Mining for Deep Value at Fresh 52-Week Lows

Shares of Cliffs Natural Resources (NYS: CLF) hit a new 52-week low yesterday. Let's take a look at how it got here to find out whether there are still cloudy skies ahead.

How it got here

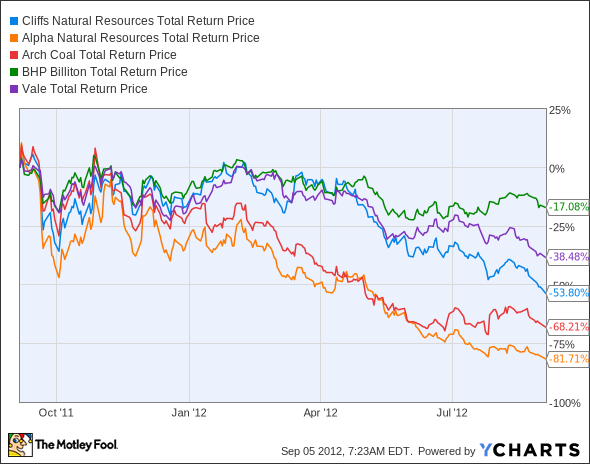

The steel-production materials smackdown hasn't stopped. Cliffs, which operates in both iron ore production and metallurgical coal mining, sits about midway between the performance of more focused iron miners and companies dependent on coal production:

CLF Total Return Price data by YCharts.

BHP Billiton (NYS: BHP) resists sector weakness through the diversity of its extractive operations, particularly in copper mining, but iron-focused miner Vale (NYS: VALE) doesn't have much to branch out into as iron demand plummets. On the flip side, Alpha Natural Resources (NYS: ANR) has had to shutter several mines due to lower coal demand.

Arch Coal (NYS: ACI) has a defense against steel-production declines in its thermal-coal focus, but American utilities have made their natural-gas preferences clear. A long-term shift toward cleaner energy production hurts Arch Coal far more than anyone else on this list, which may push it to the bottom of the pack before long.

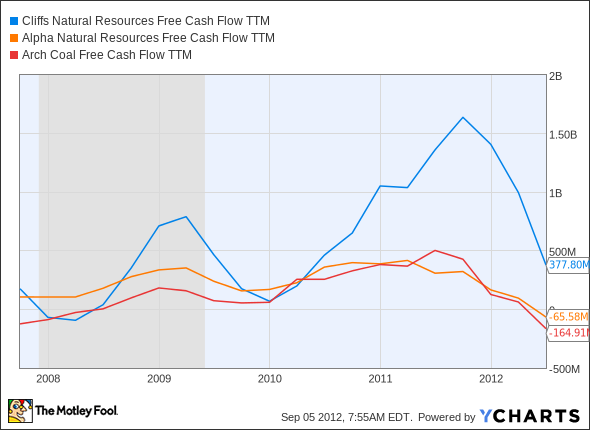

Cliffs, for its part, has had to live with weakness in both primary mining segments, leading to a sharp uptick in debt levels as net income and free cash flow have both headed south. Free cash flow is in a near free fall of late:

CLF Long Term Debt data by YCharts.

Can Cliffs turn itself around? Even with reduced profitability, is it a better investment than its peers? Let's dig into the numbers to find out.

What you need to know

We'll start with a quick look at some valuation ratios and analyst expectations. If you're a big Cliffs fan, you might already know about these numbers. However, stacking the company up against its peers shows that in most regards, Cliffs looks like a pretty good bargain today:

Company | P/E | Price/Levered Free Cash Flow | Net Margin (TTM) | Projected Growth Rate (2013) |

|---|---|---|---|---|

Cliffs Natural Resources | 3.4 | 17.7 | 21.2% | 31.3% |

Alpha Natural Resources | NM | 2.2 | (36.8%) | (8.3%) |

Arch Coal | NM | 6.8 | (7.8%) | 18.6% |

BHP Billiton | 11.3 | 38.4 | 21.2% | 15.4% |

Vale | 5.9 | NM | 28.2% | 2.3% |

Source: Yahoo! Finance. TTM = trailing 12 months. NM = not material due to negative results.

Using levered free cash flow, which is what's left after debt payments are calculated, places Cliffs at a higher valuation than Alpha or Arch Coal, but when we look at plain old cash flow, it's not even a contest:

CLF Free Cash Flow TTM data by YCharts.

Cliffs ends up with a price-to-free-cash-flow ratio of 12.7, while its peers don't get a positive ratio at all. Combined this with the highest projected growth rate of this group -- nearly double Arch Coal's -- and this stock looks like the best bargain in both iron and coal mining.

What's next?

What's next for Cliffs? Sector weaknesses don't resolve themselves overnight, and the steel sector Cliffs depends on has been in its own funk this year. Cliffs is no stranger to 52-week lows, and it can't rebound without increased demand from the steel sector. However, at these lows, Cliffs is near its 2009 bottom, and its low valuation ratios point to greater upside than downside.

The Motley Fool's CAPS community likes Cliffs' chances: They give it a four-star rating, and 96% of our CAPS players expect it to outperform. After watching this stock for months, I have to agree with them now, and I'll be placing an outperform CAPScall on the stock today.

Interested in tracking this stock as it continues on its path? Add Cliffs Natural Resources to your watchlist now for all the news we Fools can find, delivered to your inbox as it happens.

Cliffs is a smart coal play because it's not a coal energy play. But you can make smart energy investments by getting ahead of the long-term trends, and that means getting into natural gas while its prices are at all-time lows. Find out which nat-gas energy company could be the best stock on the market today in The Motley Fool's newest free report. Claim your copy of "The One Energy Stock You Must Own Before 2014" today at no cost.

The article Mining for Deep Value at Fresh 52-Week Lows originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more news and insights. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.