. Since profits may not always reported at a steady rate, we'll also look at how much ETP's free cash flow has grown in comparison to its net income.

A company that generates more earnings per share over time, regardless of the number of shares outstanding, is heading in the right direction. If ETP's share price has kept pace with its earnings growth, that's another good sign that its stock can move higher.

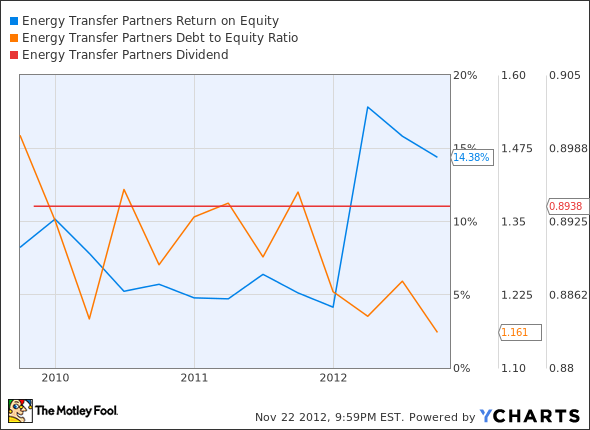

Is ETP managing its resources well? A company's return on equity should be improving, and its debt-to-equity ratio declining, if it's to earn our approval.

Healthy dividends are always welcome, so we'll also make sure that ETP's dividend payouts are increasing, but at a level that can be sustained by its free cash flow.

By the numbers

Now, let's take a look at ETP's key statistics:

ETP Total Return Price data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue Growth > 30% | 1.6% | Fail |

Improving Profit Margin | (273.3%) | Fail |

Free Cash Flow Growth > Net Income Growth | (456.2%) vs. 202% | Fail |

Improving Earnings per Share | 112% | Pass |

Stock Growth (+ 15%) < EPS Growth | 28.2% vs. 112% | Pass |

Source: YCharts.

*Period begins at end of Q3 2009.

ETP Return on Equity data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving Return on Equity | 74.7% | Pass |

Declining Debt to Equity | (22.5%) | Pass |

Dividend Growth > 25% | None | Fail |

Free Cash Flow Payout Ratio < 50% | Negative FCF | Fail |

Source: YCharts.

*Period begins at end of Q3 2009.

How we got here and where we're going

ETP earns a middling four of nine possible passing grades. Stagnant revenue, a negatively fluctuating profit margin, and increasingly negative free cash flow all contribute to ETP's failing grades today. Can ETP keep its dividend strong without going back to the stock-and-debt issue wells to fund growth? Can its free cash flow nudge higher? Let's take a look.

Cash flow, in ETP's case, depends on how you measure it. Fool contributor Aimee Duffy points out that the company's distributable cash flow, measured in discounted terms, has been on the upswing. In its latest quarter, ETP posted $339.5 million in discounted cash flow. Unfortunately, the company's volumes dipped significantly, and EBITDA fell 29% year over year. ETP felt the pain of low natural gas prices worse than pipeline peers Kinder Morgan (NYS: KMI) or Enterprise Products Partners (NYS: EPD) , even though EPD is a monster nat-gas midstream company, and Kinder Morgan isn't far behind.

Just before this underwhelming performance, Imperial Capital downgraded Kinder Morgan's pipeline MLP, Kinder Morgan Energy Partners (NYS: KMP) , while upgrading ETP. This was a bit confusing at the time, particularly to Fool contributor Rich Smith, who pointed out that the former is cash-flow positive while the latter isn't. Maybe these analysts see a bright future ahead for ETP and its many soon-to-be-online projects and acquisitions.

ETP's big move this year has been its acquisition of Sunoco, which brought it part-control of Sunoco Logistics' (NYS: SXL) retail pipeline assets as well. Sunoco should contribute a third of ETP's future cash flow, and it adds geographical reach into the U.S. northeast. On the downside, Sunoco's thousands of retail gas stations could be a drag on ETP, which has never managed retail operations before.

Another big move was to pick up a 50% stake (Kinder Morgan owns the other half) of the Citrus pipeline, bringing access to Florida, a state that relies predominantly on natural gas for energy generation. The company also has a huge amount of growth projects -- $3 billion in total -- coming online soon, in many cases by the end of this year.

As an MLP, ETP's tax issues are worth considering for many investors. Fool taxation guru Dan Caplinger offers an informative look at the relative value of investing in MLPs against the tax headaches that may crop up later.

Putting the pieces together

Today, ETP has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

The Fool's top energy analysts are just as interested in Energy Transfer Partners' future as you -- probably more so! That's why they've done the hard work of assembling a detailed premium research report on ETP to answer any questions investors may have. Is ETP worth your investing dollars? Will those massive projects be worth it? Why hasn't the Street caught on yet? Your subscription will not only answer these questions but will also keep you up to date on ETP's progress and projects for a full year. Want to get started? Click here to subscribe today.

The article Is Energy Transfer Partners Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter, @TMFBiggles, for more news and insights.Motley Fool newsletter services have recommended buying shares of Enterprise Products Partners. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.