Is Herbalife Destined for Greatness?

Every investor can appreciate a stock that consistently beats the Street without getting ahead of its fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with improving financial metrics that support strong price growth. Let's take a look at what Herbalife's (NYSE: HLF) recent results tell us about its potential for future gains.

What the numbers tell you

The graphs you're about to see tell Herbalife's story, and we'll be grading the quality of that story in several ways.

Growth is important on both top and bottom lines, and an improving profit margin is a great sign that a company's become more efficient over time. Since profits may not always be reported at a steady rate, we'll also look at how much Herbalife's free cash flow has grown in comparison to its net income.

A company that generates more earnings per share over time, regardless of the number of shares outstanding, is heading in the right direction. If Herbalife's share price has kept pace with its earnings growth, that's another good sign that its stock can move higher.

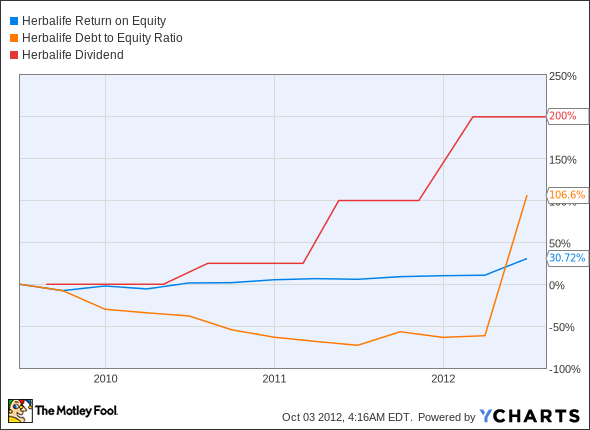

Is Herbalife managing its resources well? A company's return on equity should be improving, and its debt to equity ratio declining, if it's to earn our approval.

Healthy dividends are always welcome, so we'll also make sure that Herbalife's dividend payouts are increasing, but at a level that can be sustained by its free cash flow.

By the numbers

Now, let's take a look at Herbalife's key statistics:

HLF Total Return Price data by YCharts

Passing Criteria | 3-Year Change* | Grade |

|---|---|---|

Revenue Growth > 30% | 71% | Pass |

Improving Profit Margin | 53.2% | Pass |

Free Cash Flow Growth > Net Income Growth | 120% vs. 150.6% | Fail |

Improving Earnings per Share | 158.7% | Pass |

Stock Growth (+ 15%) < EPS Growth | 248.8% vs. 158.7% | Fail |

Source: YCharts. *Period begins at end of Q2 2009.

HLF Return on Equity data by YCharts

Passing Criteria | 3-Year Change* | Grade |

|---|---|---|

Improving Return on Equity | 30.7% | Pass |

Declining Debt to Equity | 106.6% | Fail |

Dividend Growth > 25% | 200% | Pass |

Free Cash Flow Payout Ratio < 50% | 27.2% | Pass |

Source: YCharts. *Period begins at end of Q2 2009.

How we got here and where we're going

Herbalife turns in a respectable performance, with six of nine possible passing grades. Its stock price may have run away from the growth in its bottom line, but Herbalife still only has a P/E of 14 today. With another good year of growth, the company could easily pick up another passing grade or two. Watch out for the company's debt levels, which shot higher in its latest quarter as it borrowed heavily to maintain share repurchases -- a poor strategy for increasing shareholder value, in this writer's opinion.

The biggest story of the past year for Herbalife hasn't revolved around its earnings or its guidance. Rather, Herbalife's stock suffered a precipitous drop after notorious short-seller David Einhorn jumped into its quarterly earnings call, with questions that led market participants to suspect an impending short. That was all it took to tank the stock by over 20%. Thus far, Herbalife's post-drop progress has been far more encouraging than previous Einhorn target Green Mountain Coffee Roasters, which started a long decline that's only recently begun to reverse.

The drop also brought Herbalife's valuation metrics more in line with other health-product peers, and it's now less costly than GNC Holdings (NYSE: GNC) , with a higher profit margin and dividend yield to boot. A close comparison to other direct-sales and network-marketing companies puts Herbalife head and shoulders aboveAvon Products (NYSE: AVP) and Blyth (NYSE: BTH) , which maintain much higher levels of operating expenses and offer lower expected forward growth rates.

Herbalife, for its part, is following the old adage that "success is the best revenge." Its latest earnings were just as strong as the previous quarter's, setting new records and enabling executives to boost their full-year guidance. However, short interest remains elevated after the Einhorning, so any unexpected bad news could easily cause another precipitous drop.

Putting the pieces together

Herbalife has a number of qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Herbalife's been a great under-the-radar success story, but it's hardly the only hidden gem on the Fool's radar. Our analysts have uncovered three "Middle-Class Millionaire-Makers Wall Street's Too Rich to Notice," which combine the strong growth and popular products that have made Herbalife so successful. You can find out more in our free report -- just click here to get the information you need, at no cost.

Keep track of Herbalife by adding it to your free stock Watchlist.