Is Sherwin-Williams Destined for Greatness?

Every investor can appreciate a stock that consistently beats the Street without getting ahead of its fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with improving financial metrics that support strong price growth. Let's take a look at what Sherwin-Williams' (NYS: SHW) recent results tell us about its potential for future gains.

What the numbers tell you

The graphs you're about to see tell Sherwin-Williams' story, and we'll be grading the quality of that story in several ways.

Growth is important on both top and bottom lines, and an improving profit margin is a great sign that a company's become more efficient over time. Since profits may not always be reported at a steady rate, we'll also look at how much Sherwin-Williams' free cash flow has grown in comparison to its net income.

A company that generates more earnings per share over time, regardless of the number of shares outstanding, is heading in the right direction. If Sherwin-Williams' share price has kept pace with its earnings growth, that's another good sign that its stock can move higher.

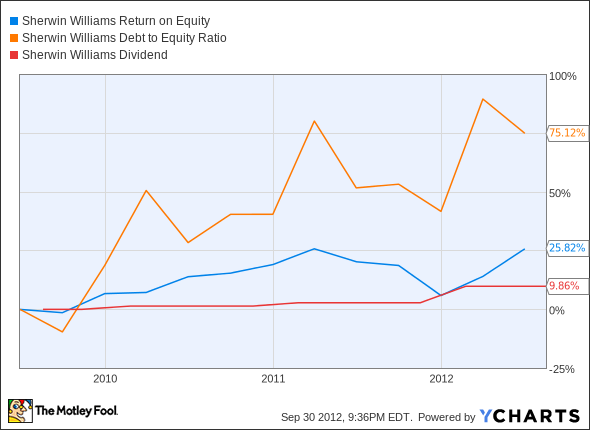

Is Sherwin-Williams managing its resources well? A company's return on equity should be improving, and its debt to equity ratio declining, if it's to earn our approval.

Healthy dividends are always welcome, so we'll make sure that Sherwin-Williams' dividend payouts are increasing, but at a level that can be sustained by its free cash flow.

By the numbers

Now, let's take a look at Sherwin-Williams' key statistics:

SHW Total Return Price data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue Growth > 30% | 24.1% | Fail |

Improving Profit Margin | 9.4% | Pass |

Free Cash Flow Growth > Net Income Growth | (14.9%) vs. 24.4% | Fail |

Improving Earnings per Share | 38.8% | Pass |

Stock Growth (+ 15%) < EPS Growth | 194.1% vs. 38.8% | Fail |

Source: YCharts. * Period begins at end of Q2 2009.

SHW Return on Equity data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving Return on Equity | 25.8% | Pass |

Declining Debt to Equity | 75.1% | Fail |

Dividend Growth > 25% | 9.9% | Fail |

Free Cash Flow Payout Ratio < 50% | 23.1% | Pass |

Source: YCharts. * Period begins at end of Q2 2009.

How we got here and where we're going

Sherwin-Williams' stock price seems to have left its fundamentals in the dust. Tepid growth on several fronts, a mediocre dividend increase, and a large increase in the company's debt to equity ratio earn Sherwin-Williams only four of nine possible passing grades.

Sherwin-Williams rode a housing-sector rebound (or at least the hope of one) to great gains in the past year, but it's not alone. Fellow paint makers PPG Industries (NYS: PPG) and Valspar (NYS: VAL) are also booming. From Home Depot (NYS: HD) to homebuilder Hovnanian (NYS: HOV) , stocks all across the housing spectrum have been flying high, beating expectations and growing their sales as homeowners (and prospective homeowners) across the country look for ways to affordably upgrade their living environs.

However, some of these companies have been buoyed more by hope than reality. Sherwin-Williams has the highest valuation metrics of its peers in most categories, as my fellow Fool Justin Loiseau points out. PPG and Valspar are comparatively inexpensive next to Sherwin-Williams' 30 P/E. An estimated 20% growth rate next year won't be enough to bring the company's stock price closer in line with its fundamentals, unless a decline is in the cards.

Justin also points out that raw material costs have been on the upswing, but Sherwin-Williams has raised prices to compensate. Higher prices have their own dangers, as competitors simply could try to compete by offering lower prices, hoping to offset reduced margins with higher volumes. Paint isn't exactly a product that's known for defensible pricing power.

If housing has indeed rebounded, Sherwin-Williams could easily post better growth rates than we've seen, bringing its fundamentals more in line with its stock price. There's a growing body of evidence that the housing bottom has been hit, so future quarters could earn Sherwin-Williams more passing grades from this analysis. For now, this stock's growth seems to have pushed beyond sustainable levels.

Putting the pieces together

Sherwin-Williams has a few of the qualities that make up a great stock, but no stock is truly perfect. These numbers are likely to change over time, so it's important to keep track of Sherwin-Williams' progress. The Fool is here to help. When you add Sherwin-Williams to your free personalized Watchlist, you'll get updates whenever we uncover any news you'll need.

Finding Sherwin-Williams several years ago uncovered a gold mine for some savvy investors. It might be time to look for the next hidden gem, and the Fool's found three that are dangling under Wall Street's nose. They're "Three Middle-Class Millionaire-Makers," brilliantly positioned businesses in important niches that most people need without even knowing it. All the information on these three great opportunities is contained in our latest free report. Just click here to find out more, at no cost.

The article Is Sherwin-Williams Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more news and insights.Motley Fool newsletter services have recommended buying shares of The Home Depot and Sherwin-Williams. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.