Will China Crush Its Coal Addiction?

Over the past year, coal stocks have plummeted, as investors turned their backs on this dying industry. But a recent rebound in Chinese rebar prices might be enough to stir the embers and get this sector heated up. Keep reading to get the down and dirty on this newest black gold rush.

The history

Coal has been dying for two main reasons: it's dirty and expensive. While coal's environmental naughtiness isn't exactly news, it's become an increasingly important concern over the past decade. It is a major greenhouse gas producer, and also creates air pollution where it is mined, refined, and, ultimately, used.

While coal is far from the priciest fuel around (I'm looking at you, tar sands), plummeting natural gas prices have caused many energy consumers to switch from coal to natural gas. Natural gas is (maybe) cleaner, and is increasingly cost effective, as its production is scaled up in the United States and elsewhere.

180°

But all that changed yesterday, when iron ore prices reached a ten week high due to speculation of another China stimulus. If China does increase its current stimulus offerings, it'll mean more steel production which, in turn, will drive up demand for metallurgical coal (the kind used to make steel).

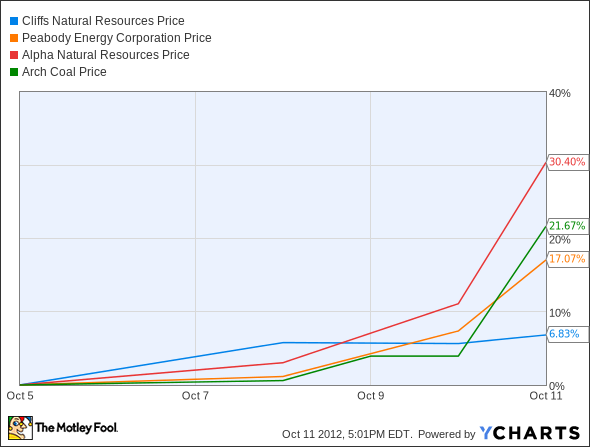

Shares of Cliffs Natural Resources (NYS: CLF) , Peabody Energy (NYS: BTU) , Alpha Natural Resources (NYS: ANR) , and Arch Coal (NYS: ACI) all shot up accordingly, with Alpha taking the lead by a long shot.

China is the largest consumer of coal in the world, and coal use is expected to grow alongside its economy. In 2008, China used 457 million tons of metallurgical coal, about one-third of the world's total industrial sector coal consumption. In the next twenty years, the Energy Information Administration calculates that China's metallurgical coal consumption could increase by a whopping 67%.

Déja vu

But wait a minute. For those of you who've been following the coal sector, you've seen this all before. Less than a month ago, a stimulus announcement from China brought coal bears to their knees, as investors looked to get in on the bottom floor of the country's $280 billion economic makeover. In a single day, shares of Cliff Natural Resources, Alpha Natural Resources, Peabody, and Arch Coal all shot up more than 10%. But two weeks later, they were back in the red.

The plot thickens

Last time this happened, I pointed to natural gas and solar as better investment alternatives with long-term potential. Since then, things are less chipper for these two energy sources. Natural gas prices have shot up, and the United States just hit Chinese solar companies with anti-dumping tariffs. Wave goodbye to your cost advantage, Trina Solar (NYS: TSL) .

But what I wrote then still holds true today. Coal is not a long-term investment, and any temporary gain is only avoiding the inevitable. Even though demand may increase, coal's fundamental value proposition remains the same, and it doesn't have me convinced.

The energy sector is more and more complicated, and an investment in any 'ol energy company can no longer serve as a proxy for economic growth. As China grows, it will increasingly be able to pick and choose its sources, and coal isn't going to be first in line.

The article Will China Crush Its Coal Addiction? originally appeared on Fool.com.

Justin Loiseau has no positions in the stocks mentioned above, but he does receive lumps of coal every Christmas. You can follow him on Twitter, @TMFJLo, and on Motley Fool CAPS, @TMFJLo.The Motley Fool has no positions in the stocks mentioned above. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.