How This Stock Beat the Bears

Since Motley Fool Stock Advisor opened its pages in 2002, David and Tom Gardner's stock picks have returned an average of 80% each. That compares to 25% for equal positions of the S&P 500.

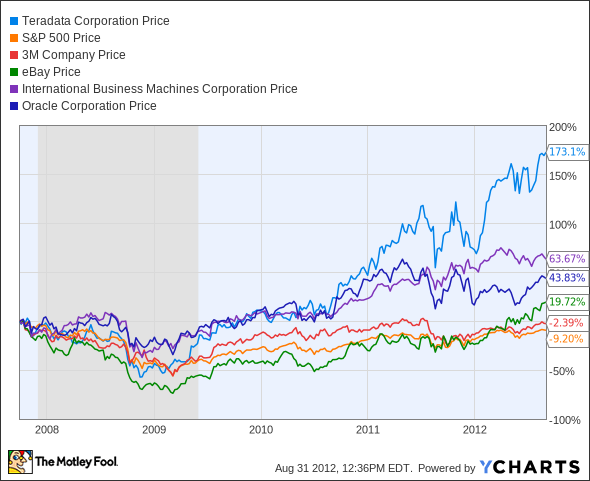

We're celebrating the newsletter's 10-year anniversary by releasing -- for free -- the recommendation articles for several of the newsletter's biggest winners. Today we look at Teradata (NYS: TDC) , recommended in both 2009 and 2011 by Tom Gardner. The two positions have returned 368% and 37%, respectively.

Below you'll find the original recommendation as it appeared in the April 2009 issue of Stock Advisor -- near the bottom of the devastating bear market.

Tom's Top Pick: Teradata

I get hundreds of emails each day. I send my share, too. I'm a big fan of Facebook, Tivo, and Netflix. I like trolling through CAPS and its 3 million stock picks. My Amazon Kindle is packed with more than 50 books. I may name my first child "ESPN."

Imagine what this means for a data miner who can capture and analyze the bread crumbs I leave behind as I hop from website to website, application to application. Now overlay my offline spending habits -- credit card purchases, store visits, NFL-watching, whatever -- and you have an accurate picture of who I am, what I do, and most important, what I'm likely to pay for.

We live in an informational age, and companies that can profit from gathering and understanding that information are going to thrive. That's why this month I'm recommending Teradata, a specialist in data warehousing and analytics that helps global companies make heads and tails of the volumes of data they capture.

Drowning in Data

Data warehousing, business intelligence, and data mining (industry speak for organizing and making sense of gobs of data) is not easy for the smallest of firms, let alone large, global conglomerates like Wal-Mart, 3M (NYS: MMM) , or Stock Advisor recommendation eBay (NAS: EBAY) . These and other influential companies seek out Teradata, which pioneered data warehousing 30 years ago through research conducted at CalTech and today is the largest sole provider of these multimillion-dollar solutions.

Teradata specializes in enterprise data warehousing solutions targeting the world's 3,000 largest companies. Its award-winning technology gathers, aggregates, organizes, and processes data, then offers intelligence that clients use to make smarter and quicker decisions. Time is money, and these large customers are willing to pay for better insights -- and easier access -- to the data behind their companies. Of course, Teradata also charges the requisite service fees to go along with its products.

Just like its customer base, Teradata is multinational, operating 90 facilities in 40 countries. North and South America make up 56% of its revenue, with Europe, the Middle East, and Africa coming in a collective second at 26%, followed by Asia at 18%. (That said, Japan is Teradata's second-largest market after the U.S.)

Yep, It's Debt-Free

With "debt" considered a naughty four-letter word these days, Andy and I are happy to say we don't have to worry about it with Teradata, which has a fortress-like balance sheet of $442 million in short-term T-bills and zero debt (just some operating leases).

Operating margins are comfortably in the high teens, and while not as high as chief competitor Oracle's (NAS: ORCL) , they're in line with IBM's (NYS: IBM) and much higher than those of a smaller pure play, Netezza. Cash flows are robust, and capital expenditures, including capitalized software costs, are reasonable.

Typically, I prefer the Netflix or Costco business models: Sell lots of things to millions of people rather than sell big-ticket items to a few large clients. But Teradata's focus has one key advantage: stickiness. Between 80% and 90% of the company's revenue comes from its existing clients through service contracts and product upgrades. After all, it's not like a multinational, multibusiness company wants to switch its data warehousing solution every year (or even every few years, for that matter).

What's It Worth?

The downside to this laser focus is that revenue growth is tepid. Management is targeting 5% to 7% annual "top-line" growth, in line with what it's managed to do the past few years. The strong U.S. dollar will nick operating margins this year, and customers may hold off on upgrades in a weak economy.

But looking out five years, Andy and I think margins will pick up and growth will kick in as clients return to investing in their data warehousing -- they can't afford to fall behind. Teradata's warehousing prowess, even in the face of stiff competition, and its deep client relationships will keep free cash flows healthy -- and management will deploy that cash back into the business at 25%-plus returns on capital. Off robust cash earnings of $225 million, we see a stock worth at least $25 in five years, giving us annualized returns of more than 10%.

When We Might Sell

The difficulty with investing in high-tech companies is that they constantly have to innovate just to tread water against fierce competition. Teradata is no exception. Oracle spends the equivalent of Teradata's market cap in R&D each year. IBM spends three times that. Tech gurus Forrester and Gartner call Teradata's technology tops in the field, and a rich history will help keep the wolves at bay -- but we'll keep our eyes and ears open.

Also, Teradata can't sell to its existing clients forever, so it has to continue landing new customers. That's one reason it's starting to target smaller companies. I think this can help jump-start organic growth over the next couple of years, but because the margins are lower, I'll be watching the delicate balance.

Finally, because a chunk of Teradata's existing clients are tied to the financial sector, there's inherent high risk here -- definitely something to watch.

The Foolish Bottom Line

I'm not a top-down investor trying to find the next hot trend, but I do pay attention to long-term, secular consumer shifts. How we gather, manage, and analyze data will continue to be mission-critical for companies all over the globe. I see it every day as CEO of The Motley Fool, where we strive to make timely decisions based on what? Data! And we're just a speck on the huge mountain of data warehousing. Teradata is an innovator -- it's only in year two as a public company -- and Andy and I are confident it will continue scaling new heights. Start your own climb today by picking up a few shares.

--Tom Gardner, April, 2009

Investing lessons

Tom and Andy recommended Teradata in the darkest of times, near what turned out to be the trough of the scariest market in decades. Yet, they were confident that the right companies would provide outstanding long-term returns.

Thus, with the long-term in mind, they picked a young and innovative business in an important and growing sector, with a rock-solid balance sheet. They knew companies would eventually have to invest in data services, or risk falling behind competitors. Teradata's competitive advantages and reasonable valuation sealed the deal.

The article How This Stock Beat the Bears originally appeared on Fool.com.

Fool analyst Rex Mooretweetsbut is not a twerp. Of the companies mentioned here, he owns shares of eBay.The Motley Fool owns shares of Costco Wholesale, International Business Machines, Netflix, and Oracle.Motley Fool newsletter serviceshave recommended buying shares of Teradata, Netflix, eBay, Costco Wholesale, and 3M.Motley Fool newsletter serviceshave recommended creating a synthetic long position in International Business Machines.Motley Fool newsletter serviceshave recommended creating a diagonal call position in 3M. The Motley Fool has adisclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.