Is California Water's Dividend Doomed?

California Water Service Group (NYS: CWT) reported sub-par earnings on Wednesday, and its stock has taken a decent dip. But is this utility drying up for good, or does this miss provide a buying opportunity for your portfolio? Grab your bathing suit, let's do a deep dive.

Number crunching

Bad news is not exactly news for California Water. Despite increasing sales and net income, the utility has missed earnings estimates for four straight quarters.

The company reported net income of $29.8 million, or $0.71 EPS. Compared to $20.9 million in last year's third quarter, this might seem like an admirable increase.

But when the tax man cameth for California Water this quarter, it was to give the company a hefty $0.15 EPS non-recurring tax benefit. In reality, the company's EPS settled in at $0.56, $0.03 below analysts' expectations.

Top-line sales did offer analysts a slight surprise, coming in 1% ahead of estimates, at $178 million. Rate increases offered the heftiest bump, adding $4.3 million more to California Water's sales this quarter. Offset rate increases offered up an additional $4.1 million more than last year.

But, even though customers are paying more for water, they're barely using more than a year ago. New customers added $300,000, and increased usage from existing customers a lukewarm $200,000.

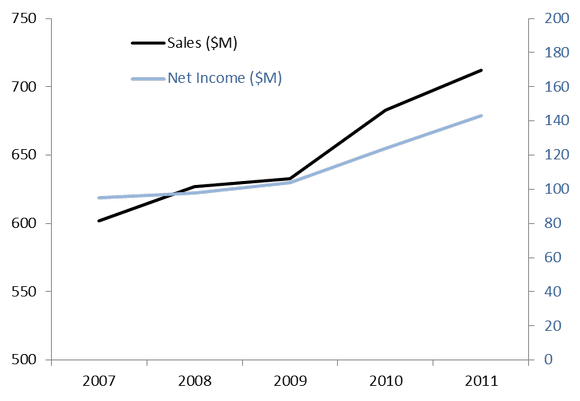

For a more long-term perspective, here's how the utility's sales and net income have stacked up for the past five years:

Source: Author, data from e*trade.com

Since 2007, California Water has increased sales by 37%, and net income by 23%. That's slow to decent growth, but utilities aren't exactly fast movers. A more telling sign might be the company's profit margin, with has shrunk from 2008's 9.8% high to last year's 7.6% low.

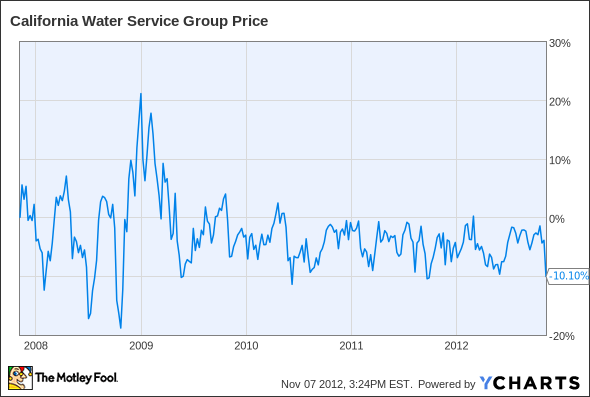

Flat. Like water.

No self-respecting investor expects to be blown away by utility earnings, but California Water has officially been a yawner for the past five years straight.

Listening to the company's Chairman and CEO Peter Nelson, it's not hard to understand why.

Our third quarter earnings are in line with our expectations, given the impact of the new tax rule and positive mark-to-market adjustment. More important for the long term is our continued success in operating within our budget and obtaining timely recovery of prudently incurred costs in water rates.

Rightly so, Nelson puts most of his emphasis on taxes and regulation, but the only mention to any company-centric action is a vague reference to "operating within our budget."

Bring on the dividend

But if there's one thing investors don't yawn at, it's a fat dividend. Rate battles have allowed California Water to increase its profit over time, and that money has gone a long way toward supporting the company's 3.45% dividend. Compared to other water utilities, this is about as good as it gets:

CWT Dividend Yield data by YCharts

VeoliaEnvironnement (NYS: VE) has droves of debt, so I'm willing to declare California Water the dividend winner. It's also increased its dividend the most, nearly 50% in the past five years.

But, even though California Water has industry-average debt, it carries the highest payout ratio around (besides silly Veolia). That means the company has less capital to self-invest, and also less wiggle room to keep that dividend growing in years to come.

Company | Payout Ratio | Debt-to-Equity Ratio |

|---|---|---|

California Water | 70% | 1.3 |

American Water Works (NYS: AWK) | 46% | 1.3 |

Aqua America (NYS: WTR) | 56% | 1.3 |

Veolia Environnement | 100% | 2.8 |

American StatesWater (NYS: AWR) | 45% | 0.8 |

Source: e*trade.com and ycharts.com

Tap that?

California Water is a long-term conservative play. Management's not going to sink, but it seems content enough to tread water. Investors who can stand the five-plus year wait for population increases in California, Hawaii, Washington, and New Mexico will get their price rise in due time, and enjoy a nice dividend along the way.

But there are other companies out there that offer dividend opportunities today with sustained growth tomorrow. The Motley Fool has compiled a special free report outlining our nine top dependable dividend-paying stocks. It's called "Secure Your Future With 9 Rock-Solid Dividend Stocks." You can access your copy today at no cost! Just click here to discover the winners we've picked.

The article Is California Water's Dividend Doomed? originally appeared on Fool.com.

Justin Loiseau has no positions in the stocks mentioned above, but he does drink water. You can follow him on Twitter, @TMFJLo, and on Motley Fool CAPS, @TMFJLo.The Motley Fool has no positions in the stocks mentioned above. Motley Fool newsletter services recommend California Water Service Group, Veolia Environnement (ADR), and Aqua America. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.