These 3 Stocks Exploded in September. Should You Still Buy?

September has been a kind month for some investors -- especially if they owned a piece of the three companies I'm covering below.

But in the game that is the stock market, investors are typically more concerned with what the future holds than what's happened in the past month. That's why I'll be letting you know what I think about the prospects for all three companies moving forward, and backing up those picks in my All-Star CAPS profile.

Read all the way to the end and I'll also offer access to a special free report that will introduce you to the only energy stock you really need to own.

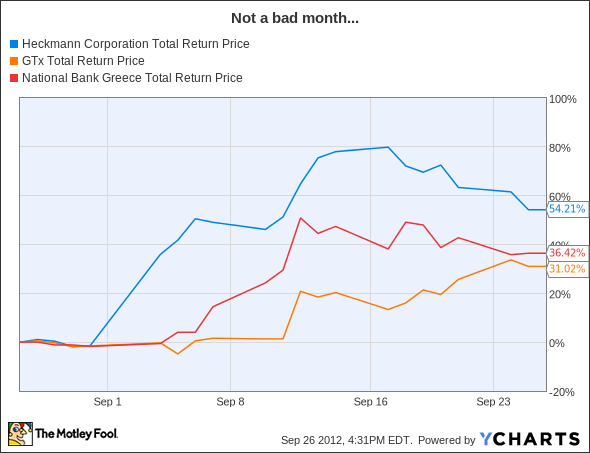

But first, here's a look at how the past month has treated investors in these three companies.

HEK Total Return Price data by YCharts

Heckmann (NYS: HEK)

This company, founded by serial entrepreneur Richard Heckmann, aims to be the 800-pound gorilla of the water services industry, especially when it comes to water used in oil and gas exploration.

For those new to the industry, the fracking process has opened up huge new possibilities for the extraction of natural gas. Fracking itself isn't without its drawbacks, and one of them is that the activity requires copious amounts of water. To meet the needs of natural gas companies, Heckmann has built out pipelines so that the water doesn't have to be trucked in -- saving time, money, and energy, and reducing pollution.

But the water needs don't stop there. Once water has been used in fracking, it needs to be either deposited in the earth or treated. With a slew of recent mergers -- especially this month's acquisition of Power Fuels -- the company is hoping to meet all of these needs as well.

Now, one problem that the company could face is continued low prices for natural gas. While this is a boon for companies like Westport Innovations (NAS: WPRT) , which designs natural gas engines for cars, trucks, and other heavy machinery, it could lower demand in the near future. Earlier this year, the nation's second-largest natural gas producer, Chesapeake Energy (NYS: CHK) , announced plans to cut natural gas exploration.

Though Heckmann experienced a nice pop when it announced its acquisition, I still think there's lots of room to grow -- last quarter alone, revenue grew by 154%. I've given the company a bullish CAPScall, and own shares in my own portfolio as well.

GTx (NAS: GTXI)

This company has the lofty goal of developing medications and treatments for patients who have cancer. One product -- Fareston, a treatment for metastatic breast cancer in postmenopausal women -- is already on the market.

The company has plenty of new products in the pipeline, but one of the most promising is enobosarm, a treatment for muscle wasting in patients with certain forms of breast cancer. Currently, enobosarm is in phase 3 clinical trials.

So why did the company pop? It was primarily because the company announced a symposium and presentation of data on the effectiveness of enobosarm. This was followed shortly thereafter by an announcement of favorable results from a trial of the company's Capesaris -- a phase 2 drug aimed at treating prostate cancer.

If you're interested in biopharmaceutical companies, big swings are the name of the game. Stocks can fly or flop on the whisper of clinical results. It is therefore important to have deep knowledge of the field. I can honestly say I don't consider myself an expert here, so I'm taking a pass on the company.

National Bank of Greece (NYS: NBG)

Oh boy! Investing in a bank that is relying heavily on its own government to pay back debts it can't pay. Sounds exciting, right?

I hope you can hear my sarcasm through the screen. The National Bank of Greece is actually in a pretty odd position. As Michael Lewis pointed out in his book Boomerang, the bankers in Greece were actually very safe and conservative versus other European countries when it came to their lending practices.

But when the group you're lending money to -- the Greek government -- is falsifying its numbers, it's hard to know if you're making a good deal. Alas, I simply don't have any desire to put money into this situation, and I'll be making a bearish CAPScall on the company.

Any better ideas?

Obviously, I'm a big fan of Heckmann, as I gave it a bullish call and already own it in my portfolio. But realizing that this is still a very young field, I've devoted only 1.3% of my real portfolio to it.

If you'd like to find out about a different company with exposure to oil that I think everyone should own (it's roughly 10% of my real-money portfolio), I highly suggest you check out our special free report: "The Only Energy Stock You'll Ever Need." Inside, you'll get the name, ticker symbol, and details behind this solid company. Get your copy of the report today, absolutely free!

The article These 3 Stocks Exploded in September. Should You Still Buy? originally appeared on Fool.com.

Fool contributorBrian Stoffelowns shares of Heckmann and Westport Innovations. The Motley Fool owns shares of Westport Innovations.Motley Fool newsletter serviceshave recommended buying shares of Westport Innovations. The Motley Fool has adisclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.