Is Whirlpool a Potential Gusher, or Is It Headed Down the Drain?

Shares of Whirlpool (NYS: WHR) hit a 52-week high on Tuesday. Let's take a look at how it got here and see whether clear skies are still in the forecast.

How it got here

I'll admit that it's a bit of a head-scratcher explaining the recent surge in Whirlpool, unless you think about with the mindset that things aren't nearly as bad as investors had first suspected.

Whirlpool's most recent quarterly report didn't do anything to help its cause, widely missing Wall Street's revenue and profit expectations because of continued weakness in Europe and concerns about cost inflation. On the bright side, Whirlpool is encouraged by growth in housing demand in Latin America and the U.S., which should eventually lead to an increase appliance purchases. We've seen a steady stream of new and current homeowners flocking to Home Depot (NYS: HD) to remodel their homes, including appliance replacement, and America's largest homebuilder, D.R. Horton (NYS: DHI) , did note a 25% jump in new sales orders in its most recent quarter. It would appear on the surface that Whirlpool's thesis holds water.

Another factor giving Whirlpool a boost is the prospect that global governments will act cohesively to jumpstart growth. The European Central Bank's plan to buy bonds from its member nations to stabilize interest rates, as well as a $156 billion infrastructure stimulus from China and the prospect of another round of quantitative easing in the U.S., have investors feeling optimistic that the global economy will soon be on the mend. With Whirlpool being intricately tied to the health of the economy, this is definitely good news.

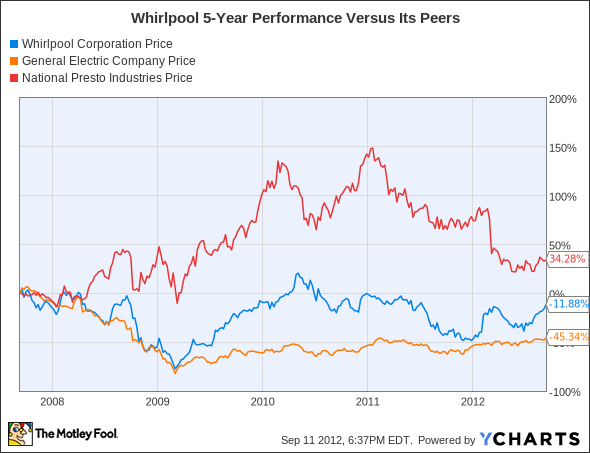

Of course, Whirlpool must contend with very tough competition from conglomerate General Electric (NYS: GE) and National Presto Industries (NYS: NPK) , as well as overcome weak growth prospects in Europe.

How it stacks up

Let's see how Whirlpool stacks up next to its peers.

It's pretty easy to see that GE's other business segments, especially its financial arm, GE Capital, have made it far more volatile than either Whirlpool or National Presto, whose tie-ins to the cyclical nature of the economy have caused natural ebbs and flows.

Company | Price/ Book | Price/ Cash Flow | Forward P/E | Dividend Yield |

|---|---|---|---|---|

Whirlpool | 1.5 | 15.3 | 7.8 | 2.6% |

General Electric | 1.9 | 7.1 | 12 | 3.1% |

National Presto Industries | 1.6 | 7.3 | 11.4 | 1.4% |

Source: Morningstar.

Although these companies are very comparable based on these metrics, Whirlpool's biggest competition is against itself in terms of its pricing strategy, and the overall health of the global economy.

GE is currently focused on splitting up its energy infrastructure operations into three separate segments and in continuing to mend its GE Capital financial arm.

National Presto, on the other hand, is probably the most direct competitor to Whirlpool, and in the latest quarter it absolutely schooled Whirlpool at its own game. A jump in unit volume caused its small-appliance sales to rocket 19% higher, all while Whirlpool's unit sales dipped.

What's next

Now for the $64,000 question: What's next for Whirlpool? That question depends entirely on the health of the global economy, its ability to adjust to changing consumer trends, and whether currency fluctuations hurt its results.

Our very own CAPS community gives the company a three-star rating (out of five), with 81.7% of members expecting it to outperform. Feel free to count me among the optimists, as my CAPScall of outperform on Whirlpool is currently up an eye-pleasing 46 points.

Although I freely admit that it's tempting to close my outperform call here, especially with Whirlpool continuing to disappoint on the earnings front, I don't see much in the way of long-term downside even if the global economy slows down further. A lack of big appliance competition in the U.S. and Latin America should allow Whirlpool to command strong pricing power while its ability to keep up with changing consumer trends will keep EPS relatively steady. In the meantime, Whirlpool is kicking back $2 per share annually to shareholders in the form of a dividend. This is a company I'd bet on over the long haul.

Is General Electric back to its old form? Find out the answer to this question and more by getting your copy of our latest premium research report on General Electric. This report is packed with in-depth analysis on the opportunities and risks that could affect GE's share price over the long-term and comes complete with a full-year of regular updates. Get your copy and claim your investing edge.

The article Is Whirlpool a Potential Gusher, or Is It Headed Down the Drain? originally appeared on Fool.com.

Fool contributorSean Williamshas no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen nameTMFUltraLong, track every pick he makes under the screen nameTrackUltraLong, and check him out on Twitter, where he goes by the handle@TMFUltraLong.The Motley Fool owns shares of National Presto Industries.Motley Fool newsletter serviceshave recommended buying shares of Home Depot. Try any of our Foolish newsletter servicesfree for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.