Is This Company Sitting on a Tower of Potential Profits?

Shares of American Tower (NYS: AMT) hit a 52-week high on Tuesday. Let's take a look at how it got there and see if clear skies are still in the forecast.

How it got here

Not since 4G LTE technology was introduced to the world has there been such buzz in the cellular tower sector.

The three companies that comprise the tower sector -- American Tower, Crown Castle (NYS: CCI) , and SBA Communications (NAS: SBAC) -- have all been in rally mode over the past month following the announced deals that Deustche Telekom's T-Mobile will be purchasingMetroPCS Communications (NYS: PCS) and that SoftBank will be taking a majority stake in Sprint Nextel (NYS: S) . Both Sprint and MetroPCS have struggled to build-out their advanced 4G networks, and capital infusions from SoftBank and T-Mobile should help fuel infrastructure build-out and spur antenna spending and data usage for all tower companies. Crown Castle, of course, is really licking its chops, since it holds exclusive rights to T-Mobile's data usage via a multi-decade contract signed last month.

The entire sector is also a play on future mobile data growth. With the introduction of tablets, the reliance on PCs is waning, creating even more growth opportunities for tower companies. Many of these companies also boast high gross margins since it's both quick and cheap to simply add antennas to existing towers.

The concern with tower companies is their massive debt load which comes from their need to expand their coverage and build towers to meet mobile providers' needs.

How it stacks up

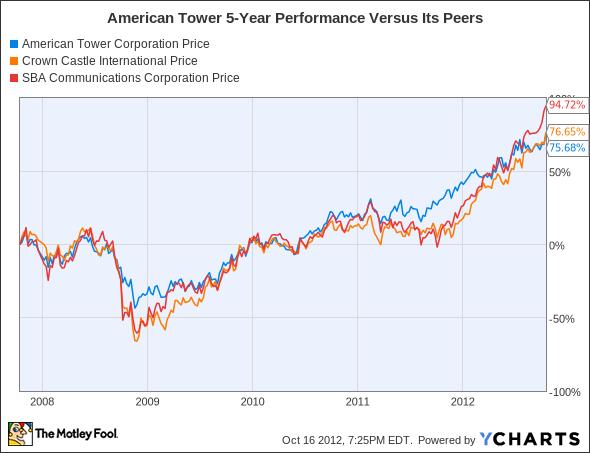

Let's take a look at how American Tower compares to its peers.

Correlated much? It's almost scary how correlated these movements are!

Company | Price/Book | Price/Cash Flow | Forward P/E | Debt/Equity |

|---|---|---|---|---|

American Tower | 8.7 | 21.6 | 35.7 | 214.2% |

Crown Castle | 6.9 | 28.1 | 47.9 | 292.6% |

SBA Communications | 16.8 | 27.4 | NM | 814.5% |

Sources: Morningstar and Yahoo! Finance. NM = not meaningful; earnings are expected to be negative over the next 12 months.

Value investors, turn around now lest ye be turned to stone! That debt-to-equity column is enough to make anyone gasp for air.

As a play on free cash flow, these tower companies' metrics aren't nearly as horrific as the above figures would suggest, but they aren't that great, either. American Tower is a consistently profitable company and has garnered the love of income investors now that it's officially classified as a real estate investment trust. As a REIT, it receives favorable tax status in exchange for returning 90% or more of its earnings in the form of a dividend to shareholders. Neither Crown Castle nor SBA pay a dividend.

Crown Castle is bound to see a boost in its figures over the coming years as it realizes a increase in data usage thanks to T-Mobile's MetroPCS investment. SBA, on the other hand, has been a horror. It hasn't turned an annual profit once in the past decade, and has missed Wall Street's EPS projections in 14 consecutive quarters!

What's next

Now for the $64,000 question: What's next for American Tower? The answer is dependent on the company's ability to add new antennas and build towers to meet mobile providers' needs, as well as prudently regulate its high debt load.

Our very own CAPS community gives the company a four-star rating (out of five), with 91.4% of members expecting it to outperform. Although I've yet to "officially" make a CAPScall rating on American Tower, apparently I did support an outperform call in April, yet the selection of that pick appears to have never actually made it into my CAPS portfolio.

I will be rectifying that this go-around and making sure to select American Tower with an outperform rating. Even after the sector run-up I'd call American Tower the clear leader in both margins and balance sheet health. American Tower provides its shareholders a 1.3% yield and just might be the only truly sustainable tower company over the long-term, as I hold underperform CAPScalls on both Crown Castle and SBA Communications.

American Tower isn't the only company set to benefit from a boost in mobile usage. Find out which company our analysts at Stock Advisor have highlighted as leading the next trillion-dollar revolution, for free, by clicking here to get your copy of this latest special report.

The article Is This Company Sitting on a Tower of Potential Profits? originally appeared on Fool.com.

Fool contributor Sean Williams has no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen name TMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle @TMFUltraLong.The Motley Fool has no positions in the stocks mentioned above. Motley Fool newsletter services recommend American Tower . Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.