Is Macy's Destined for Greatness?

Every investor can appreciate a stock that consistently beats the Street without getting ahead of its fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with improving financial metrics that support strong price growth. Let's take a look at what Macy's (NYS: M) recent results tell us about its potential for future gains.

What the numbers tell you

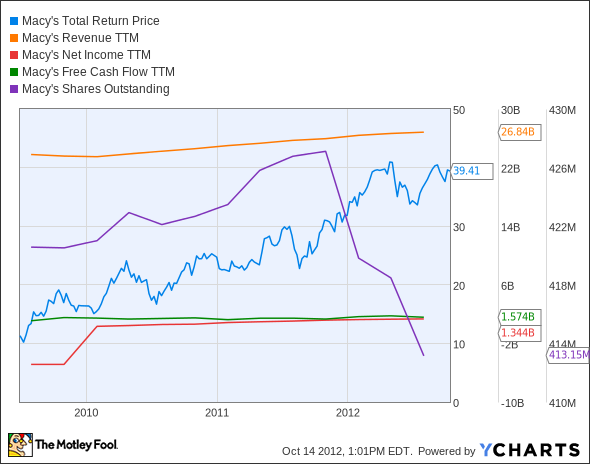

The graphs you're about to see tell Macy's story, and we'll be grading the quality of that story in several ways.

Growth is important on both top and bottom lines, and an improving profit margin is a great sign that a company's become more efficient over time. Since profits may not always reported at a steady rate, we'll also look at how much Macy's free cash flow has grown in comparison to its net income.

A company that generates more earnings per share over time, regardless of the number of shares outstanding, is heading in the right direction. If Macy's share price has kept pace with its earnings growth, that's another good sign that its stock can move higher.

Is Macy's managing its resources well? A company's return on equity should be improving, and its debt to equity ratio declining, if it's to earn our approval.

Healthy dividends are always welcome, so we'll also make sure that Macy's dividend payouts are increasing, but at a level that can be sustained by its free cash flow.

By the numbers

Now, let's take a look at Macy's key statistics:

M Total Return Price data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue Growth > 30% | 12.8% | Fail |

Improving Profit Margin | 3,260% | Pass |

Free Cash Flow Growth > Net Income Growth | 44.1% vs. 127.6% | Fail |

Improving Earnings per Share | 127.4% | Pass |

Stock Growth (+ 15%) < EPS Growth | 248.3% vs. 127.4% | Fail |

Source: YCharts.

*Period begins at end of Q2 2009.

M Return on Equity data by YCharts

Passing Criteria | 3-Year* Change | Grade |

Improving Return on Equity | 130.9% | Pass |

Declining Debt to Equity | (38.6%) | Pass |

Dividend Growth > 25% | 300% | Pass |

Free Cash Flow Payout Ratio < 50% | 15.8% | Pass |

Source: YCharts.

*Period begins at end of Q2 2009.

How we got here and where we're going

Macy's earns six out of nine possible passing grades, salvaging an otherwise mediocre showing with a strong performance on its dividend metrics. Even though its stock price has shot well past the growth of its main financial metrics, Macy's still has a perfectly reasonable P/E of 12.5.

Macy's has continued to grow a number of important metrics in its recent quarters, with its latest earnings report showing bigger gains in the bottom line than the top line, a nice indicator that the retailer's become leaner and more efficient. However, it's had to contend with an uncertain consumer market over the summer, as many retailers saw mediocre same-store sales growth, if they managed any at all. That doesn't mean that dark clouds are here to stay -- Macy's, along with big-box competitors Target (NYS: TGT) and Wal-Mart (NYS: WMT) , plans to increase seasonal hiring for the holiday period to higher levels than were needed in 2011. Macy's actually anticipates more seasonal additions than Wal-Mart, despite its much smaller footprint.

Thanks to deals with affordable-luxury brands True Religion (NAS: TRLG) and Fossil (NAS: FOSL) , Macy's can differentiate from big-box peers and cater to a more well-heeled (but still not too exclusive) clientele. Macy's also offers Michael Kors (NYS: KORS) kit , providing discerning fashionistas access to a hot brand that's still expanding its footprint.

Fashion is one of the few holdouts that still succeeds with bricks-and-mortar strategies, so Macy's can ensure its relevance by carving out a particular niche -- not all the way upscale, but hardly bargain-basement. By contrast, the lower-cost Kohl's (NYS: KSS) saw a decline in its same-store sales over the second quarter, while Macy's same-store numbers improved.

Putting the pieces together

Macy's has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Macy's is holding its own in a highly competitive market, but will it be a retail king? Our analysts have identified three companies ready to rule retail, and each gets a detailed write-up in our exclusive free report. Want to find out more? Click here to get all the information you need for a great buy, at no cost.

Keep track of Macy's by adding it to your free stock Watchlist.

The article Is Macy's Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter, @TMFBiggles, for more news and insights.Motley Fool newsletter services have recommended both buying shares of and shorting Fossil. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.