Can Skechers Maintain Its New 52-Week High?

Shares of Skechers (NYS: SKX) hit a 52-week high yesterday. Let's look at how it got here and whether clear skies are ahead.

How it got here

Skechers has been on a nice run higher in recent months not because its results have been outstanding, but because they just haven't been as bad as they were a year ago. The company has been able to sell more full-priced items and has seen some slight improvements in its sales comps at its retail stores.

But bouncing back from the abyss doesn't mean the company is raking in profits. Sales were down 11.6% in the most recent quarter to $384 million, and the company still reported a loss of $1.8 million, or $0.04 per share. There's no doubt the bottom line is improving, which is why the stock is up, but the company still isn't making a profit.

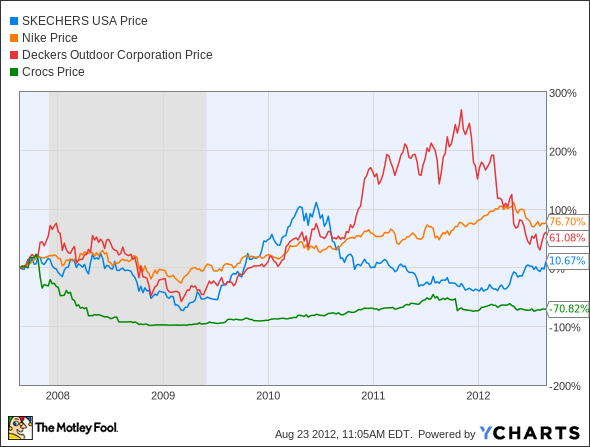

The stock also hasn't been a particularly strong performer over the past five years. When comparing to Nike (NYS: NKE) and Deckers Outdoor (NAS: DECK) the stock has vastly underperformed, and it only beats the wildly volatile shares of Crocs (NAS: CROX) .

From a more fundamental perspective, Skechers is behind each of these shoe competitors with lower revenue growth and return on assets.

Skechers | 1.3 | -11.5% | -2.8% | 26.2 |

Deckers Outdoor | 2.6 | 13.1% | 17.6% | 9.5 |

Crocs | 2.6 | 12% | 12.9% | 9.7 |

Nike | 4.2 | 12.2% | 12.5% | 16.3 |

Source: Yahoo! Finance.

Even if the company is able to return to a profit, investors are putting a high price on the stock with a forward P/E ratio higher than those of Deckers, Crocs, and Nike.

What's next?

The new 52-week high is more of a dead-cat bounce in my eyes than a sign of great things to come. Skechers is no longer a hot brand, and the company's operations leave a lot to be desired. I think the stock is a risky bet on the company's recovery, and I would stay away.

But the CAPS community disagrees, giving the stock a four star rating (out of five). I guess they have more faith that revenue has stabilized and profits will improve than I do.

Interested in reading more about Skechers? Click here to add it to My Watchlist, and My Watchlist will find all of our Foolish analysis on this stock.

Also, be sure to check out our newest premium report on the biggest name in online retail: Amazon.com. In it, you'll learn why the stock's astronomical valuation shouldn't be all that concerning. On the other hand, our analyst also runs through some of the key obstacles standing in the e-tailer's path. Click here to claim your copy.

The article Can Skechers Maintain Its New 52-Week High? originally appeared on Fool.com.

Fool contributorTravis Hoiumowns lots of Nike shoes but does not have a position in any company mentioned. You can follow Travis on Twitter at@FlushDrawFool, check out hispersonal stock holdingsor follow his CAPS picks atTMFFlushDraw.The Motley Fool owns shares of Amazon.com.Motley Fool newsletter serviceshave recommended buying shares of Skechers USA, Crocs, NIKE, Amazon.com, and Deckers Outdoor.Motley Fool newsletter serviceshave recommended creating a diagonal call position in NIKE. The Motley Fool has adisclosure policy.

We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.