Is Capstone Turbine Destined for Greatness?

Every investor can appreciate a stock that consistently beats the Street without getting ahead of its fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with improving financial metrics that support strong price growth. Let's take a look at what Capstone Turbine's (NAS: CPST) recent results tell us about its potential for future gains.

What the numbers tell you

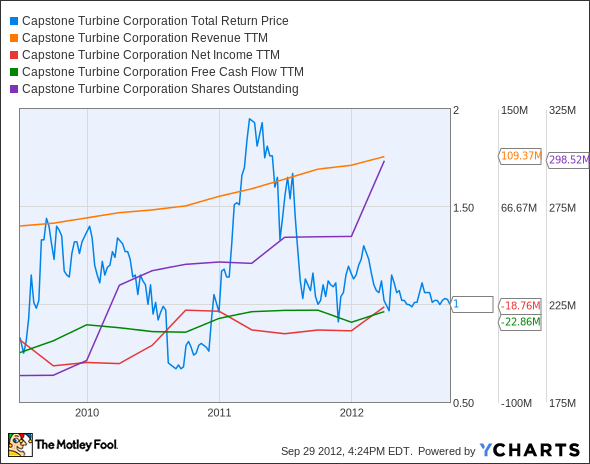

The graphs you're about to see tell Capstone's story, and we'll be grading the quality of that story in several ways.

Growth is important on both top and bottom lines, and an improving profit margin is a great sign that a company's become more efficient over time. Since profits may not always be reported at a steady rate, we'll also look at how much Capstone's free cash flow has grown in comparison to its net income.

A company that generates more earnings per share over time, regardless of the number of shares outstanding, is heading in the right direction. If Capstone's share price has kept pace with its earnings growth, that's another good sign that its stock can move higher.

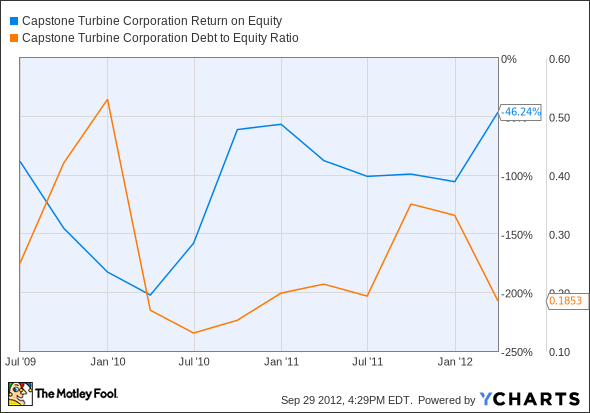

Is Capstone managing its resources well? A company's return on equity should be improving, and its debt to equity ratio declining, if it's to earn our approval.

By the numbers

Now, let's take a look at Capstone's key statistics:

CPST Total Return Price data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue Growth > 30% | 118.1% | Pass |

Improving Profit Margin | 75.2% | Pass |

Free Cash Flow Growth > Net Income Growth | 60.5% vs. 60.2% | Pass |

Improving Earnings per Share | 73.1% | Pass |

Stock Growth (+ 15%) < EPS Growth | 20.5% vs. 73.1% | Pass |

Source: YCharts. * Period begins at end of Q2 2009.

CPST Return on Equity data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving Return on Equity | 47.5% | Pass |

Declining Debt to Equity | (27.8%) | Pass |

Source: YCharts. * Period begins at end of Q2 2009.

How we got here and where we're going

Despite a history of unprofitability and a lack of positive free cash flow, Capstone's key metrics are all moving in the right direction, indicating the potential for future sustainable gains. However, an unprofitable company can't survive forever, so Capstone has to find a way to get itself into the black soon.

Capstone opened the year with a weak earnings report, and hasn't impressed the Street with its progress in subsequent quarters -- its latest report was a double whiff on top and bottom lines. The company's focus on sales to unconventional oil and gas drillers hasn't boosted it yet, as increases in operational oil drilling rigs have been offset by a long-term natural gas drilling decline.

Capstone's focus on Eagle Ford shale drillers may not be the best course of action, as major Chesapeake Energy (NYS: CHK) has been busy trying to divest a lot of its assets. The cost of Capstone's microturbines is also higher up front, which makes competing generation technologies from industrial powerhouses Caterpillar (NYS: CAT) and Cummins (NYS: CMI) more attractive to smaller drillers that may not have Chesapeake-size resources to work with.

However, those companies might see Capstone's technology as a valuable complement and decide to acquire the company with the $300 million market cap. General Electric (NYS: GE) , whose waste-heat-recovery generators Capstone sells under contract, might also be a potential acquirer. That contract runs through 2016, which gives the two parties ample time to ponder a closer relationship. Capstone may need a larger company's deep pockets if natural gas prices fail to rebound, since the continued low-cost nat-gas glut is preventing most producers from more aggressive expansion.

Putting the pieces together

Capstone has some of the qualities that make up a great stock, but no stock is truly perfect. These numbers are likely to change over time, so it's important to keep track of Capstone's progress. The Fool is here to help. When you add Capstone to your free personalized Watchlist, you'll get updates whenever we uncover any news you'll need.

Capstone isn't the only company banking on a big nat-gas recovery. The Fool's found one stock that's got so much going for it that you simply have to take a look before prices rebound. It's "The One Energy Stock You Must Own Before 2014," and its information is all available in the Fool's latest free report. Find out everything you need to know at no cost -- click here now to get started.

The article Is Capstone Turbine Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more news and insights.The Motley Fool owns shares of Cummins. Motley Fool newsletter services have recommended buying shares of Cummins. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.