Is Big Tech Back on Top?

Shares of Google (NAS: GOOG) hit a 52-week high last week, but it wasn't the only major tech company reaching new heights lately. Apple (NAS: AAPL) continues to cement its status as the world's largest company and hit an all-time high last week as well. Fellow tech leaders Microsoft, IBM (NYS: IBM) , and Amazon.com (NAS: AMZN) are all near their own 52-week highs. Is Big Tech back? Let's look at what's behind these gains.

How it got here

Here's how these five companies have performed over the past 52 weeks:

GOOG Total Return Price data by YCharts

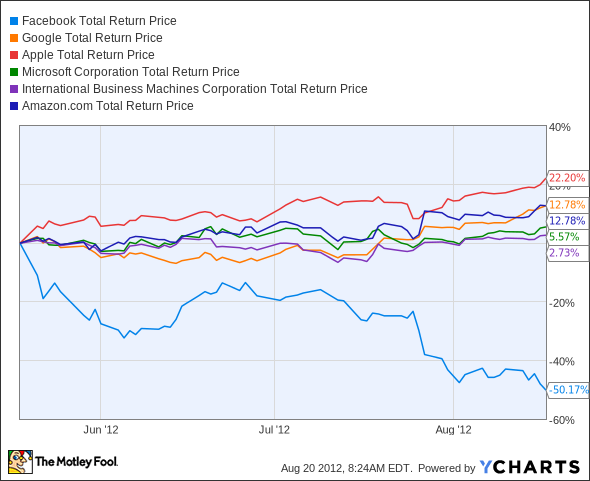

Apple's clearly the leader of the pack, with Google and Amazon tied for a distant second place. A fair bit of growth in all three companies' stock prices occurred more recently, however, after a certain social-media superstar's public debut:

FB Total Return Price data by YCharts

Could Facebook's (NAS: FB) very public struggle to justify the largest IPO market cap of all time be partly responsible for the megacap tech rebound? Or are investors simply coming around to the notion that these established masters of the digital universe aren't as out of touch as once thought? Maybe we'll find answers by digging through some key numbers.

What you need to know

With the exception of Amazon, Big Tech is valued far less dearly than Facebook, despite posting (at least in Google's and Apple's cases) superlative bottom-line growth:

Company | P/E Ratio | Price-to-Free Cash Flow | Net Margin (TTM) | 3-Year Annualized Income Growth |

|---|---|---|---|---|

20.0 | 17.4 | 25.7% | 19.4% | |

Apple | 15.2 | 14.9 | 27% | 69.5% |

IBM | 14.6 | 14.1 | 15.3% | 6.6% |

Amazon | 293.8 | 99.2 | 0.7% | (25.2%) |

123.5 | 71.5 | 13.3% | NA |

Source: Morningstar. Annualized from 2009 annual result to trailing 12-month result.

NA = Not applicable; Facebook does not have three years of reported income yet.

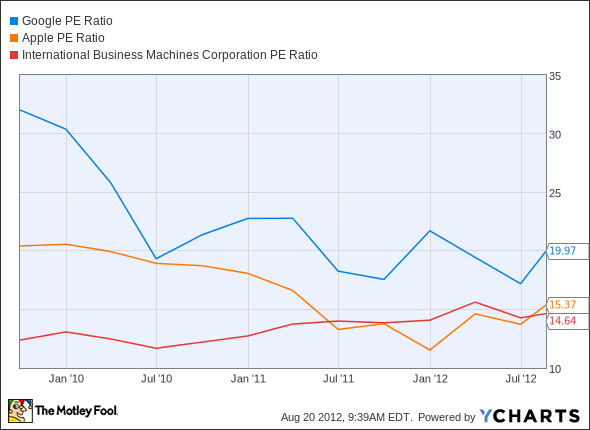

Amazon's outlier status rests more on its expected future net margin expansion than in its current cash-generating capabilities. But what about Google or IBM? IBM's been the beneficiary of steady investor appreciation, as its P/E has grown over the past three years. On the other hand, Google and Apple are finally starting to see a P/E rebound after reaching lows in that ratio within the first half of the year:

GOOG P/E Ratio data by YCharts

Apple's growth has been so fast and so substantial that there really isn't anything comparable -- investors are likely to be cautious because they simply don't believe that the company's incredible growth can be sustained without another transformative product. IBM has a successful hardware-to-services turnaround behind it, and it has enough history on its side to merit the market's confidence.

Google, for the moment, is caught between an ad-centric business model in long-term decline and a pivot to next-gen technology that seems to be at least a year or two away. Investors seem to be taking a look at the company's wearable computing innovations, self-driving cars, and other major developments, and saying "I'd like a piece of that." By pursuing hardware innovation, Google's shown itself to be a forward-thinking tech company. Facebook, in contrast, seems to be fighting to hold on to its present position -- and the present becomes the past very quickly in the tech world.

What's next?

What's next for Google? The company's integration of Motorola should soon lead to more hardware developments. The big question is, "How big will Project Glass be, and how soon?" Will it be the iPhone of wearable computing, or will it be a flash in the pan?

The Motley Fool's CAPS community has given Google a four-star rating, with more than 15,000 of our CAPS players expecting the company to beat the indexes in the long run. If you're interested in tracking its stock, add Google to your Watchlist now, and you'll get all the news we Fools can find, delivered to your inbox as it happens.

It'll be a long time before Google's projects pan out (or don't), and both Apple and Facebook could have something to say about Big G's success. The Fool's created a brand-new premium stock-research service, to help you stay on top of these two fast-moving tech companies and remain ahead of the game. To get your subscription started with the first in a year's worth of exclusive in-depth updates, follow the links for Apple and Facebook.

The article Is Big Tech Back on Top? originally appeared on Fool.com.

Fool contributorAlex Planesholds no financial position in any company mentioned here. Add him onGoogle+or follow him on Twitter,@TMFBiggles, for more news and insights.The Motley Fool owns shares of Facebook, Microsoft, Amazon.com, Google, Apple, and IBM.Motley Fool newsletter serviceshave recommended buying shares of Amazon.com, Apple, Microsoft, Facebook, and Google.Motley Fool newsletter serviceshave recommended creating a synthetic long position in IBM, creating a synthetic covered call position in Microsoft, and creating a bull call spread position in Apple. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.