Can Agilent Blame This Miss on the Economy?

You win some, you lose some. This time, Agilent's (NYS: A) losses outweighed the wins.

The maker of chemical, electronic, medical, and communications measurement tools just reported a weak third quarter. Strength in wireless communications, medical diagnostics, and forensics was drowned out by soft orders from industrial and defense customers. In Agilent's opinion, all the bad news came from a slowing economy.

All things considered, Agilent reported 2% sales growth year over year at $1.7 billion and non-GAAP earnings climbed 2.6% to $0.79 per share. Both numbers fell short of analyst targets. Moreover, guidance for the fourth quarter came in far weaker than the current Street view. So it's hardly surprising that shares fell hard overnight, bottoming out nearly 8% below Wednesday's closing prices.

CEO Bill Sullivan took a dim view of Agilent's near-term prospects. Customers in many segments are delaying their expected orders, and there's no guarantee that all these lagging orders will come through. "While we are not seeing outright order cancellations, we're seeing all the classic signs of a slowdown," he said. "Looking ahead, we believe we're entering a slow growth environment."

At the same time, head-on rival Aeroflex (NYS: ARX) beat Wall Street's earnings targets in its own report this morning. Thermo Fisher Scientific (NYS: TMO) and Bruker (NAS: BRKR) had no such cushion to fall back on. Both stocks are underperforming the market on Thursday, largely on Agilent's negative end-market comments.

The gap between the Agilent and Aeroflex reports makes me wonder whether demand really is all that weak. Maybe Agilent is simply losing market share to smaller and hungrier rivals. Medical expert Thermo Fisher wouldn't count, given that even Agilent is doing well in that sector. Use your Foolish watchlist to keep an eye on the measurement industry -- ironically, I don't think we have enough data to reach a solid diagnosis yet.

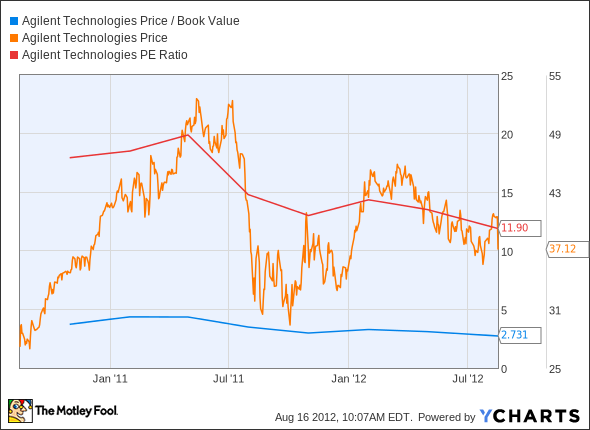

As for Agilent itself, this sudden drop isn't big enough to create a screaming value. Shares are trading at 11.9 times trailing earnings and three times book value right now, which is roughly in line with Agilent's recent history:

A Price/Book Value data by YCharts.

Thermo Fisher, on the other hand, is an active recommendation from our Inside Value bargain-hunting newsletter. There's still hope for this sector.

And keep in mind that government spending could skyrocket when this year's presidential election is in the books. To see why this event should boost defense and health care businesses across the board -- no matter which party walks off with a win -- you should grab our free report on the topic. Get your copy right now, because this unbeatable deal won't be around forever.

The article Can Agilent Blame This Miss on the Economy? originally appeared on Fool.com.

Fool contributorAnders Bylundholds no position in any of the companies mentioned. Check outAnders' holdings and bio, or follow him onTwitterandGoogle+.Motley Fool newsletter serviceshave recommended buying shares of Thermo Fisher Scientific. The Motley Fool has adisclosure policy.We Fools may not all hold the same opinion, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter servicesfree for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.