Will This Department Store Stock Keep Moving Higher?

Shares of Dillard's (NYS: DDS) hit a 52-week high last week. It wasn't the only department store chain to push toward new highs -- Macy's (NYS: M) has been moving higher all summer, and The Bon-Ton Stores (NAS: BONT) shot to a 52-week high as well last week. Let's look at what's driving these gains to understand what lies over the horizon. Are there clear skies ahead? We'll have a better forecast once we examine the details.

How it got here

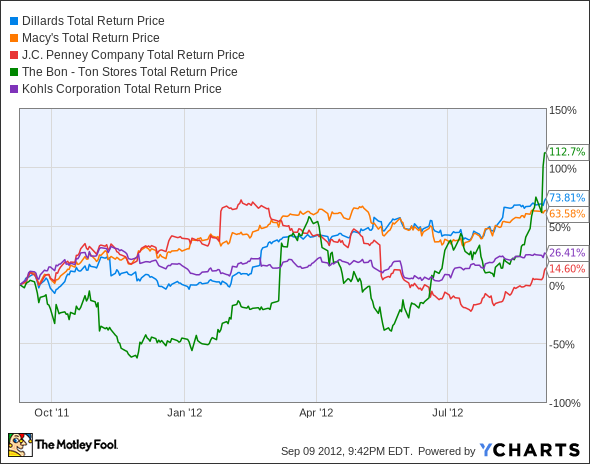

A number of major department stores have been posting steady gains for the past 52 weeks, with a few notable exceptions. J.C. Penney (NYS: JCP) hasn't quite managed the hoped-for turnaround under CEO and former Apple retail guru Ron Johnson. Its same-store sales are in virtual free-fall while the "transformation" proceeds. It's an exception in this group, which also includes Kohl's (NYS: KSS) , which has seen respectable growth for the past year.

DDS Total Return Price data by YCharts

Fool analyst Alyce Lomax took issue with Bon-Ton's big pop last week, pointing out that investor enthusiasm doesn't have the numbers to support it. Macy's and Dillard's are better buys in her view, with increasing sales, consistent profits, and more manageable debt levels. Kohl's has been a bit underwhelming this year, as its same-store sales are down through 2012 despite a strong August performance.

With all this in mind, let's drill deeper into each company's numbers, to figure out if each stock's movement is justified or just full of hot air.

What you need to know

Where our companies are profitable, they seem to be supported as much by low valuations as by natural growth rates. Where they're unprofitable, analyst optimism is maintaining their prices:

Company | P/E Ratio | Price to Levered Free Cash Flow | Net Margin (TTM) | Projected Growth Rate (2013) |

|---|---|---|---|---|

Dillard's | 8.0 | 10.6 | 7.6% | 8.8% |

Macy's | 12.8 | 12.1 | 5% | 12.4% |

Bon-Ton Stores | NM | NM | (1%) | 450% |

J.C. Penney | NM | NM | (3.5%) | 6,500% |

Kohls | 12.4 | 16.3 | 5.6% | 11.1% |

Source: Yahoo! Finance. TTM = trailing 12 months. NM = not material due to negative results.

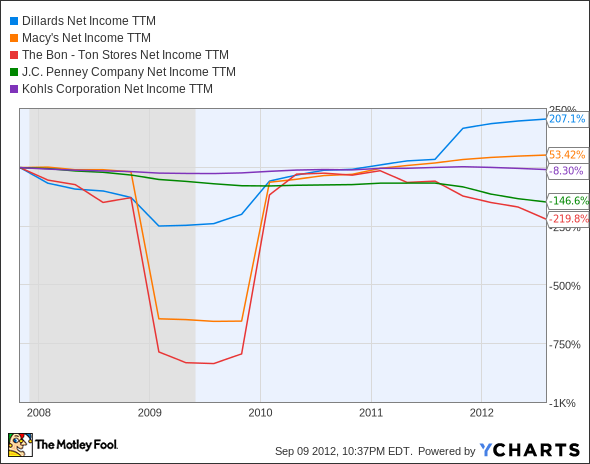

Dillard's saw its P/E artificially deflated by a one-time tax charge last year, but it's still attractively valued next to its peers on a price-to-free-cash-flow basis. Its net income growth was already leading the pack before the tax charge, which lends validity to its strong stock price growth:

DDS Net Income TTM data by YCharts

Only Macy's can claim comparable bottom-line growth. J.C. Penney and Bon-Ton investors will have to bank on the big turnarounds promised by analysts to justify the continued growth of either stock. For the moment, however, Dillard's still looks like a good value, as it's already on a path of proven growth.

What's next?

Where does Dillard's go from here? Fool contributor Sean Williams added Dillard's to his list of high-flying stocks to consider selling in May, but the stock's continued to rise. Returning to a "normal" level of profitability shouldn't damage Dillard's valuation enough to knock it out of line with its peers, so the key thing to watch will be its ability to continue growing profitably.

The Motley Fool's CAPS community has given Dillard's a one-star rating, with only 40% of our CAPS players expecting the company to continue outperforming the indexes. The CAPS community clearly isn't keen on Dillard's long-term prospects.

Interested in tracking this stock as it continues on its path? Add Dillard's to your Watchlist now, for all the news we Fools can find, delivered to your inbox as it happens. If you're looking for other great retail stocks for the long haul, the Fool's got three suggestions. Discover why they're the "3 Companies Ready to Rule Retail" in our latest free report -- just click here to find out more.

The article Will This Department Store Stock Keep Moving Higher? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more news and insights.The Motley Fool owns shares of Dillard's. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.