Tim Cook's First Year as Apple CEO: So Far, So Good

Many leaders are judged by the early days of their time in the driver's seat. It was exactly one year ago today that Steve Jobs tendered his resignation letter to Apple's (NAS: AAPL) board, handing the iKeys to the ship over to Tim Cook:

August 24, 2011

Letter from Steve Jobs

To the Apple Board of Directors and the Apple Community:

I have always said if there ever came a day when I could no longer meet my duties and expectations as Apple's CEO, I would be the first to let you know. Unfortunately, that day has come.

I hereby resign as CEO of Apple. I would like to serve, if the Board sees fit, as Chairman of the Board, director and Apple employee.

As far as my successor goes, I strongly recommend that we execute our succession plan and name Tim Cook as CEO of Apple.

I believe Apple's brightest and most innovative days are ahead of it. And I look forward to watching and contributing to its success in a new role.

I have made some of the best friends of my life at Apple, and I thank you all for the many years of being able to work alongside you.

Steve

Exactly six weeks later, Jobs would pass away, losing his battle to the health issues that had been plaguing him for so long.

That's what I call a signing bonus

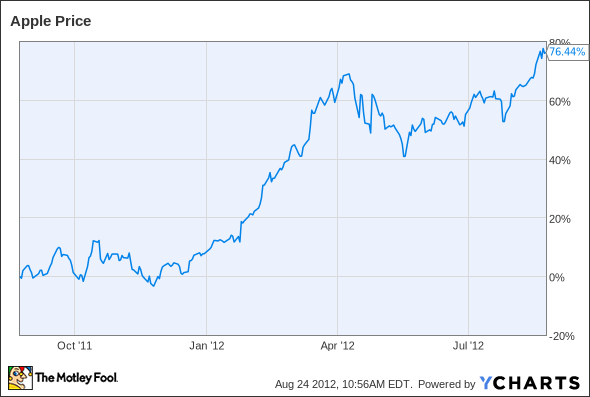

Upon Cook becoming CEO, after several occasions of serving as interim CEO during Jobs' medical leaves, Cook was the happy recipient of a cool 1 million restricted stock units, or RSUs. The grant was meant for retention, with half of it vesting in five years and the remainder in 10. Shares closed that day at $376.18, valuing this award at over $376 million. Since then, investors have expressed confidence in Cook's leadership as Apple continues to post tremendous results and the shares have nearly doubled in just one year's time.

The stock is up an incredible 77% since then, and shares have reached as high as nearly $675, meaning the value of Cook's award has similarly skyrocketed to about $675 million at the peak. Now that's what I call a signing bonus.

Products first

Over the past year, Cook has overseen several major product introductions, the first of which was the iPhone 4S, which was unveiled the day before Jobs' death. Apple would proceed to sell a monstrous 37 million iPhones that quarter, a sequential jump of nearly 20 million units. That contributed greatly to Apple's current record quarterly revenue of $46.3 billion.

A few months later, Apple unveiled the third-generation iPad on Cook's watch. The device launched at the very end of the first quarter, and the second quarter saw iPad unit sales jump 44% sequentially to 17 million. The iPad currently continues to claim an estimated 69% share of the booming tablet market.

At the company's worldwide developer conference in June, Apple brought the Retina display to its Mac lineup, starting with a redesigned MacBook Pro, and updated the rest of its notebook lineup to include the latest Intel (NAS: INTC) Ivy Bridge processors and NVIDIA (NAS: NVDA) Kepler graphics. These chips will inevitably make their way throughout the rest of Apple's Mac lineup.

More recently, Apple released the newest version of its desktop operating system, Mountain Lion, and the new iPad was launched in China after the resolution of its trademark dispute in the country.

Think Different

There are several other ways that Cook is leaving his mark on Apple, ways that are decidedly different than those of his predecessor. He reinstated Apple's charitable contribution matching for employees, a program that Jobs had axed over a decade prior.

Jobs had an inexplicable predisposition to hoarding Apple's cash, even declining to heed advice from Warren Buffett (who does that?) to the contrary. Buffett recalled, "He just liked having the cash." At a certain point, though, enough is enough. Apple's swelling money mountain was a frequent topic of investor debate, and Cook has now implemented a quarterly dividend -- the first one in 17 years -- and share repurchase program.

There's now speculation that Apple may be considering a stock split. The last one was a 2-for-1 split back in February 2005. A split could also potentially lead to Apple's inclusion in the Dow Jones Industrial Average. With Apple being the largest company in the world by market cap and the Dow consisting primarily of blue chips, Apple is the bluest chip of them all, so it's arguable that Apple should be in the Dow. Due to the Dow's silly price-weighting mechanism, Apple's current price is prohibitively high, although Apple also carries a disproportionate weight in market-cap-weighted indexes as well. At the end of June it comprised 4.4% of the S&P 500 and currently equals 13.2% of the Nasdaq Composite.

In some ways, Apple is also less close-mouthed under Cook. Before, many of Apple's relations with the media were considered a one-way street. The Mac maker would reach out to select members of the press when it wanted something. Proactively reaching out to Apple for press inquiries would either be fruitless or simply yield a "No comment." Nowadays, Apple will issue official statements to the press, like when it responded in defense to TheNew York Times' piece on how Apple minimizes its tax liability (like just about every other tech company). Apple is much more willing to converse with the media under Cook.

Kudos

The past year has been very kind to Cook, Apple, its customers, and its shareholders. Cook had already been responsible for much of Apple's success behind the scenes, and will continue to lead the way now that he's in the spotlight.

So far, so good, Mr. Cook.

Apple has entered a new era of growth on Cook's watch, and you can read all about it right here in this brand new premium report on Apple. Sign up today and get free updates at no additional cost!

The article Tim Cook's First Year as Apple CEO: So Far, So Good originally appeared on Fool.com.

Fool contributorEvan Niuowns shares of Apple, but he holds no other position in any company mentioned.Click hereto see his holdings and a short bio. The Motley Fool owns shares of Intel and Apple.Motley Fool newsletter serviceshave recommended buying shares of Intel, Apple, and NVIDIA.Motley Fool newsletter serviceshave recommended writing puts on NVIDIA.Motley Fool newsletter serviceshave recommended creating a bull call spread position in Apple. The Motley Fool has adisclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.