As Coffee Bean Prices Fall, Which Coffee Stocks Are the Winners?

Starbucks (NAS: SBUX) is a company heavily dependent on one commodity: raw arabica coffee. It's nice, then, that prices for those beans have generally been dropping in recent months. And based on futures contract data, that trend looks as if the trend will continue. So that seems a clear win for the company and other arabica buyers. But not all business advantages can be exploited equally, and Starbucks might not be the company best positioned to capture the opportunity.

Drier and cheaper

The prolonged dry weather badly affecting crops in the U.S. has been beneficial for certain commodities abroad, most notably coffee. An unusually heavy bout of wet weather affecting output in java-growing countries several years ago is largely over, bringing production back to former levels. Forecasts indicate that production in Colombia, for example, could reach a half-decade high of 9 million bags (approximately 1.2 billion pounds) next year; 2011's haul of 7.8 million (1 billion pounds) was the lowest in 35 years.

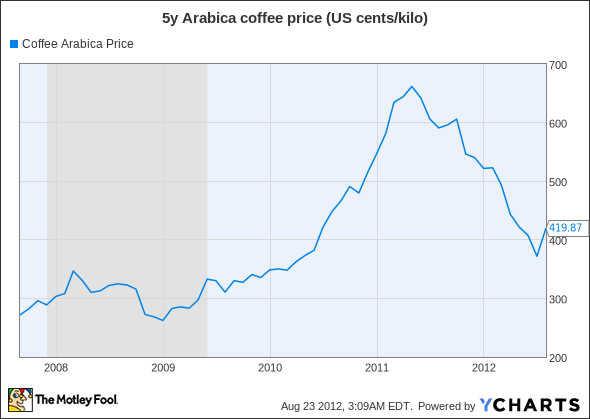

Prices have gone south thanks to the increased supply. These days, a pound of coffee on the commodities market will run a buyer around $4.20 per kilogram, or $1.91 a pound. That's quite a far way down from the weather-influenced price spike of last year, when java changed hands at prices in excess of $6.60 per kilo ($3 per pound).

Coffee arabica Price data by YCharts

In 2011, Starbucks paid an average price of $2.38 per pound for its coffee, meaning at current rates the company is saving around 20% on the costs of that most crucial input. And this equals a lot of dosh -- Starbucks bought more than 428 million pounds of raw beans that year, meaning a total cost of $1 billion or so. If today's prices were applied, that figure would drop to around $820 million.

Unfortunately for Starbucks regulars like your humble correspondent, the company is loath to cut the prices of its beverages. But the story is different for shareholders -- all things being equal, fewer costs should mean higher profits and more money in the company's pocket.

Avoiding the espresso machine

But not necessarily if you're an international operator, as Starbucks has increasingly become. Europe's protracted economic slowdown has eviscerated the market for luxury goods, and many newly un- or under-employed Europeans consider coffee to be a luxury at the moment. So they're cutting down on their traditional morning bracer of espresso or the daily cappuccino. These, however, are the drinks made from the higher-end arabica beans, and arabica is the type Starbucks buys exclusively.

Overall coffee-bean imports to the hardest-hit European economies have dropped significantly. In the most recent October-to-April period, they were down by 6.6% year over year in Spain and nearly 3% in Italy, two nations renowned for their high java consumption. This wasn't offset by two of the continent's biggest coffee quaffers, Germany and France, which saw meager increases of 0.4% and 1.3%, respectively. Those four nations, incidentally, together imported around 5.4 billion pounds of coffee during the period, compared with 3.4 billion for America.

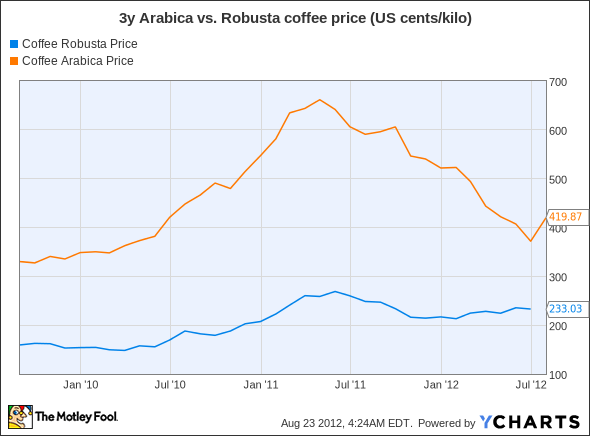

Many Europeans are replacing their beloved craft beverages with more downscale coffees made from the less favored robusta bean. This change in habit is affecting the raw coffee market; the price gap between arabica and robusta has narrowed to levels not seen in years.

Coffee Robusta Price data by YCharts

Domestic or diversified

Although Europe is only a small part of Starbucks' operations at the moment (8% of total stores worldwide), its participation has grown over the years. The number of stores on the continent increased by 15% from Q1 2009 to Q3 2012, the most recent quarter, while the figure dropped by 5% for the company's American branches.

Eight percent isn't a big number, but it's large enough to make an impact. Flat growth in same-store sales in Europe (plus the Middle East and Africa, as Starbucks lumps all of them into one region) was one of the reasons the company's most recent quarterly results disappointed the market. "Europe," CFO Troy Alstead was quoted as saying, "continues to be our most challenged part of the world by far."

So maybe the better way to play the drop in arabica prices is to place bets on the more domestically focused purveyors of the bean. Green Mountain Coffee Roasters (NAS: GMCR) , a onetime market star that's lost much of its shine, could benefit from better margins. In its most recent quarter, the company grew revenue strongly (by 21% year over year), but gross margins narrowed slightly.

Alternatively, a stock with a strong coffee presence yet more hedged with food offerings might be a good way to go. There's always the durable McDonald's (NYS: MCD) , which, after rolling out its McCafe offerings several years ago, takes in an estimated 4% of total revenue from espresso-based drinks, around double the rate of five years ago. That would equate to a little more than $1 billion out of the company's 2011 top line of $27 billion.

Dunkin Brands (NAS: DNKN) also uses arabica beans exclusively and pours an awful lot of coffee -- almost 1.5 billion cups of the stuff every year. Its flagship Dunkin' Donuts outlets sell food items to absorb the java, while its Baskin-Robbins ice cream parlors help offset the parent company's reliance on the hot brown liquid.

Of course, there are Starbucks' direct competitors. Both Peet's and Caribou (NAS: CBOU) have seen their gross margins slip over the past few fiscal years and could use a break in the form of lower-cost raw coffee.

Every company likes cheaper input prices, and Starbucks will almost certainly benefit from less pricey arabica. But they won't be the only one enjoying that advantage, so it's worth looking around for rivals that might be better placed to exploit it.

If you're a Green Mountain investor and watching for any signs of hope as coffee prices drop, make sure to check out our new premium research report on the company. The report will not only outline the opportunities and threats facing the company, but it also comes with a year of updates on the company. Get started today!

The article As Coffee Bean Prices Fall, Which Coffee Stocks Are the Winners? originally appeared on Fool.com.

Fool contributorEric Volkmandrinks gallons of coffee but owns no stocks mentioned in the story above. The Motley Fool owns shares of Green Mountain Coffee Roasters, Starbucks, and McDonald's.Motley Fool newsletter serviceshave recommended buying shares of McDonald's, Green Mountain Coffee Roasters, and Starbucks, writing naked calls on Dunkin Brands Group, writing covered calls on Starbucks, and creating a lurking gator position in Green Mountain Coffee Roasters. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.