Why Brocade Communications Could Head Even Higher

Shares of Brocade Communications (NAS: BRCD) hit a 52-week high on Friday. Let's take a look at how it got there and see if clear skies are still in the forecast.

How it got here

For some companies, buyout chatter occasionally lasts for a few weeks or perhaps a month or two. For Brocade, that chatter has been constant for the last two years.

Brocade has been flying high on a long-running rumor stemming from CEO Mike Klayko to improve shareholder value by selling the company. A foolish purchase in 2008 of Foundry Networks has held back Brocade's potential, but with the company beginning to fire on all cylinders again, anything seems possible.

For the third quarter, Brocade reported a 10% increase in revenue and a huge 59% jump in net income that it attributed to a 17% increase in storage revenue over the previous year. If there was a weak component to the quarter, it was that enterprise business revenue rose by just 2% while service provider revenue fell 5% year over year. However, Brocade's weaknesses have been more than negated by its strong supply partnerships with IBM (NYS: IBM) , Hewlett-Packard (NYS: HPQ) , and Dell, as well as its move into cloud-based operations.

What could potentially stand in the way of Brocade heading higher is increased fiber channel over Ethernet competition from Cisco Systems (NAS: CSCO) , as well as the possibility that a buyout may not occur.

How it stacks up

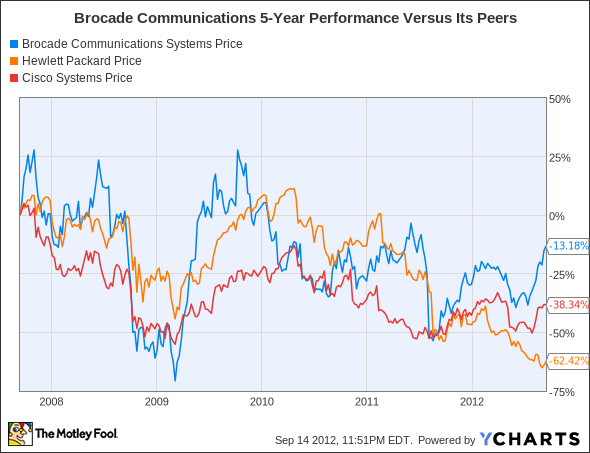

Let's see how Brocade compares to its peers.

In spite of big money being spent on enterprise infrastructure expansion over the past decade, not a single one of these three names is higher over the past five years.

Company | Price/Book | Price/Cash Flow | Forward P/E |

|---|---|---|---|

Brocade Communications | 1.4 | 5.3 | 11.4 |

Cisco Systems | 2.0 | 9.2 | 9.4 |

Hewlett-Packard | 1.1 | 4.0 | 4.2 |

Source: Morningstar.

As you can see from these metrics, the entire sector is priced inexpensively. Much of that has to with investment dollars moving from mainline infrastructure investments to the cloud, and because of unique problems affecting each company.

Brocade, as I've mentioned, has been dealing with a poorly timed purchased of Foundry Networks. Cisco's plights have been much different. A drastic slowdown in European demand coupled with a product shift to cloud-based technologies has been countered with cost-cutting measures that included sizable layoffs. HP could be the worst off the of the bunch, having lost its identity as a hardware company and seeing much of its PC market share slowly evaporating to Lenovo and other competitors.

What's next

Now for the $64,000 question: What's next for Brocade Communications? The answer depends on whether the company does indeed put itself up for sale, if it can successfully compete against the larger Cisco Systems, and if it can bolster its business by establishing a presence in the cloud.

Our very own CAPS community gives the company a three-star rating (out of five), with 94.1% of members expecting it to outperform. Feel free to count me among the optimists, as my CAPScall of outperform is currently up by 20 points -- and it could be headed even higher.

There are a multitude of catalysts that could still send Brocade higher. First, I consider the likelihood of a buyout very high. IBM would make a logical suitor since it already has supply partnerships with Brocade. However, fellow Fool Anders Bylund has made a strong case for why EMC (NYS: EMC) would be wise to add Brocade's leading storage switches to its already impressive array of storage products. That leads me to my second point: storage. Spending on cloud-computing and storage for big data centers is only expected to increase, and Brocade's storage switches are a key component to that growth. Finally, Brocade's valuation is still attractive. Sure, its forward P/E isn't as low as some of its peers, but as a smaller company, it's poised to grow at a faster rate.

Cloud-computing isn't the only revolution sweeping the tech landscape. Find out which three companies our analysts at Motley Fool Stock Advisor have identified to lead the next industrial revolution. Click here to get this latest special report, for free!

The article Why Brocade Communications Could Head Even Higher originally appeared on Fool.com.

Fool contributor Sean Williams has no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen name TMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle @TMFUltraLong.The Motley Fool owns shares of IBM, Cisco Systems, and EMC. Motley Fool newsletter services have recommended creating a synthetic long position in IBM. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.