Analysts Debate: Is Target a Top Stock?

The Motley Fool has been making successful stock picks for many years, but we don't always agree on what a great stock looks like. That's what makes us "motley," and it's one of our core values. We can disagree respectfully, as we often do. Investors do better when they share their knowledge.

In that spirit, we three Fools have banded together to find the market's best and worst stocks, which we'll rate on The Motley Fool's CAPS system as outperformers or underperformers. We'll be accountable for every pick based on the sum of our knowledge and the balance of our decisions. Today, we'll discuss Target (NYS: TGT) , the discount retailer.

Target by the numbers

Here's a quick snapshot of the company's most important numbers:

Statistic | Result (Most Recent Available) |

|---|---|

Revenue | $71.3 billion |

Net income | $2.9 billion |

Market cap | $42.2 billion |

Dividend yield | 2.2% |

Number of stores | 1,772 |

Key competitors |

Sources: Yahoo! Finance and company filings.

Travis' take

The retail space is changing at a rapid pace, and trying to pick winners is a dangerous task. Best Buy, once thought of as a crown jewel in retail, is struggling to survive after an onslaught by online competitors. The rough economic conditions have pushed consumers beyond discount stores to dollar stores (even though they're more expensive, but that's another story). Even discount giants like Target and Wal-Mart have to adapt and change to the new environment.

What I like about Target's place in retail is that it carries nearly everything -- groceries, sporting goods, clothing, and electronics -- yet it doesn't feel like a cheap store. Items are generally high quality, the stores are clean and streamlined, and innovative design is part of Target's culture. Wal-Mart may be improving in these areas, but their stores still feel like cheap-junk showrooms to me.

Online shopping is still a threat, and the company's online store isn't nearly what Amazon.com is, but I can find out if the item I want to buy is in stock at my local store and pick it up on the same day. I also see online shopping as a different threat to Target than it was to Best Buy, because I can't get a gallon of milk or a loaf of bread at Best Buy. With Target, there's no need to buy online and wait a few days because I'll just get whatever I need up when I go and pick up some grocery items. Heck, I even bought a TV from Target because I was already there and was in the market for one. No special trip to Best Buy, and no waiting for a purchase from Amazon.

Target isn't going to be a growth engine like Amazon.com, but I do think it has a strong place in retail. And unlike Amazon, it's making a lot of money. Last quarter, the company's revenue grew 3.3%, and an August update shows a 4.2% gain in comparable-store sales. Considering the company's forward P/E ratio of 13 and 2.2% dividend yield, I think that deserves an outperform call, something I'm hesitant to do with any other retailer.

Alex's take

Last week, I needed to buy supplies for a trip. There were two options -- Wal-Mart and Target, both right next to each other in the same shopping complex. I initially went to Wal-Mart, hoping to find an inexpensive laptop listed on its website. No luck. No big deal, I thought. I'll just go get the clothes I need. A brief, abortive attempt to justify buying some truly hideous white cargo shorts convinced me that I needed to try shopping elsewhere. Long story short, Target had everything I needed, including luggage and other supplies, and Wal-Mart had ... bupkis.

One man's shopping experience should never persuade you to pick one stock over the other -- but brand polling data might help. YouGov's BrandIndex, a rolling monthly consumer-favorability poll that ranges from 100 to negative 100, gave Target a 33.5 score in August against 21.3 for Wal-Mart. The most recent American Consumer Satisfaction Index results, released this February, give Target a score of 80 out of 100, versus 70 for Wal-Mart. Target's score improved 2 points over the prior year, while Wal-Mart's declined by 3 points.

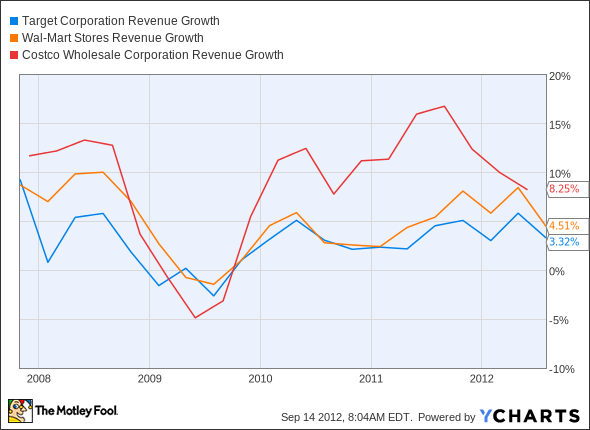

Unfortunately, the strength of its brand hasn't led to superior revenue growth. Target's revenue growth has consistently underperformed both Wal-Mart and Costco (NAS: COST) :

TGT Revenue Growth data by YCharts

And as a result, the past few years have seen those two companies' stocks vastly outperform Target's, which has just barely kept pace with a dividend-adjusted S&P 500 (INDEX: ^GSPC) :

TGT Total Return Price data by YCharts

Don't get me wrong. I like Target. It's a solid company, and it's certainly not going away anytime soon. If you want to match the index, then Target's been a good stock for that purpose. However, we don't want to match the index. We want to beat it. I'm going to call this a "market perform" stock, which means I don't think it merits either a thumbs-up or a thumbs-down.

Sean's take

Talk about a company I've been completely split down the middle on for years. Let me give you the skinny on why I like Target and what has me hesitant to click the "buy" button.

On the bright side, Target has a well-known brand name; it carries brand-name merchandise with beefy margins at a reasonable price that gets customers into its stores; and it's transforming itself into a one-stop shop that will keep consumers in its stores and away from its competitors. As Travis said, he purchased his TV at Target simply because of convenience.

Target aims to take a page right out of the Wal-Mart and Costco handbook and cater to consumers' need for necessary items -- i.e., groceries. As Costco, Wal-Mart, and now Target have learned, the margins aren't anything to write home about, but the discretionary purchases that are derived from keeping consumers in the store are often worth it.

Target is also planning to lure return customers to its stores with its in-store credit card loyalty rewards program, which will offer cardholders a 5% discount.

However, there's another side to the Target story. That side involves a turnaround in Wal-Mart's U.S. operations for the first time since 2009, which is increasing competition across the sector; rising food inflation costs, which are threatening the primary product that's getting the Target customer into the store; and an uninspiring growth rate that has Target pegged at just 5% revenue growth for 2012.

I share my Foolish colleagues' enthusiasm about Target's dividend, brand name, and convenience, as well as its plan to lure customers back into its stores. But I also can't overlook the fact that Target is relying on low-margin grocery items to push revenue growth, and it hasn't added nearly enough differentiation to separate itself far enough from Wal-Mart or Costco, in my eyes.

To sum this up, I'm going to pass altogether on making a call on Target until I get better clarity on the success of its loyalty program and see better identity separation from its peers.

The final call

So, we've all decided that Target has a superior shopping experience, but the enthusiasm about the company's stock is lacking. Therefore we'll refrain from making either an outperform or underperform call on the stock right now. But on the 18 picks we have made, we're outperforming the market by a tidy 136 points -- not too bad.

One of the stocks that has outperformed Target in recent years is Amazon, the dominant online retailer. If you're looking at buying this stock, you should take a look at our premium report on the company before you pull the trigger. Find out more about the report.

The article Analysts Debate: Is Target a Top Stock? originally appeared on Fool.com.

Fool contributors Travis Hoium, Alex Planes, and Sean Williams have no positions in any companies mentioned. You can follow Travis on Twitter at@FlushDrawFool, Sean at@TMFUltraLong, and Alex at@TMFBiggles.The Motley Fool owns shares of Amazon.com and Best Buy.Motley Fool newsletter serviceshave recommended buying shares of Amazon.com. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.