Why Home Depot Could Head Even Higher

Shares of Home Depot (NYS: HD) hit a 52-week high on Wednesday. Let's take a look at how it got there, and see if clear skies are still in the forecast.

How it got here

Is there anything that can stop Home Depot? Based on its recent performance, I'd say it's unlikely.

The impetus propelling Home Depot to a new 52-week high is, again, another strong earnings report. Fueling Home Depot's gains continues to be the operational changes it's undertaken to make consumers' shopping experience quick and efficient, its cost-saving initiatives, and the underperformance of its peers. Strength in homebuilders is also helping, as it now appears that consumer remodels, and the commercial side of Home Depot's business, are picking up. America's largest homebuilder, D.R. Horton (NYS: DHI) , confirmed this with net sales orders ticking higher by 25% in the third-quarter, while Lennar (NYS: LEN) reported a 310 basis-point home-sales margin expansion to 22.5%.

For the second-quarter, Home Depot grew earnings by 17%, as net sales ticked moderately higher by 2%. Sales growth would have been strong had it not been for the warmer weather, which pushed spring sales into the first-quarter. What's truly a marvel is Home Depot's $4.3 billion in cash flow generated from operations during the first six months of 2012. This operating cash is what has fueled a tripling in Home Depot's dividend since 2004.

Of course, potential pitfalls exist in Home Depot's model. The company had used $2.6 billion of its $4.3 billion in cash flow to repurchase its shares. I'm not a big fan of companies with only moderate sales growth buying back their shares at a new high. Also, the housing recovery is still on rocky ground. There are enough foreclosed homes on the market that home prices and, therefore, construction, could easily be affected, which could negatively impact Home Depot.

How it stacks up

Let's see how Home Depot stacks up next to its peers.

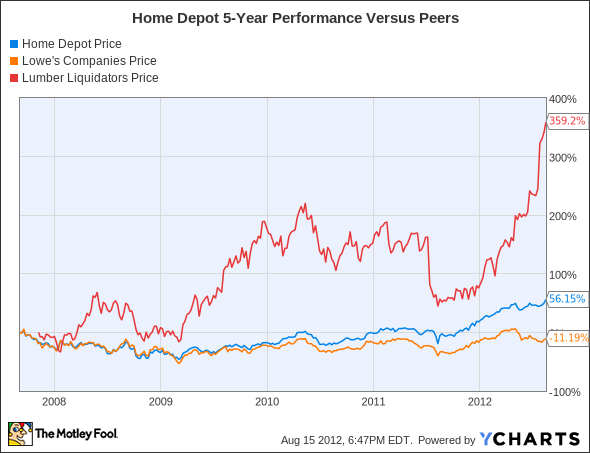

While Home Depot shareholders aren't complaining, it's Lumber Liquidators (NYS: LL) that has cleaned up over the past five years, with Lowe's (NYS: LOW) bringing up the rear.

Company | Price/ Book | Price/ Cash Flow | Forward P/E | Dividend Yield |

|---|---|---|---|---|

Home Depot | 4.7 | 12.1 | 16.2 | 2.1% |

Lowe's | 2.1 | 7.6 | 12.1 | 2.2% |

Lumber Liquidators | 5.9 | 30.1 | 27.7 | 0% |

Source: Morningstar.

As you can see from the above metrics, if you can outperform in a very difficult housing products environment, investors will reward you with a pricey valuation. Although hardwood flooring specialist Lumber Liquidators doesn't pay a dividend, its share price has nearly tripled over the past year. Net sales rose 20% in its most recent quarter, while comparable-store sales were up more than 12%.

Lowe's is the turnaround/value play of this group; but that's if it can get its act together. Lowe's has been losing market share to Home Depot on a regular basis, and has struggled to cope with the low margins associated with its appliance-heavy business. One area that could be Lowe's saving grace, however, is its online push, known as MyLowe's. With convenience being a big spending driver these days, it could lure in some bricks-and-mortar Home Depot shoppers.

What's next

Now for the $64,000 question: What's next for Home Depot? That question depends on the strength in the homebuilding and remodeling sector, how cooperative the weather is for improvement and construction projects, and if its peers continue to falter.

Our very own CAPS community gives the company a three-star rating (out of five), with 78.3% of members expecting it to outperform. Count me among the majority, as my CAPScall of outperform is currently up 42 points - and I have no intention of closing it!

Home Depot is a play on more than just a rebound in the construction sector; it's also a play on home remodels and tight credit markets. As long as home loans remain difficult to get for people with poor to average credit, they'll choose to stay in their homes and remodel, further driving up Home Depot's profits. Home Depot's deployment of technology within its store is another driver that's making checkout easier, and improving customers search and satisfaction. I'd prefer to see Home Depot utilize less cash for buybacks and more for dividends, but if that's my worst complaint, then I'm not too worried about its future.

Peter Lynch is a big proponent of buying businesses that you know and understand, and Home Depot is one great example of that. Believing in this ethos, our team of analysts at Stock Advisor has identified three stocks that could make us middle-class investors millions; because, let's face it, we aren't all walking around with Warren Buffett-type cash in our pockets. Find out the identity of these three stocks for free by clicking here and claim your investing edge.

Craving more input on Home Depot? Start by adding it to your free and personalized watchlist. It's a free service from The Motley Fool to keep you up to date on the stocks you care about most.

The article Why Home Depot Could Head Even Higher originally appeared on Fool.com.

Fool contributorSean Williamshas no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen nameTMFUltraLong, track every pick he makes under the screen nameTrackUltraLong, and check him out on Twitter, where he goes by the handle@TMFUltraLong.The Motley Fool owns shares of Lumber Liquidators Holdings.Motley Fool newsletter serviceshave recommended buying shares of The Home Depot and Lumber Liquidators Holdings.Motley Fool newsletter serviceshave recommended writing covered calls on Lowe's Companies. The Motley Fool has adisclosure policy.We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.