Is a Crash on the Way for This High-Flying Biotech?

Shares of PDL BioPharma (NAS: PDLI) recently hit a new 52-week high. The stock has soared 55% so far this year. Will PDL continue to fly high, or is a crash possibly in the wings? Let's take a look.

How it got there

You might think that a company whose stock skyrocketed so much so quickly would have strong revenue and earnings growth. That's not the case for PDL. Total revenue and earnings for the first six months of 2012 actually dropped compared to the same period last year.

These declines come with asterisks, though. The company received a temporary bump in revenue for the first half of 2011 because of a one-time settlement payment from UCB Pharma. Earnings were up for the period if we factor in an adjustment for non-cash interest expense associated with two notes.

PDL's success comes primarily from four products. Avastin, Herceptin, and Lucentis are all licensed to Genentech. Tysabri is licensed to Elan (NYS: ELN) .These products, along with asthma drug Xolair, continue to drive revenues for PDL.

How it stacks up

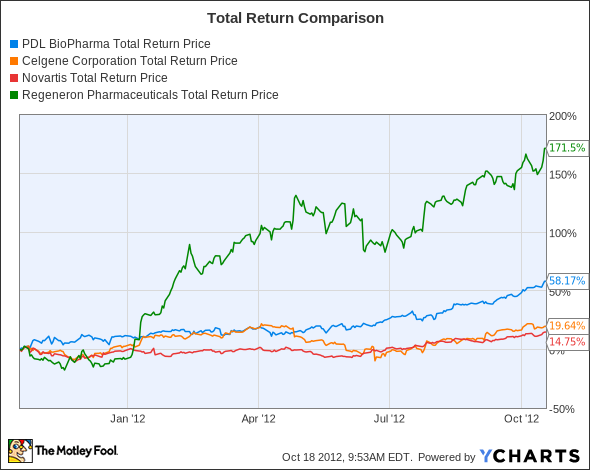

PDL goes against multiple competitors with its various drugs. Here's how it stacks up against three of its major rivals in terms of total return performance over the past year.

PDLI Total Return Price data by YCharts.

PDL's total return over the year is quite impressive. The performance crown, though, belongs to Regeneron Pharmaceuticals (NAS: REGN) . Regeneron's year-to-date return tops 171%.

Returns for the other two rivals aren't too shabby, either. Celgene (NAS: CELG) returned nearly 20% so far this year, while Novartis (NYS: NVS) saw total returns of nearly 15%.

The rankings are shuffled some, though, when we look at other key metrics.

Company | Price/Book | Price/Cash Flow | Forward P/E | Dividend Yield |

|---|---|---|---|---|

PDL BioPharma | NM | 5.50 | 4.77 | 7.20% |

Celgene | 5.71 | 18.20 | 14.19 | N/A |

Novartis | 2.39 | 18.00 | 11.87 | 3.90% |

Regeneron | 26.53 | 2,382.00 | 37.24 | N/A |

PDL looks very cheap in terms of price/cash flow and forward P/E. The company also boasts one of the strongest dividend yields of any health care stock.

What's next

With great total return performance, attractive valuation, and a terrific dividend, what's not to like about this stock? The answer lies in what lurks around the corner.

PDL's patent protection runs out by the end of 2014 for most of its key products.Without new products, PDL won't make any significant amount of revenue after the first quarter of 2016. The fantastic run experienced by the company could realistically come to an end in the near future.

Are there any potential life-savers on the horizon? Nothing huge yet. The Food and Drug Administration approved PDL's Perjeta cancer drug in June. PDL also signed a deal with Axogen recently to obtain royalties on some of the company's peripheral nerve repair products.It's too soon to know how big of an impact these developments will have, though.

All the numbers look great, but I'm a little leery jumping into PDL without a clear path for the company's future beyond 2014. Things are just too iffy for me right now. While PDL's management could very well find a suitable approach to succeed over the long run, I recommend taking a wait-and-see attitude.

If you're looking for less-risky dividend stocks, The Motley Fool has compiled a special free report outlining our nine top dependable dividend-paying stocks. It's called "Secure Your Future With 9 Rock-Solid Dividend Stocks." You can access your copy today at no cost! Just click here to discover the winners we've picked.

The article Is a Crash on the Way for This High-Flying Biotech? originally appeared on Fool.com.

Fool contributor Keith Speights has no positions in the stocks mentioned above. The Motley Fool has no positions in the stocks mentioned above. Motley Fool newsletter services recommend Elan. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.