Is ZAGG Destined for Greatness?

Every investor can appreciate a stock that consistently beats the Street without getting ahead of its fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with improving financial metrics that support strong price growth. Let's take a look at what ZAGG's (NAS: ZAGG) recent results tell us about its potential for future gains.

What the numbers tell you

The graphs you're about to see tell ZAGG's story, and we'll be grading the quality of that story in several ways.

Growth is important on both top and bottom lines, and an improving profit margin is a great sign that a company's become more efficient over time. Since profits may not always reported at a steady rate, we'll also look at how much ZAGG's free cash flow has grown in comparison to its net income.

A company that generates more earnings per share over time, regardless of the number of shares outstanding, is heading in the right direction. If ZAGG's share price has kept pace with its earnings growth, that's another good sign that its stock can move higher.

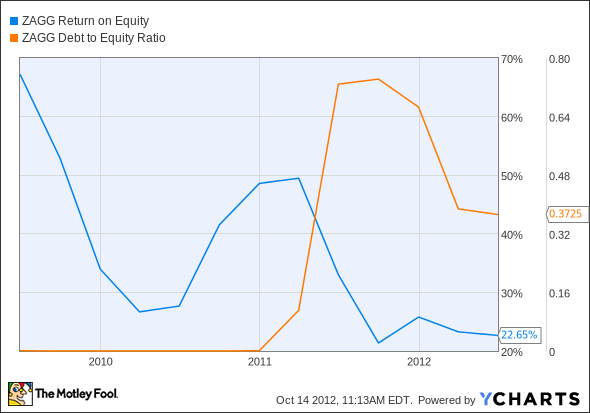

Is ZAGG managing its resources well? A company's return on equity should be improving, and its debt to equity ratio declining, if it's to earn our approval.

By the numbers

Now, let's take a look at ZAGG's key statistics:

ZAGG Total Return Price data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue Growth > 30% | 631.4% | Pass |

Improving Profit Margin | (27.2%) | Fail |

Free Cash Flow Growth > Net Income Growth | 2,460% vs. 442.6% | Pass |

Improving Earnings per Share | 252.4% | Pass |

Stock Growth (+ 15%) < EPS Growth | 16.2% vs. 252.4% | Pass |

Source: YCharts.

*Period begins at end of Q2 2009.

ZAGG Return on Equity data by YCharts

Passing Criteria | 3-Year* Change | Grade |

Improving Return on Equity | (66.3%) | Fail |

Declining Debt to Equity | 37,150% | Fail |

Source: YCharts.

*Period begins at end of Q2 2009.

How we got here and where we're going

ZAGG could be doing better. It earns four of a possible seven passing grades, losing the possibility of earning 2 more points by not paying a dividend. ZAGG may have done a great job at improving its earnings, but it's done a better job improving its revenue, which detracts from its profit margin and its ability to generate high returns on equity.

ZAGG's certainly had a dramatic year, from a big first-half rise to a disappointing third quarter, capped with the resignation of CEO Robert Pedersen, which destroyed the stock's momentum. Like many accessory makers, ZAGG was banking on a huge Apple (NAS: AAPL) iPhone 5 release to drive accessory sales. However, as longtime Fool Rick Munarriz points out, Apple has been dipping into the accessory game as well, and touchscreen-glass maker Corning (NYS: GLW) continues to develop harder, lighter, and more durable protective surfaces, which may eliminate the need for ZAGG's plastic defenses.

ZAGG seeks to combat this perception of one-dimensionality through the iFrogz subsidiary it acquired last year, which expands the company's product offerings to compete directly with Skullcandy (NAS: SKUL) in higher-end headsets and earbuds, as well as more traditional mobile-device cases. That acquisition brought ZAGG about a quarter of its total revenue and a fifth its net income through the first half of 2012 , which makes it seem like a pretty darn good move in retrospect.

At the moment, iFrogz is generating about a quarter of the revenue and net income of Skullcandy , but ZAGG has product placement deals with both AT&T's (NYS: T) mobile outlets and with massive megaretailer Wal-Mart (NYS: WMT) that should help its numbers (and visibility) grow.

Putting the pieces together

ZAGG has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

ZAGG had a fantastic run from obscurity several years ago, making a few savvy investors a lot of money. Where will the next millionaire-making opportunity come from? The Fool's dug deep into the market to uncover three great small-cap stocks that Wall Street's too rich to notice. All the information's available in our exclusive free report -- click here to find out more at no cost.

Keep track of ZAGG by adding it to your free stock Watchlist.

The article Is ZAGG Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more news and insights.The Motley Fool owns shares of Corning and Apple. Motley Fool newsletter services have recommended buying shares of Corning and Apple and creating a bull call spread position in Apple. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.