Will This Mega-Dividend Survive?

Rural telecom Windstream (NAS: WIN) just reported third-quarter results. Shares plunged as much as 9.6% on the news, setting fresh three-year lows.

It's not that the third quarter was terrible. Windstream hit analyst estimates right on the nose with adjusted earnings of $0.09 per share on $1.55 billion in sales.

But, management lowered its fourth-quarter forecast for -- take a deep breath, please -- adjusted operating income before depreciation and amortization, or OIBDA. That non-standard metric is a key component of Windstream's adjusted cash flow calculations, so anything that pushes OIBDA down will also threaten the company's stellar dividend.

After Thursday's price drop, Windstream's dividend yield stands at 11.7%. That's the third-highest yield you'll find on the S&P 500 index, trailing only Pitney Bowes' (NYS: PBI) 12.3% yield, and R.R. Donnelly's (NAS: RRD) 10.8% payout. Both stocks are trading near multi-year lows, just like Windstream. It's a painful way to boost your dividend yield.

Windstream's payout is also larger than fellow second-tier telecoms Frontier Communications (NAS: FTR) and CenturyLink (NYS: CTL) , neither of which break the 9% mark.

These are the kinds of dividends that people build portfolios around. You can bet your pants that the stock would plunge drastically if management ever dared to lower those juicy payouts. And that goes a long way toward explaining this week's hair-raising drop -- the yield really is at risk.

Oh, CEO Jeff Gardner put a positive spin on it. It's kind of his job, and he's kind of getting used to it. He said:

I am confident in our ability to deliver strong free cash flow long-term to support our dividend. The dividend is a key component of our investment thesis, and we believe it is the best way to provide returns to our shareholders.

Yeah, but Windstream may soon have to dip into cash reserves to keep those quarterly checks flowing. The company has converted 66% of that OIBDA-based adjusted free cash flow into dividend checks this fiscal year -- and a heart-stopping 81% in the third quarter.

Keep in mind that these are heavily-adjusted numbers. Windstream backs out inconvenient items, like pension plans and merger expenses. The free cash flows that Fools know and love added up to an even $100 million this quarter, which is far less than the $147 million spent on dividend checks.

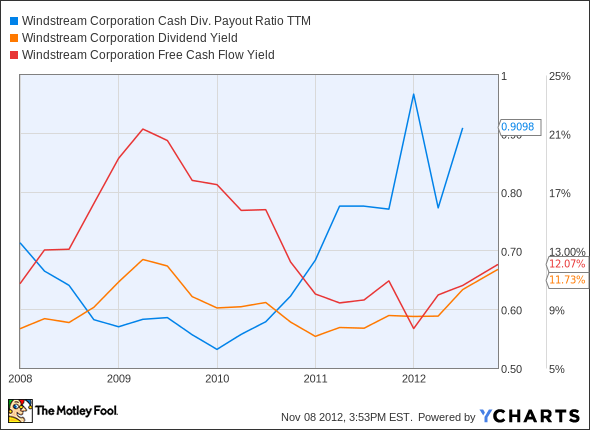

And it's not exactly recent news, either. Watch the spread between cash flow yields and dividend yields shrinking to nearly nothing, then see the payout ratio spike:

WIN Cash Div. Payout Ratio TTM data by YCharts

Windstream must reverse this terrible trend, or risk losing investor confidence on a massive scale. Dividend cuts are all the rage among European telecoms right now; France Telecom (NYS: FTE) just slashed its dividend budget by the ankles, and Telefonica (NYS: TEF) put its policy on ice altogether. Will Windstream be the first American telecom to go down that dark road?

When it comes to dividend yields, you won't find many higher than Frontier Communications. While its juicy dividend is tempting, every Frontier investor has to understand that it's not a sure thing. A huge acquisition has transformed the company forever. Will the move bear fruit, or are investors destined for another disappointing dividend cut? In this premium research report on Frontier Communications, we walk you through all of the key opportunities and threats facing the company. Better yet, you'll receive a full year of updates to boot. Click here to learn more.

The article Will This Mega-Dividend Survive? originally appeared on Fool.com.

Fool contributor Anders Bylund owns shares of France Telecom, but he holds no other position in any company mentioned. Check out Anders' bio and holdings, or follow him on Twitter and Google+. The Motley Fool owns shares of France Telecom. Motley Fool newsletter services have recommended buying shares of France Telecom. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.