Can Anything Stop Equinix?

Shares of Equinix (NAS: EQIX) hit a 52-week high on Wednesday. Let's take a look at how it got there and see if clear skies are still in the forecast.

How it got here

With the prediction that cloud-computing could account for as much as $241 billion in spending by the year 2020, the move toward big data centers has been very profound and lucrative for neutral-network data center provider Equinix. Rather than spread itself thin, Equinix has chosen to focus its data center efforts on big cities. This has allowed it to garner big clients, including many financial sector firms that require large amounts of storage and split-second data transfers, in addition to customers in many other industries.

At the heart of Equinix's ascent is a boost in cloud-computing expenditures and the consistency of the company's recurring revenue stream. Equinix has benefited from major telecom providers shunning mainline expansion in favor of back-end data and storage spending. This is the primary reason why fiber optic player JDS Uniphase (NAS: JDSU) reported a 7% decline in revenue in the second quarter and networking products provider Alcatel-Lucent (NYS: ALU) has witnessed a free fall in total sales since the recession.

Equinix is also being aided by its reported 18% increase in recurring revenue (which comprises 95% of total sales), which easily surpassed Wall Street's expectations. A high percentage of recurring revenue translates into predictable cash flow -- something Wall Street loves.

Of course, Equinix isn't going to be without its problems, which include data center competition from far bigger rivals in AT&T (NYS: T) and Verizon (NYS: VZ) , as well as the challenge of paying down its $2.6 billion in debt.

How it stacks up

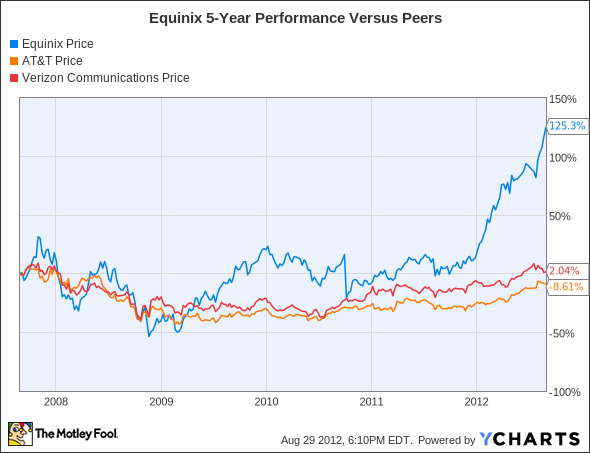

Let's see how Equinix compares to its peers.

Being considerably more specialized and targeted toward major cities, Equinix has moved well beyond its peers over the past year.

Company | Price/Book | Price/Cash Flow | Forward P/E | Debt/Equity | Dividend Yield |

|---|---|---|---|---|---|

Equinix | 4.7 | 14.9 | 44.2 | 121.8% | 0% |

AT&T | 2.1 | 6.2 | 10.2 | 62.3% | 4.8% |

Verizon | 3.3 | 3.8 | 15.3 | 57.9% | 4.7% |

Sources: Morningstar and Yahoo! Finance.

This is really comes down to a case of growth versus income. Both AT&T and Verizon have considerably more diverse business operations than Equinix, and thus are much cheaper on a forward earnings basis and pay out handsome yields near 5%. Equinix, on the other hand, will run circles around both AT&T and Verizon in terms of growth rates.

The big question that will really make these numbers somewhat relevant has to do with the magnitude of AT&T and Verizon's investments into their data centers, as well as industrywide consolidation or acquisitions, which could eat into Equinix's niche category.

What's next

Now for the $64,000 question: What's next for Equinix? The answer depends on its ability to find other geographic centers to expand to, its ability to pay down debt, and whether or not it can stand up against AT&T and Verizon's deep pockets.

Equinix isn't the only company with a technology that everyone's soon going to want. Find out which three stocks stand to benefit from the mainstream introduction of the next disruptive technology by clicking here to get your copy of this latest free report!

Our very own CAPS community gives the company a two-star rating (out of five), with just 69.3% of members expecting it to outperform. I made a CAPScall on Equinix a few months ago that currently has me down an unpleasant 32 points, but I'm not thinking about closing the pick anytime soon.

As my Foolish colleague Rich Duprey noted last month, Equinix's unique position within data center traffic and the potential for the company to become a real estate investment trust have investors rightfully excited. Even I can see very long-term potential in the company. Where I have my qualms with Equinix is simply in its valuation. If Equinix is growing at 18% per year and its forward P/E is 44, we're looking at a PEG ratio of 2.44 which is awfully high - even for a company with recurring revenue. I'm also concerned that its high debt levels will constrain its expansion even with ample revolving credit available. There's just not enough value left here to justify a move higher in my opinion.

Craving more input on Equinix? Start by adding it to your free and personalized Watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.

The article Can Anything Stop Equinix? originally appeared on Fool.com.

Fool contributor Sean Williams has no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen name TMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle @TMFUltraLong.Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.