Is Apple Losing Its Cool?

Apple's (NAS: AAPL) cool factor has always been one of its defining corporate characteristics. You don't expect the world's largest company to be cool. That's usually reserved for the upstarts, the ones that take one look at the establishment and tell it to take a hike. Heck, Apple's so cool that it barely needs to market its wares like most of its competitors do. When the iPhone first went on sale, news outlets and tech blogs slobbered all over it so thoroughly that Apple didn't pay for advertising at all.

But that was when Apple was still a comparatively plucky $100 billion upstart. Now that Apple effectively is the smartphone and tablet establishment, consumer goodwill seems to be on the wane. Its latest TV ads, which make its older users look like bumbling oafs, have been widely panned and have since been pulled. Was that reaction justified? Perhaps not.

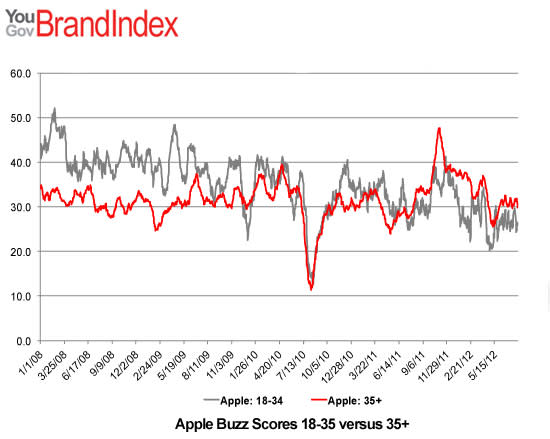

Marketing firm YouGov has been tracking Apple's favorability among both old and young consumers, and in recent months the company's strong favorability advantage in the 18-to-35 demographic has slipped. Apple's after their parents now -- for the first time in years, consumers over age 35 have a more favorable view of the company than those in the "cool" demographic.

Apple's future might be graying, but that doesn't mean it won't be flush with green. Read on to find out why this strategy makes sense in the long run.

Behind the buzz

YouGov's BrandIndex is a daily tracker of brand perception. Respondents to their regular polls answer the question: "If you've heard anything about the brand in the last two weeks, through advertising, news, or word of mouth, was it positive or negative?" The discrepancy between positive and negative responses creates a "Buzz score" between positive and negative 100, with zero representing an even balance. Here's how the scores have changed for Apple over time:

Source: YouGov.

Apple's scored highly in both demographics for years, but a trend has emerged lately -- younger consumers are hearing fewer positive things, while older consumers' views are little changed from the start of BrandIndex tracking in 2008. Those in the 18-to-35 age bracket reported a 50+ Buzz score early in 2008 and have steadily reported lower scores since, with their current result holding steady at 24. Those older than 35 have a score of 32, which is virtually identical to the earliest reported scores.

Go where the money is

Older consumers make ideal targets for Apple's new hand-holding style of advertising. The new "Genius" ads aren't as cool as the Mac vs. PC commercials that helped ignite Apple's resurgence and put Microsoft (NAS: MSFT) on the defensive, but Apple didn't get where it is by being tone-deaf. Its marketing execs will learn from this and come back with better branding, and we'll probably see the same focus continued. Here's why:

Age, Head of Household | 2010 Median Income | 2010 Median Net Worth |

|---|---|---|

Less than 35 | $35,100 | $9,300 |

35-44 | $53,900 | $42,100 |

45-54 | $61,000 | $117,900 |

55-64 | $55,100 | $179,400 |

65-74 | $42,700 | $206,700 |

Source: Federal Reserve.

Older consumers have higher incomes and a great deal more saved up. They can afford a second iPhone for the kid, an iPad for their significant other, and a new MacBook for work, and they can buy all three this year if needed. These consumers aren't as plugged in to the constant one-upmanship of consumer electronics, hence a steadier buzz score.

Youth in revolt

Apple's declining favorability with young people shouldn't be ignored, though. YouGov's scores have roughly tracked the poor market performance of Apple's erstwhile competitors Nokia (NYS: NOK) and Research In Motion (NAS: RIMM) . Late last year, YouGov's Smartphone Mobile Internet Experience tracked users' next expected smartphone purchase and found Apple far in the lead with 41% of respondents saying they'd buy an iPhone, trailed by BlackBerry phones at 10% and Nokia at just 4%.

As you may remember, Apple went on to post record-breaking year-end revenue, while Nokia and RIM both continued to slide:

AAPL Revenue data by YCharts

Meanwhile, Apple and Google (NAS: GOOG) duke it out for the top overall tech Buzz scores, with Google narrowly beating Apple in the first half of the year. Top Android smartphone maker Samsung is also hot on Apple's heels, trailing the iPhone brand by just four Buzz points.

Older consumers might have more to spend, but many of them listen to their kids when it comes to tech purchases. I can't imagine that Apple will abandon the taste-making demographic yet, but its upcoming iPhone 5 release will be a critical driver of near-term consumer attitudes. Will Apple knock it out of the park, as we've come to expect? Or will this be another one of those rare missteps that seem to happen more frequently in the post-Jobs era?

The best way to keep ahead of Apple's relentless release cycle is The Motley Fool's new premium research service. Our top tech analysts will bring you all the coverage you need for a full year, at less than the cost of your average buy order. Get your deep dive started today.

The article Is Apple Losing Its Cool? originally appeared on Fool.com.

Fool contributorAlex Planesholds no financial position in any company mentioned here. Add him onGoogle+or follow him on Twitter,@TMFBiggles, for more news and insights. The Motley Fool owns shares of Apple, Google, and Microsoft.Motley Fool newsletter serviceshave recommended buying shares of Google and Apple and creating bull call spread positions in Microsoft and Apple. We Fools don't all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. Try any of our Foolish newsletter servicesfree for 30 days. The Motley Fool has adisclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.