How Much More Can GE's Stock Grow?

Shares of General Electric (NYS: GE) hit a 52-week high last week. Let's look at what's driving these gains to better understand what the future holds for this company.

How it got here

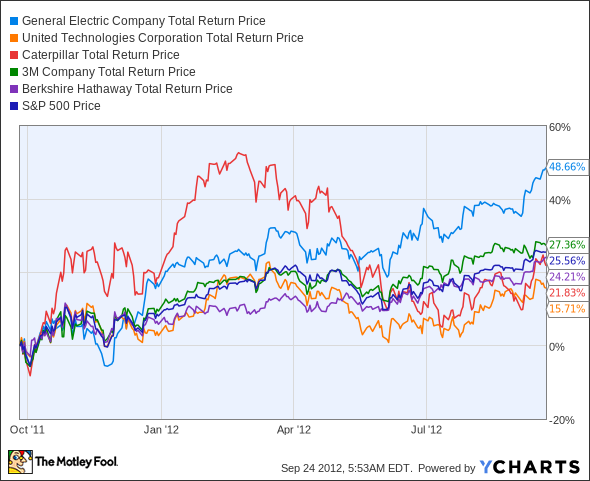

The past year's been a good one for GE, as it continues to make fresh 52-week highs regularly, and now stands as one of the best conglomerate performers on the market after a summer surge. United Technologies (NYS: UTX) , 3M (NYS: MMM) , and Berkshire Hathaway (NYS: BRK.B) are all roughly keeping pace with the S&P 500 (though United Tech has lagged recently), and Caterpillar (NYS: CAT) is now following the index as well after sinking from springtime highs:

GE Total Return Price data by YCharts

The latest pep in GE's stock seems to have come from the Fed's announcement of QE-Infinity (or QE3, or "Easing Without End," or whatever you choose to call it). My fellow Fool Russ Krull explains the benefits of more easing to GE with this pithy haiku: "Gee-whiz! No, GE. / Trainloads of credit paper, / And Ben is buying." GE Capital should feel its bad debt load lighten as the Fed snaps up more mortgage-backed securities, so the theory goes. It's come a long way since requiring a Buffett bailout during the credit crisis, but its balance sheet still isn't spotless.

The Bernanke Bump may explain why GE's outpaced its peers recently, but it had already pulled ahead months ago. To find out if that growth is sustainable, we turn to the key numbers that attract many investors to shares of these blue-chip conglomerates.

What you need to know

GE's latest surge has made it the head of its class in P/E terms, and the company's already sporting the highest payout ratio of its peers -- except for dividend holdout Berkshire Hathaway, of course:

Company | P/E Ratio | Net Margin (TTM) | Projected Growth Rate (2013) | Dividend Payout Ratio |

|---|---|---|---|---|

General Electric | 19.5 | 9.0% | 12.3% | 55% |

United Technologies | 16.9 | 7.5% | 19.2% | 34% |

3M | 15.2 | 14.6% | 8.3% | 37% |

Berkshire Hathaway | 18.5 | 8.1% | 4.2% | NM |

Caterpillar | 10.3 | 9.0% | 9.3% | 21% |

Source: Yahoo! Finance. NM = not material due to lack of dividend.

GE hopes to juice its bottom line with a split-slash-streamlining of its energy businesses, which would help save a significant amount in annual costs. GE and United Tech both grappled with major currency-exchange losses in their latest quarters, so every bit of saving counts. Creating more specialized foci in three sub-segments could also help GE compete with Caterpillar and 3M in a competitive alternative-energy field. That would help GE meet that double-digit forward growth estimate.

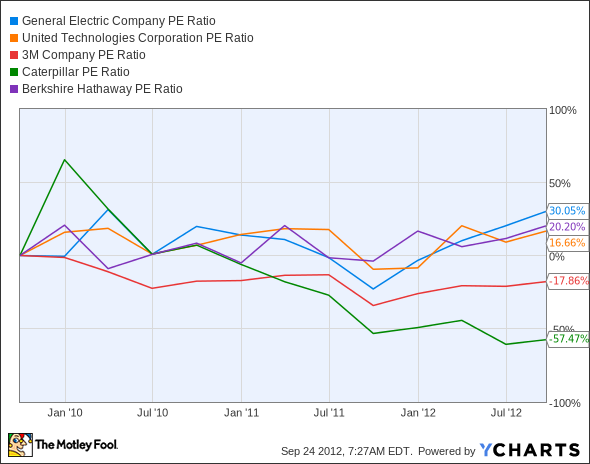

One thing to watch with GE is its growing P/E. Over the past three years, only Caterpillar's P/E has shrunk significantly -- GE's P/E has grown the most out of any of these conglomerates:

GE P/E Ratio data by YCharts

This opens up the possibility that GE's gains may be built more on sentiment than fundamentals. The further it pulls away from its peers, the more unsustainable GE's gains may become. Its dividend isn't likely to be in any danger, but all of its peers have more flexibility to boost their payouts, which makes them seem like potentially better options.

What's next?

What's next for GE? It faces headwinds like any other major manufacturer. Its dangers may be double, as the fiscal cliff threatens to ripple through its defense-based segments and touch many other aspects of its business. International weakness is also a grave concern, but neither this nor the fiscal cliff are unexpected events. Investors should be able to anticipate slowdowns, and GE's finance arm is in better shape now than it was the last time the economy turned sour.

The Motley Fool's CAPS community has given GE a four-star rating, with 94% of our CAPS players expecting it to beat the indexes going forward. They've certainly been right this year.

Interested in tracking this stock in the months and years ahead? Add GE to your Watchlist now, for all the news we Fools can find, delivered to your inbox as it happens. For GE, the recent financial crisis struck a blow, but management took advantage of the market's dip to make strategic bets in energy. If you're a GE investor, you need to understand how these bets could drive this company to become the world's infrastructure leader. At the same time, you need to be aware of the threats to GE's portfolio. To help, we're offering comprehensive coverage for investors in a premium report on General Electric, in which our industrials analyst breaks down GE's multiple businesses. You'll find reasons to buy or sell GE, and you'll receive continuing updates as major events unfold during the year. To get started, click here now.

The article How Much More Can GE's Stock Grow? originally appeared on Fool.com.

Fool contributorAlex Planesholds no financial position in any company mentioned here. Add him onGoogle+or follow him on Twitter@TMFBigglesfor more news and insights.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.