How Far Can Verizon Ride the iPhone 5 This Quarter?

Another earnings season is upon us. The telecom sector leads off with some heavy hitters, and it all starts on Thursday night with Verizon's (NYS: VZ) third-quarter report.

Analysts expect Big Red's earnings to jump 16% year-over-year, landing at $0.65 per share. Sales are seen climbing 3.8% to $29 billion.

The Apple (NAS: AAPL) iPhone 5 is a key driver of this quarter's results. The handset was introduced with a record-breaking bang, and carriers could hardly get their hands on enough units. Verizon's iPhone sales are still in pre-order mode, as orders placed today aren't expected to ship until early November. Verizon's management saw this coming. As CFO Fran Shammo explained at a recent industry conference, "It all comes down to allocation from Apple, and they have an allocation worldwide. So look, we'll sell what we get."

A long, hard look at Verizon's iPhone numbers should give you a clue to other important reports. Apple and AT&T (NYS: T) both report next week, and are working under the same iPhone supply constraints as Verizon. What Verizon's management says about iPhone sales will move markets far beyond the company's own stock.

Wireless is the sexy side of Verizon, but don't forget about the good old wireline connections. The segment sported a 23% EBITDA margin and $2.3 billion in EBITDA profits last quarter. Verizon drives a hard line on operating efficiency here, and is likely to sell off underperforming assets rather than wasting time, money, and sweat on turnaround efforts.

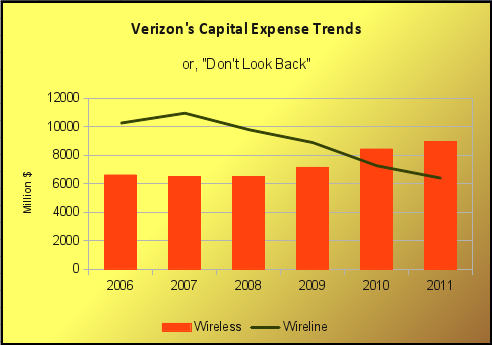

The wired division remains important, but if you follow the money, you'll see that Verizon doesn't mind it slipping into the darkness:

Data from S&P Capital IQ.

That mind-set goes a long way toward explaining the $8.5 billion sale of copper line and FiOS assets to Frontier Communications (NAS: FTR) back in 2010. Frontier is perfectly happy putting its back into low-performing FiOS accounts with infrastructure upgrades and marketing blitzes, while Verizon has bigger (wireless) fish to fry.

Every time Verizon reports, I'm looking for clues to the next wireline yard sale. It's how Big Red keeps its margins fit and trim, while allowing smaller players a shot at massive overnight growth. You can play the winners on both sides of these deals.

When it comes to dividend yields, Verizon's may be tasty but you won't find many higher than Frontier Communications. While its juicy dividend is tempting, every Frontier investor has to understand that it's not a sure thing. A huge acquisition has transformed the company forever. Will the move bear fruit, or are investors destined for another disappointing dividend cut? In this premium research report on Frontier Communications, we walk you through all of the key opportunities and threats facing the company. Better yet, you'll receive a full year of updates to boot. Click here to learn more.

The article How Far Can Verizon Ride the iPhone 5 This Quarter? originally appeared on Fool.com.

Fool contributor Anders Bylund has no positions in the stocks mentioned above. Check out Anders' bio and holdings, or follow him on Twitter and Google+. The Motley Fool owns shares of Apple. Motley Fool newsletter services recommend Apple. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.