Breaking Down the Broadcom Earnings Report

Shares of Broadcom (NAS: BRCM) weren't getting much love on Wednesday, despite beating analysts' estimates for its third quarter. The chip maker saw growth across all of its business segments in the quarter, with wireless in particular growing at an impressive pace.

Broadcom CEO Scott McGregor said, "We achieved key company milestones including our first quarter above $2 billion in revenue and our first quarter of mobile and wireless revenue above $1 billion." With Apple's (NAS: AAPL) iPhone 5 dominating the smartphone market alongside with Samsung's Galaxy products, Broadcom continues to benefit from its supplier relationships with these companies.

Net revenue climbed 9% to $2.13 billion for the quarter, ahead of analysts' estimates for revenue of $2.09 billion. However, the higher-than-expected revenue was offset by increased investments in research and development, as well as an 11% increase in manufacturing costs. As a result, earnings came in at $0.38 per share, down from $0.48 per share in the year-ago period.

Not to worry

While it's never fun to see operating expenses outpace revenue, it's critical that the company continues to beef up research and development spending. It's key in this industry, especially with intense competition from big names such as Texas Instruments (NAS: TXN) , Qualcomm (NAS: QCOM) , and NVIDIA (NAS: NVDA) .

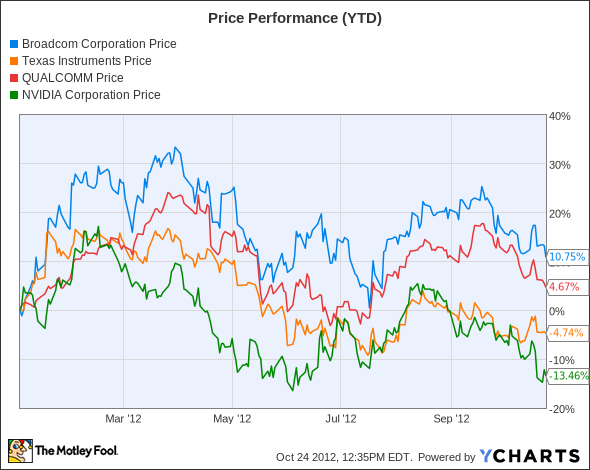

Shares of Broadcom are up more than 14% this year. But, let's see how the stock measures up next to its industry peers in terms of price performance.

It's clearly besting Qualcomm, NVIDIA, and Texas Instruments -- and doing it consistently. Overall, Broadcom's third-quarter earnings report was positive. However, the company forecasts lower revenue for its current quarter as a result of weakness in the global economy. Broadcom lowered its guidance for the fourth quarter to reflect sales ranging from $1.95 billion to $2.1 billion, which is less than analysts' expectations of $2.11 billion, according to Reuters.

All told, I like Broadcom's leading market position and diverse product portfolio. With more companies using Broadcom's chips in their tablets and mobile devices, the company looks poised for success over the long term. Also, there's a good chance that Apple will use Broadcom's chips in its newly unveiled iPad Mini, which should give the company a nice boost in its mobile segment going forward.

The introduction of the iPad Mini is an event Apple investors have been looking forward to for months. The stakes are high and the opportunity is huge, to help investors better understand where Apple is headed, we've released an in-depth research report on the iDevice maker. By picking up a copy of our premium research report on Apple, you'll learn everything you need to know about the launch, and receive ongoing guidance as key news hits. Claim your copy today by clicking here now.

The article Breaking Down the Broadcom Earnings Report originally appeared on Fool.com.

Fool contributor Tamara Rutter owns shares of Apple. The Motley Fool owns shares of Apple and Qualcomm. Motley Fool newsletter services recommend Apple and NVIDIA. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.