AT&T Rides The iPhone 5 to New Highs

Shares of AT&T (NYS: T) hit a 52-week high on Friday, the same day Apple launched its iPhone 5. Let's look at how it got here and whether clear skies are ahead.

How it got here

Ma Bell has long been the dominant domestic iPhone carrier, even after rivals Verizon (NYS: VZ) and Sprint Nextel (NYS: S) officially got their hands on the device. For example, AT&T had a 47% domestic share of iPhone activations in the second quarter, compared to Verizon's 34% and Sprint's 19%. Researcher comScore estimates that AT&T's network garnered 68% of domestic preorders in the first three days.

This is a double-edged sword, because the iPhone has margin-crushing powers but also reduces customer churn. Ma Bell will be making many more subsidy checks payable to Cupertino than its red and yellow rivals, but it seems that investors have more confidence that the addition of LTE will boost data revenue, making up for the upfront costs.

Last week, AT&T CEO Randall Stephenson said, " As the customers move to LTE, they consume more data. We are feeling really good about this and how it is playing out so far."

How it stacks up

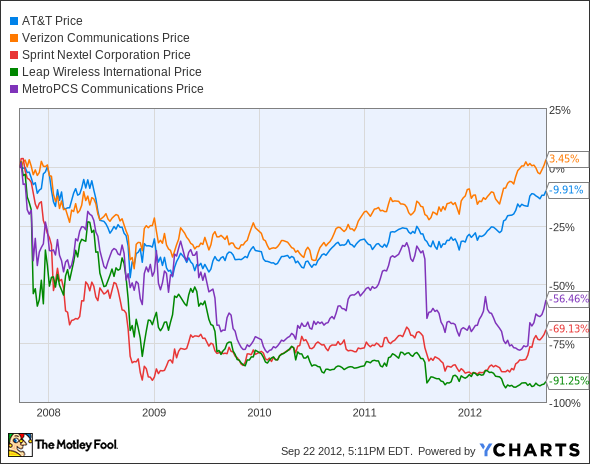

Let's see how AT&T compares to its wireless carrier peers.

We'll include some fundamental metrics for additional insight.

Company | P/S (TTM) | Sales Growth (TTM) | Net Margin (TTM) | ROE (TTM) |

|---|---|---|---|---|

AT&T | 1.7 | 1.4% | 3.7% | 4.1% |

Verizon | 1.2 | 5.3% | 10.2% | 7.5% |

Sprint | 0.5 | 4.7% | (11.1%) | (34.1%) |

Leap Wireless (NAS: LEAP) | 0.2 | 8.9% | (10%) | (47.4%) |

MetroPCS (NYS: PCS) | 0.9 | 11.4% | 6.6% | 11.2% |

Source: Reuters. TTM = trailing 12 months.

Leap's Cricket prepaid brand just recently got the iPhone, but it pays less of a subsidy in exchange for no contract requirement from subscribers, which is something of a risk in itself if people buy the device and promptly defect. Sprint continues to try and catch up with its LTE rollout relative to its larger rivals, and MetroPCS lacks Apple's affections (much like T-Mobile), also due to technical spectrum incompatibilities.

What's next?

The spike in iPhone unit sales will cause some dips in carrier margins across the board, with AT&T feeling the brunt of it as the favored domestic iPhone carrier. Hopefully, Ma Bell will be able to milk more data fees out of all those iPhone 5 buyers, though.

The introduction of the iPhone 5 is an event Apple investors have been looking forward to for months. The stakes are high and the opportunity is huge, so to help investors understand this epic Apple event, we've just released an exclusive update dedicated to the iPhone 5 launch. By picking up a copy of our premium research report on Apple, you'll learn everything you need to know about the launch, and receive ongoing guidance as key news hits. Claim your copy today by clicking here now.

The article AT&T Rides The iPhone 5 to New Highs originally appeared on Fool.com.

Evan Niu, CFA owns shares of Apple, AT&T, and Verizon Communications. The Motley Fool owns shares of Apple. Motley Fool newsletter services recommend Apple. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.