Will This Dow Stock Ever Boost Its Dividends Again?

The mortgage-fueled financial disaster of 2008 was not an equal-opportunity crisis.

Two of the surviving American megabanks recovered swiftly from the global calamity, while the other two are down for the count:

BAC Total Return Price data by YCharts. Shaded areas denote U.S. recessions.

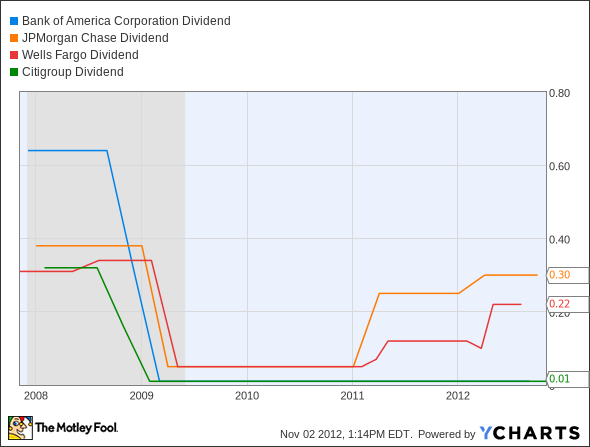

Citigroup (NYS: C) lost its coveted spot on the Dow Jones Industrial Average (INDEX: ^DJI) in 2009, while Bank of America (NYS: BAC) still clings to the market's most widely followed index. But how long can the red, white, and blue money-center maintain that distinction? Bank of America's shares have lost 90% of their value in five years' time, and its government-approved quarterly dividend remains a lousy penny per share:

BAC Dividend data by YCharts. Shaded areas denote U.S. recessions.

If Bank of America ever manages to increase its dividend again, it would be a sure sign that the company can check out of the intensive-care unit. For one, the bank's own management and board would have to conclude that cash flows and the balance sheet can support a richer payout. But more importantly, the decision would have to pass muster with government regulators, too.

A dividend boost from American banks can't be a marketing move these days. It's more like an official stamp of approval from the people who design financial stress tests. That's why any dividend increase from Bank of America would result in a huge boost to its share prices. Investors would not only cash in larger quarterly checks, but they could also assume that the deeply wounded business is back on the mend.

Will Bank of America recover or die? I'm not the Fool's finest banking expert by a long shot, but I can certainly point you to the guy who is.

Our chief analyst for the financial sector, Anand Chokkavelu, has pondered the circumstances that would drop Bank of America's shares from $10 to $5 -- or shoot them past $20.

To learn more about the most-talked-about bank out there, check out our in-depth company report on Bank of America, penned by Anand and based on his deep expertise in the sector. The report details Bank of America's prospects, including three reasons to buy and three reasons to sell. Just click here to get access.

The article Will This Dow Stock Ever Boost Its Dividends Again? originally appeared on Fool.com.

Fool contributor Anders Bylundhas no positions in the stocks mentioned above. Check out Anders' bio and holdings, or follow him on Twitter and Google+. The Motley Fool owns shares of Bank of America, Citigroup Inc , JPMorgan Chase & Co., and Wells Fargo & Company. Motley Fool newsletter services recommend Wells Fargo & Company. Try any of our Foolish newsletter services free for 30 days.We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.