These Stocks Are Defying the Dow's Drop

At the halfway point of the trading day, the Dow Jones Industrial Average (INDEX: ^DJI) was down 10 points (-0.09%) to 13,540. The S&P 500 (INDEX: ^GSPC) was up six points (0.42%) to 1,461.

There were two economic releases this morning which were positive for stocks.

Report | Period | Figure | Previous |

|---|---|---|---|

Housing starts | September | 872,000 | 758,000 |

Building permits | September | 894,000 | 801,000 |

Source: MarketWatch U.S. Economic Calendar.

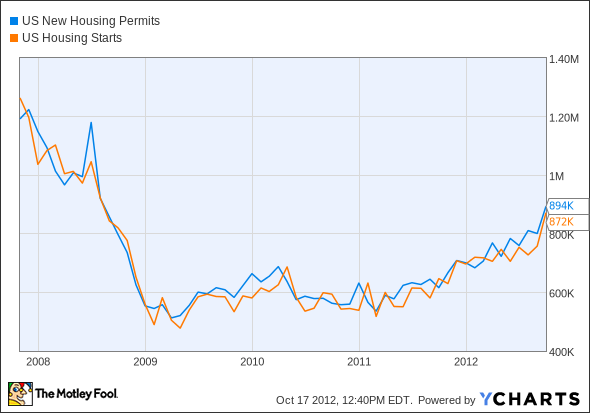

The U.S. Department of Commerce reported annualized housing starts of 872,000, trouncing last month's 758,000 and analyst expectations of 770,000. Housing starts are at their highest levels in four years. The department also reported that building permits rose to 894,000 from last month's 801,000. While housing starts reflect strength in the housing market currently, the building-permits metric is a forward-looking measure of housing-market strength, and the latest result bodes well for the housing market going forward.

U.S. New Housing Permits data by YCharts.

The U.S. markets are up on the news, and a few stocks are leading the Dow's rise.

Today's Dow leaders

Today's Dow leader is Alcoa (NYS: AA) , up 2.24% ($0.20) to $9.14. Alcoa is a cyclical company highly dependent on GDP growth for profitability. The positive housing data bodes well for the economy, and thus Alcoa is up. The aluminum manufacturer reported earnings last Monday of $0.03 per share, excluding $175 million ($0.15 per share) in one-time charges. While the headline number of $0.03 was in line with analyst expectations, all the one-time charges were not figured in, and as such, the stock dropped 4.6% yesterday. Fool analyst Taylor Muckerman took a closer look at Alcoa's earnings. Click here for his take.

Second for the day is Caterpillar (NYS: CAT) , up 2.05% ($1.74) to $86.70. Like Alcoa, Caterpillar is a cyclical company highly dependent on GDP growth for profitability. Today the company is being buoyed by the positive U.S. housing data. It reports earnings on Monday. Analysts expect the equipment manufacturer to report earnings of $2.21 per share, up 15% from last year's $1.93 per share, and revenue of $16.8 billion, up 7% from last year's $15.72 billion. Fool analyst Eric Volkman recently took a look at Caterpillar after the company announced a 3% price increase across all of its products. Click here for his take.

Get in the know

Caterpillar is the market share leader in an industry in which size matters, and its quality products, extensive service network, and unparalleled brand strength combine to give it solid competitive advantages. Read all about Caterpillar's strengths and weaknesses in our brand-new report. Just click here to access it now.

The article These Stocks Are Defying the Dow's Drop originally appeared on Fool.com.

Dan Dzombak can be found on his Facebook page, he holds no position in any company mentioned. Click here and like his Facebook page to follow his investing articles. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.