I'm Buying This Stock Now!

Earlier this week, I introduced readers to four companies I was considering putting my own Roth IRA money into. Today, I'm telling you that in the end, Baidu (NAS: BIDU) beat out fellow contenders Intuitive Surgical (NAS: ISRG) , Johnson & Johnson (NYS: JNJ) , and Google.

I certainly think there's a lot to like in all four companies -- I own and have bullish CAPScalls for all of them in my All-Star profile. But, in the end, Baidu happens to be the best deal I see the market offering up right now. Read below to find out why, and at the end, I'll show you how to access a premium report on the company.

An overblown fear

Earlier this month, analysts downgraded Baidu, because a report surfaced saying that the company was planning to sue Qihoo 360 (NAS: QIHU) , which had just dumped Google as its search partner of choice.

The fear was that Qihoo -- which has historically focused on Internet security products -- was making serious enough inroads into Baidu's core Internet search market that the company would have to take legal action to defend its territory.

Whether or not that's actually true remains to be seen. Here's what we know: Qihoo has a personalized start-up page that averages about 83 million users. By putting a search button on that page, it could be an obvious choice for many of these users. But, as fellow Fool Rick Munarriz points out, "It's never as easy as that. Sohu.com (NAS: SOHU) runs a popular portal, yet its seasoned Sogou search engine has a mere sliver of the market."

In the end, I have to side with another Fool -- Alex Planes -- who pointed out that, "Investors shouldn't expect Qihoo to suddenly trounce a very well-established Chinese search engine without substantial effort and significant market dissatisfaction with the incumbent." I just don't see evidence of either of these occurring right now.

A more-than-fair price

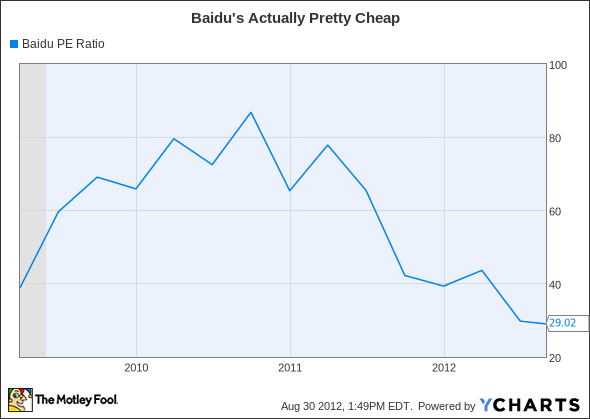

By traditional measures, Baidu might not appear cheap; it has a price-to-earnings ratio of 29. But consider a couple of variables to put this in perspective. First, the stock is down over 15% since the Qihoo news broke -- so there's a significant short-term discount right now.

But, more importantly, Baidu exists in a country where millions of Chinese users are beginning the Internet experience every day. When these citizens want to perform an Internet search, Baidu is the default choice. That helps explain why the company's advertising partners were paying 35% more for use of Baidu's services last quarter than they were one quarter ago.

Furthermore, over the past five years, the company has been able to grow earnings per share by an astounding 74% per year! Analysts predict -- and remember, these are just predictions -- that the company will show continued 30% growth over the next two years.

And yet, despite these numbers, the company is selling for cheaper than it was back when the global economy just started to show signs of recovery back in early 2009.

BIDU PE Ratio data by YCharts

While some may worry that Baidu, much like Google, is going to suffer by Internet searches moving to less-profitable mobile devices, let's remember what the last few conference calls have taught us: mobile search is mostly incremental to desktop search.

In plain English, this means that people aren't abandoning desktop searches, even though searches on mobile devices are growing. This is primarily because, in the past, you couldn't perform any Internet searches when you were in your car or walking around town. Now, you can, but that doesn't mean you've stopped doing so on your desktop computer.

For all of these reasons, I'm going to be buying shares of Baidu when Motley Fool trading rules apply. If you're interested in the company, and want on-going, premium research, I highly suggest checking out our special report on Baidu. For those who can't spend hours deciphering the noise from the crucial information, there's no better way to stay on top of the company. Get your copy and continual access to this report today.

The article I'm Buying This Stock Now! originally appeared on Fool.com.

Fool contributorBrian Stoffelowns shares of Baidu, Johnson & Johnson, Google, and Intuitive Surgical. The Motley Fool owns shares of Intuitive Surgical, Baidu.com, and Johnson & Johnson.Motley Fool newsletter serviceshave recommended buying shares of Johnson & Johnson, Sohu.com, Intuitive Surgical, Google, and Baidu.com.Motley Fool newsletter serviceshave recommended creating a diagonal call position in Johnson & Johnson. The Motley Fool has adisclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.