Why Bank of America Is the Dow's Best Stock

The Dow Jones Industrial Average (INDEX: ^DJI) contains 30 of the best known and most successful companies in the world. They build the airplanes we ride on, serve us millions of hamburgers every day, and bring us the Internet on the devices they assemble.

But while their distinct identities are often usurped by inclusion in the index, each of the Dow's components offers investors unique opportunities and exposure. With this in mind, the current article series provides a cursory update on each of the 30 stocks included on the storied index. Up today is Bank of America (NYS: BAC) .

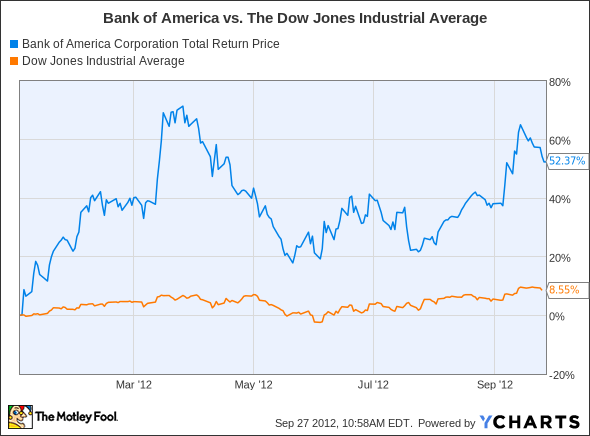

As you can see in the following chart, shares in Bank of America have rocketed up this year, gaining over 50% and outpacing the Dow by nearly 44 percentage points. Its performance has been so good, in fact, that it's the top-performing stock on the index year to date, beating out the runner-up, home improvement retailer Home Depot (NYS: HD) , by 10 percentage points.

BAC Total Return Price data by YCharts

However, there's actually much less to B of A's year-to-date success than meets the eye.

As I've discussed previously, it continues to face numerous legal and regulatory hurdles, both of which have seriously eroded the lender's bottom line; its top line continues to compress thanks to ongoing stimulus measures by the Federal Reserve; and its loan book remains in dire straits, causing the bank to charge off roughly $3.5 billion a quarter in excess bad loans.

So why is it up?

In the first case, up was arguably the only direction for it to move after it lost approximately 60% last year. Going into 2012, it was trading for less than a third of book value, a patently ridiculous figure for the nation's second largest bank by assets.

And second, B of A is taking tangible steps to right its course. The bank is in the midst of New BAC, a program designed to reduce expenses by upward of $8 billion a year. And in addition, it's wrapping up the settlement of a multibillion-dollar class action lawsuit dating to the financial crisis. Once these are completed and it extinguishes its still-formidable toxic loan book, B of A will finally be in a position to distribute money to shareholders.

Could B of A double or triple?

Given B of A's progress, many analysts and investors are beginning to think the bank could be one of the market's best-performing stocks going forward. Our own senior banking analyst, Anand Chokkavelu, even believes that it could "double or triple within the next five years." To find out why, click here to download our new in-depth report on Bank of America, which thoroughly covers both its risks and opportunities.

The article Why Bank of America Is the Dow's Best Stock originally appeared on Fool.com.

Both Fool contributor John Maxfield and The Motley Fool own shares of Bank of America. The Motley Fool has adisclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.