Apple's Last Stand

Well, here it is. After weeks -- months -- of nearly nonstop promotion from the tech and finance blogs of the world, the iPhone 5 is here. That trumpeting sound you may hear in the background is the angelic chorus, heralding the arrival of what's sure to be the most glorious phone the world has ever seen. Why, what's that? It's Steve Jobs himself, riding back to Earth on clouds of victory! Hail to Apple (NAS: AAPL) ! Hail and hallelujah!

It's almost impossible to escape the hype machine behind Apple's announcement. Other phones get press conferences. Apple gets triumphal processions. Why, look, there's Tim Cook, emerging from beneath a victory arch built entirely out of Android phones.

Have we got that out of our collective systems yet?

Hype has its place. Without hype, Apple wouldn't be where it is today. The first iPhone rode into view behind years of speculation and enjoyed a six-month window from unveiling to its first sales that allowed the punditsphere to whip fans into a veritable froth. Even Apple haters can (or at least should) admit that the first iPhone was a transformative device in the mobile space. It created a new design paradigm, made touchscreens popular, and eventually helped create the app-ecosystem model that continues to be a defining factor in the success or failure of competing operating systems.

Now, what could Apple possibly add to the iPhone 5 that would be similarly transformative? The 4S's key new feature, Siri, was hyped to the moon and given prime billing on Apple's TV ads with celebrities. What was it in reality? A partly functional voice-activated personal-assistant software suite that so underperformed its commercial promise that a class action suit was filed over false advertising. The iPhone 4's key new feature was supposed to be a front-facing camera for video chatting with FaceTime, and a better display resolution to boot. Its most notable design feature turned out to be a poorly placed antenna that created reception issues when holding the lower left corner of the phone.

There are two key changes that got the bulk of the pre-release hype: The iPhone 5 will be taller, and its charging cable connection has been reworked -- the better to sell you new accessories, of course.

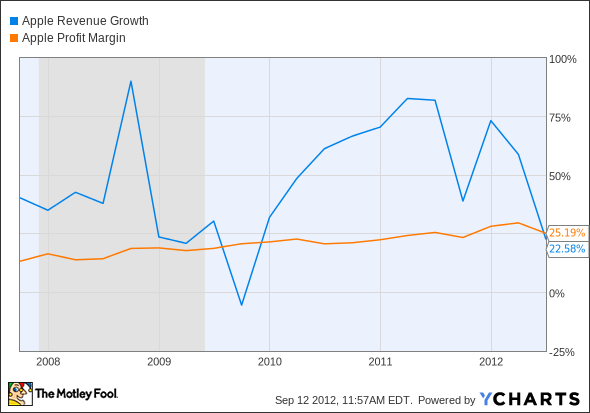

Is that enough to justify the hype? No. But Apple needs this hype in a bad way. The iPhone is Apple's major moneymaker, expected to account for more than half Apple's total revenue this year and probably more than 60% of its profit. The iPad expanded Apple's reach, but it didn't do much to reduce the company's dependency on the iPhone. When iPhone sales drop, revenue growth -- normally eye-popping in its pace over the past few years -- declines substantially. The most recent quarter's dip in iPhone sales even undid a long-running trend toward higher profit margins:

AAPL Revenue Growth data by YCharts.

Analysts and Apple bulls have largely built their case on the premise that Apple's popularity will remain at high levels, perhaps indefinitely. But the evidence shows otherwise. Last month, I highlighted a rolling poll by brand-analytics company YouGov that showed a gradual long-term decline in Apple's "buzz score," or the difference between positive and negative consumer perceptions of the company.

Since then, Apple's highly publicized global patent battle with Samsung was decided in its favor in American courts, but it saw less success internationally. I said after that trial concluded that the fight made Apple seem like a bully. YouGov's polling agrees. Pre-decision buzz scores for Apple and Samsung had Apple with a clear lead. After the decision, Apple's lead evaporated among early adopters, narrowed to nearly nothing among the general population, and actually lost out to Samsung in the coveted 18-to-34 demographic, which now clearly favors Samsung.

Popularity is a fickle thing to build a brand on, and consumer trends can shift easily. The Fool's most dedicated fans already appear to be tired of our constant iPhone hype, even though many have been loyal Apple stockholders for years -- and I'm sorry for adding to that hype, folks, but some things need to be said. A quick glance at the Fool's Facebook feed shows a lot of weariness over frequent Apple updates. Many fans have expressed lack of interest, annoyance, or an outright desire to switch to Google's (NAS: GOOG) Android or even a Nokia (NYS: NOK) Lumia running Microsoft (NAS: MSFT) Windows Phone 8.

One way for Apple to overcome this domestic apathy would be an international sales boom. Gaining access to China Mobile's (NYS: CHL) huge subscriber base would generate a ton of sales, the theory goes. The only problem with that theory is that China Mobile's own employees don't see that happening any time soon, and a lack of official support hasn't stopped an estimated 15 million Chinese subscribers from using the iPhone on the carrier's network anyway.

Then there's the fact that an iPhone costs about $800 in China, as carriers don't offer the subsidies American subscribers are used to. That means a Foxconn worker -- not poorly paid by Chinese standards -- would have to spend more than two months building iPhones on the assembly line before he could afford to buy one of his own. The war against cheaper Android phones hasn't put Apple on top. The company saw its share of the Chinese smartphone market cut from 19% to 10% in the second quarter of this year. Sure, there's some status to having an iPhone, but if Americans can get tired of it, why should the Chinese be any different?

Every new iPhone needs to sell many more units than its predecessor to maintain Apple's momentum and justify the continued increase in its stock price. The next few months will go a long way toward telling us whether the iPhone 5 will do so. The smartphone industry is mature, saturated, and established. Apple's now playing an incremental game, but its strength is in transformation. The last time Apple had to fight for inches, it lost badly to competitors who were less concerned with near-term profit margins than in growing long-term market share. Will that happen again? It may not take long to find out.

The Motley Fool's built a premium research service to help you stay a step ahead of the talking heads. Subscribe today and receive a premium report outlining the bear and bull cases for Apple. Best of all, it comes with a full year of updates by our top tech analysts -- all at no extra cost! Find out more.

The article Apple's Last Stand originally appeared on Fool.com.

Fool contributorAlex Planesholds no financial position in any company mentioned here. Add him onGoogle+or follow him on Twitter,@TMFBiggles, for more news and insights.The Motley Fool owns shares of Microsoft, Apple, China Mobile, and Facebook.Motley Fool newsletter serviceshave recommended buying shares of Apple, Facebook, Google, and Microsoft and creating a bull call spread position in Apple and a synthetic covered call position in Microsoft. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.