How High Can Exxon Mobil Fly?

Shares of Exxon Mobil (NYS: XOM) hit a 52-week high yesterday. Let's look at how it got here, and whether clear skies are ahead.

How it got here

Shares of Exxon Mobil have been on a roll recently, despite the fact that the company hasn't hit earnings estimates for two straight quarters. The declining price of natural gas and oil in the second quarter didn't help, but production was down 5.6% in the quarter, which is a better sign of where operations were heading.

But the decline in production and prices didn't hurt profit, because the company had a net gain of $7.5 billion after asset sales and tax-related items, which accounted for $5.3 billion of the jump in net income. But one-time items like this don't last forever, so investors need to keep their eyes on prices and production going forward.

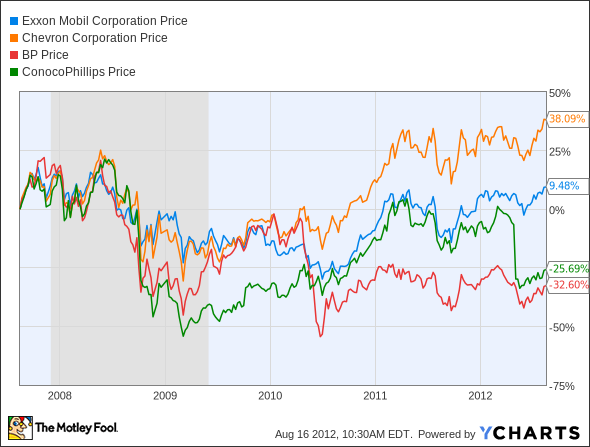

The declining operating trends aren't Exxon Mobil's alone. BP (NYS: BP) , ConocoPhillips (NYS: COP) , and Chevron (NYS: CVX) all saw revenue decline in the second quarter, as prices weighed on their businesses. But their stocks have all recovered nicely in recent weeks as the price of oil and natural gas was rising.

As you can see, Exxon Mobil has been treading water for the last five years and is only middle-of-the-pack versus competitors. From an operational perspective, you could say that Exxon Mobil beats out those competitors, because revenue declined less than those four in the most recent quarter, and return on assets is close to the top of comparison companies. This is why the stock can still command a premium when it comes to price/book and P/E ratio.

Price/Book | Quarterly Revenue Growth | Return on Assets | Forward P/E | |

|---|---|---|---|---|

Exxon Mobil | 2.5 | -7.1% | 9.5% | 11.1 |

BP | 1.2 | -7.9% | 5.0% | 7.7 |

ConocoPhillips | 1.5 | -17.3% | 9.9% | 10.3 |

Chevron | 1.7 | -10.2% | 11.3% | 9.2 |

Source: Yahoo! Finance

What's next?

The big question is, will the stock continue to rise over the next year?

I think that Exxon Mobil, and energy stocks, in general, will have a good year because the economy is slowly improving in the U.S. and, if Europe ever gets its act together, it will act with emerging markets to increase global demand. Prices have fallen due to the weak economy but, once the election is over, and the fiscal cliff mess is figured out, I think the economy will improve, energy prices will rise, and we'll see a steady improvement from Exxon Mobil.

Let's also not forget that the company pays a 2.6% dividend yield, which should be music to the ears of investors looking for income. Motley Fool CAPS members have put their weight behind the stock, giving it our top five-star rating. I don't think a 20% upside is out of the question if oil ends the year above $100 per barrel.

Interested in reading more about Exxon Mobil? Click here to add it to My Watchlist, and My Watchlist will find all of our Foolish analysis on this stock.

The article How High Can Exxon Mobil Fly? originally appeared on Fool.com.

Fool contributorTravis Hoiumdoes not have a position in any company mentioned. You can follow Travis on Twitter at@FlushDrawFool, check out hispersonal stock holdingsor follow his CAPS picks atTMFFlushDraw.The Motley Fool owns shares of Exxon Mobil. Motley Fool newsletter services have recommended buying shares of Chevron. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.