Best Buy Hit a 52-Week Low: Still Not the Best Buy

Shares of Best Buy (NYS: BBY) hit a 52-week low yesterday. Let's look at how it got here and whether dark clouds are ahead.

How it got here

After getting a nice boost earlier this month when founder Richard Schulze expressed interest in buying out the company, shares promptly gave it all back and then some when the struggling retailer said, "Thanks, but no thanks," and appointed a new CEO, crushing the odds of said buyout actually transpiring.

Best Buy then proceeded to report dismal second-quarter results. Revenue decreased 3%, comparable store sales fell 3.2%, and gross margin declined by 110 basis points to 24.3%. Best Buy also incurred $91 million in restructuring charges, contributing to the 87% plunge in operating income. All of that spelled $0.20 per share in adjusted non-GAAP profit, roughly half the $0.39 per share a year prior, and short of the $0.31 per share that the market was expecting.

Shares opened 10% lower at new lows following the early morning release but recovered throughout the day.

How it stacks up

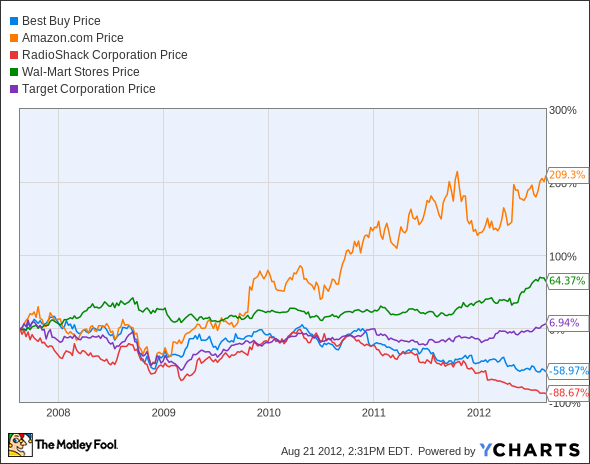

Let's see how Best Buy stacks up with some of its retail and e-tail rivals.

BBY data by YCharts

We'll include some fundamental metrics as well.

Company | P/S (TTM) | Sales Growth (TTM) | Net Margin (TTM) | ROE (TTM) |

|---|---|---|---|---|

Best Buy | 0.1 | 3.0% | 0.7% | (20.7%) |

Amazon.com (NAS: AMZN) | 2.0 | 34.9% | 0.6% | 4.9% |

RadioShack (NYS: RSH) | 0.1 | 2.6% | (0.4%) | (2.2%) |

Wal-Mart Stores (NYS: WMT) | 0.5 | 6.7% | 3.7% | 23.6% |

Target (NYS: TGT) | 0.6 | 4.2% | 4.1% | 19.0% |

Source: Reuters. TTM = trailing 12 months.

Electronics retailers such as Best Buy and RadioShack aren't doing very well, as buyers have turned to Amazon for those types of purchases, looking for savings on big-ticket items. Amazon has the most growth of the bunch, fetching it a relatively premium valuation. Traditional retailers Wal-Mart and Target are faring well, as online savings for the low-ticket products they offer are negligible and customers value the convenience of a one-stop shop. Additionally, some items like apparel are better purchased in person.

What's next?

For Best Buy, a buyout would have been the best possible ending for public shareholders, putting them out of their misery. Sadly, the company is opting to stick with the status quo, which will entail continued underperformance.

The face of retail is changing, and these two companies are cashing in. To find out who they are, grab a copy of this special free report while you can. It won't be free forever, so click here now to claim a copy.

The article Best Buy Hit a 52-Week Low: Still Not the Best Buy originally appeared on Fool.com.

Fool contributor Evan Niu holds no position in any company mentioned. Click here to see his holdings and a short bio. The Motley Fool owns shares of RadioShack, Best Buy, and Amazon.com. Motley Fool newsletter services have recommended buying shares of Amazon.com. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.