3 Dow Stocks Declining Today

Apparently, that's all it takes: As Congressional leaders voice optimism on averting the fiscal cliff, Mr. Market gets his mojo back and stocks begin to post gains for the day, with the Dow Jones Industrial Average (INDEX: ^DJI) and the broader S&P 500 (INDEX: ^GSPC) up 0.2% and 0.3%, respectively, as of 1:30 p.m. EST. That's my hypothesis, or post hoc ergo propter hoc fallacy, anyway.

The micro view

Hewlett-Packard (NYS: HPQ) shares are down 2.9% so far today. As I pointed out in this column this morning, I believe the stock's decline is related to the disappointing results Dell reported after the market's closed yesterday. Historically, there is a high correlation between the two companies' earnings per share. HP reports results for its fiscal quarter ended Oct. 31 next Tuesday.

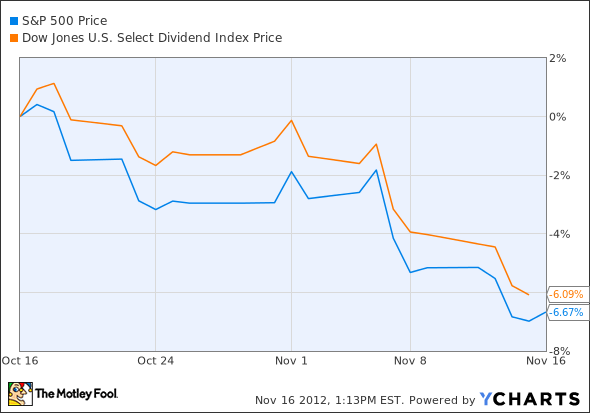

Verizon (NYS: VZ) and AT&T (NYS: T) are both losers today, with no identifiable news or fundamental drivers to explain the losses. In fact, the entire telecom services sector is lagging the market. This may be related to a rebalancing out of dividend stocks due to concerns over the potential expiration of the 15% tax rate on dividends next year (part of the "fiscal cliff"). As the following chart shows, dividend stocks, which have won investors' favor in the post-crisis, zero-interest-rate environment, have underperformed the market over the past month:

Nevertheless, high-quality dividend shares continue to offer some of the safest, most compelling opportunities to earn attractive long-term total returns in this market. For some of the best examples of these opportunities, click here to receive our free report "The 3 Dow Stocks Dividend Investors Need."

The article 3 Dow Stocks Declining Today originally appeared on Fool.com.

Alex Dumortier, CFA has no positions in the stocks mentioned above; you can follow him @longrunreturns. The Motley Fool has no positions in the stocks mentioned above. Motley Fool newsletter services recommend AT&T. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.